The Tesla Roadster Elon Musk launched into space in 2018 (via The Fast Lane Car).

Extending The Light

Senator Bernie Sanders singled out Tesla (TSLA) Technoking Elon Musk and Amazon founder Jeff Bezos recently for being the two richest Americans. Elon Musk responded that he was “accumulating resources” to “extend the light of consciousness to the stars”. https://seekingalpha.com/embed/14050

The main way Musk has been gathering resources, of course, has been by the appreciation of Tesla shares. Cathie Wood’s ARK Invest predicted recently that that appreciation would continue: the firm sees Tesla hitting $3,000 per share in 2025.

An Astronomical Target Price?

That share price may seem astronomical at first glance, but as Barron’s pointed out, it works out to roughly a 37% annual return between now and then. That’s still an ambitious return, but ARK Invest thinks fully autonomous ride-hailing could drive it:

In our last valuation model, ARK assumed that Tesla had a 30% chance of delivering fully autonomous driving in the five years ended 2024. Now, ARK estimates that the probability is 50% by 2025. Since our last forecast, neural networks have solved many complex problems previously considered unsolvable, increasing the probability that robotaxis are viable.[6] ARK estimates that Tesla’s vehicle fleet gives it access to 30-40 million miles of data per day, up from 20 million per day last year. If successful, Tesla could scale its robotaxi service rapidly, allocating the additional cash in turn to manufacturing capacity serving its autonomous network. If 60% of its vehicles equipped with Autopilot were to serve as robotaxis, Tesla could generate an additional $160 billion in EBITDA in 2025.[7] In our bull case, ride-hail would account for the majority of Tesla’s enterprise value in 2025.

A Skeptic’s Take

Bill Maurer argues that ARK’s ride-hailing expectations in particular are unrealistic. The “bear case scenario” he refers to below is the one ARK Invest gives a 25% probability to: a $1,500 price target for Tesla in 2025. Ark Invest’s bear case assumes human ride-hailing, rather than robo-taxis.

First of all, Ark states in its bear case scenario that Tesla will generate $42 billion in revenue and $20 billion in operating profit for its ride-hailing business in 2025. As a point of reference, that’s roughly 10% more than Uber (UBER) is projected for that future year, and in 2020 Uber reported an operating loss of $4.86 billion according to its 10-K filing.

At this moment, there is no Tesla ride-hailing service. We don’t even know if one will ever exist, but Ark has it soaring past Uber’s total revenue in just 4 years, and this includes the fact that Tesla will price its service significantly lower than the likes of Uber and Lyft (LYFT). Assuming of course Tesla can find potentially millions of drivers to provide such services, how is it possible that operating margins are going to be close to 50% when multiple established companies in the industry haven’t even been able to make a profit yet?

Our Take

One way we try to make our predictions easier by focusing on the next six months, rather than the next several years. Another is by relying on the wisdom of crowds, two in particular: stock market participants and options market participants. Our system analyzes stock and options market sentiment on Tesla and every other security with options traded on it in the U.S. every trading day. It then ranks each of those names by its estimate of their potential returns over the next six months, net of hedging cost. As of Tuesday’s close, Tesla was #3 overall in that ranking. So, we’re bullish on it over the next six months. We don’t have a 2025 price target for it.

In Case We’re Wrong

The reason we sort our top names by potential returns net of hedging cost is that, like everyone else, our predictions are wrong sometimes. And when they’re wrong, we want your downside to be strictly limited. If you’re long Tesla, here are a couple of ways you can hedge your bet in case we’re wrong about it.

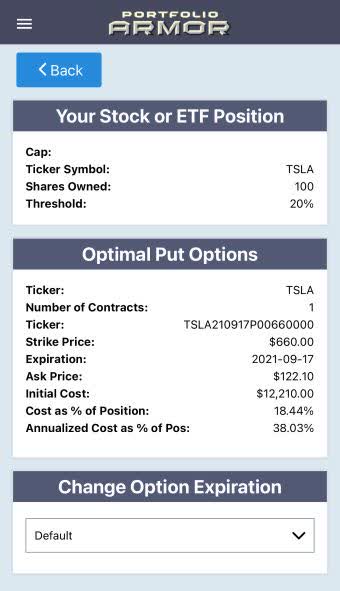

Uncapped Upside, Positive Cost

This one’s a bit pricey. Let’s say you were willing to tolerate a 20% drop in your Tesla shares over the next ~6 months, but not one larger than that. If so, these were the optimal, or least expensive put options to do that, as of Tuesday’s close.

Screen captures via the Portfolio Armor app.

As we said, this one’s a bit pricey: the cost here was $12,210, or 18.44% of position value. That cost was calculated conservatively, using the ask price of the puts (in practice, you can often buy and sell options at some price between the bid and ask).

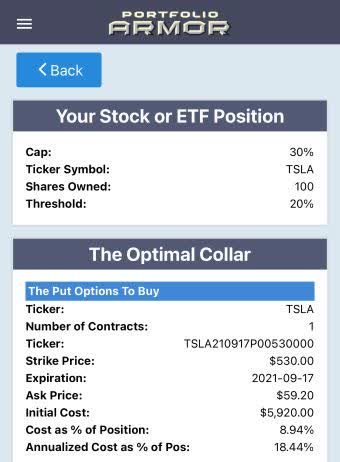

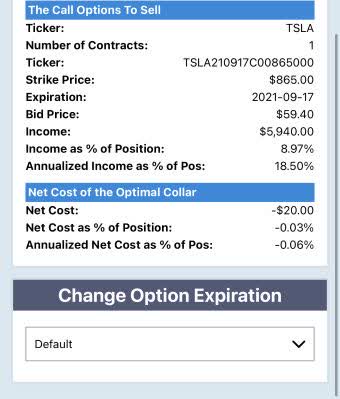

Capped Upside, Slightly Negative Cost

If you were willing to cap your potential upside at 30% over the next six months (an annualized return even more ambitious than Cathie Wood’s), this was the optimal collar to hedge against the same, >20% decline as the previous hedge.

With this one, the net cost was slightly negative, meaning you would have collected a net credit of $20 when opening the collar, assuming, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Go For The Cheaper Hedge?

If cost is your main concern, then yes. If you want to maximize your return net of hedging cost, it depends. We described how our hedged portfolio construction algorithm decides whether to hedge with collars or puts here.