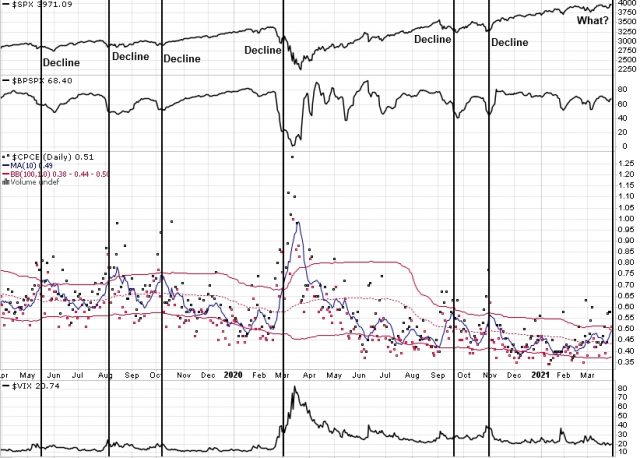

I have something to share today that is just too weird to leave in a comment. I was going over my EOD checks Monday evening and I saw the Equity PCR pretty much at its upper weekly bollinger band while the VIX hasn’t really jumped at all.

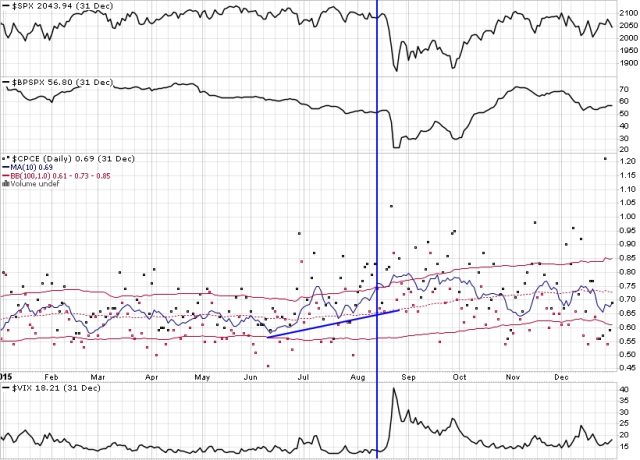

Typically, the Equity PCR 10MA only reaches its UWBB after a decline. It’s so unusual, it prompted me to look back through my entire historical pics back to 2004. The ONLY other instance I could find was in 2015 at this extremely bullish juncture (sarcasm).

Now I’m not saying it’s going to crash this week or next, perhaps it’s just the nature of the current market. Perhaps it’s just signs of hedging into an increasingly stretched trend. Perhaps it has something to do with Archegos Capital blowing up. I don’t know. I’m just offering these charts up as a “what if?” scenario and as a warning to always have your stops in and plan for the unexpected. Perhaps we get a blowoff top as a few people here and elsewhere are expecting. I guess only time will tell. As interesting as that would be, looking back over S&P500 price interactions with the UWBB, it was almost always a grind. Extreme moves were “extremely” rare.

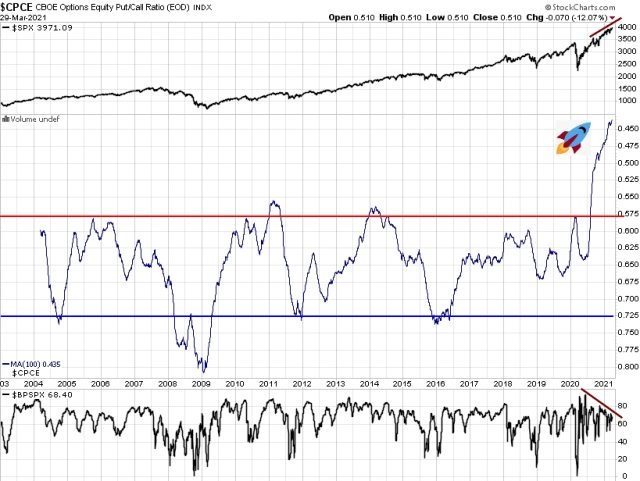

One final note, as a quick revisit to the Complacency/Fear chart I shared last year, the timing has been far more lagging than I expected. The extreme CPCE is still there, the extreme negative divergence in the SPX:VIX ratio is still there, and now there is a pretty sick looking BPI negative divergence, too (in the next chart). To quickly review, here is the 20wkMA of CPCE which just continues to fly higher and higher. Rocket to the moon indeed (on thinner and thinner participation).

There aren’t a lot of things I can say for certain, but one thing I’m sure of, WHEN this reverts to the mean, it’s going to be a ROUGH landing.