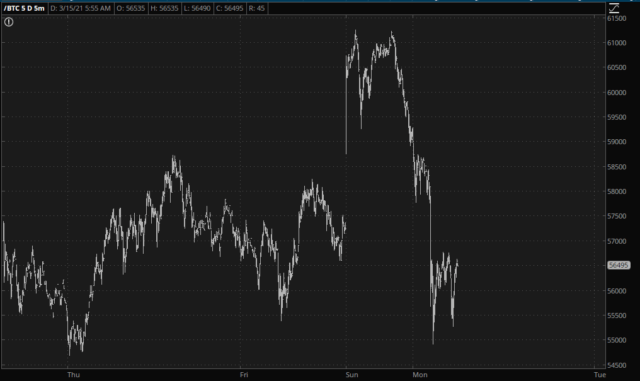

What’s up with the title of this post? Am I ill or something? No. It’s simply how I keep thinking of this market: waiting for the fever to break. In a mad world, the sane person begins to question his own sanity. Or at least that’s my experience. Thus, when I saw Bitcoin rocket past $61,000, I saw the fever was still raging. For the immediate moment, there’s at least a pause, as we’ve had a $5,000 reversal.

This diminishment of animal spirits has been expressed in the small caps as well, which reached yet another lifetime high overnight and have backed off (to be clear, these charts may seem dramatic, but as I am typing this, the /RTY is down all of 0.3%, so it’s not that big a deal).

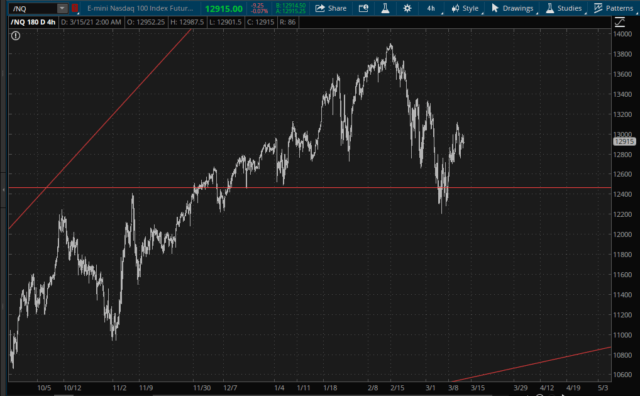

To me, The Big Kahuna chart remains the /NQ, which is still in what could be a terrific topping formation.

This is a big week, though, with respect to the Fed and interest rates. There are a trio of markets that look like they want to bounce. Once of them is poor, downtrodden gold.

Next is bonds, which will surely be on the edge of its seat on Wednesday when the Fed does their latest announcement. Keep in mind that bonds have been falling virtually nonstop for a solid year, and there’s going to come a time when rocketing interest rates aren’t exactly what the Fed desires.

And, of course, volatility has been The Incredible Shrinking Man for a solid year, and we are currently grinding at what, in this environment, are just about the lowest levels imaginable.

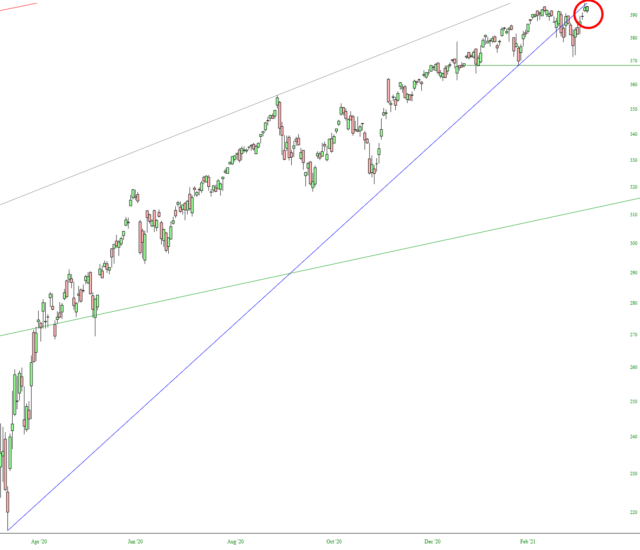

The Big Picture, to my eyes, remains the wedge on so many equity instruments, most particularly the SPY. Yes, we remain near lifetime highs on virtually every market, but there has undoubtedly been some damage done in recent weeks. The real question is whether this modest damage will express itself in a meaningful down-move, which we haven’t experienced for a very long time.