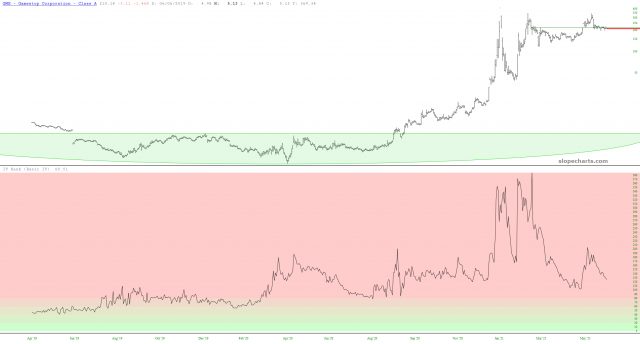

In late January and early February, failing game retailer Gamestop was the hottest investment on the planet. It exploded from $5 to over $500. Lately, however, things have calmed way, way down. Incredibly, most of those gains are still intact, but the volatility has taken a dive. I thought this would be an opportunity to show some of the SlopeCharts features related to this.

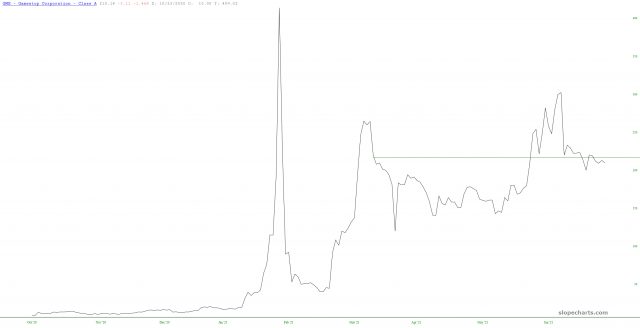

I must say, however, looking at that horizontal line, whoever it is who has been selling options the past couple of weeks has been engaging in what has been, in retrospect, a risk-free way to print money. The poor slobs hoping to see the wildness of early this year who have been gobbling up options have been sorely disappointed. The winners are the guys selling all this premium, because the stock isn’t’ budging.

The 30-day implied volatility went up to nearly 700 (!!!!!!!) and has withered away to a tiny fraction of that amount.

The one-month IV rank shows how the relative volatility has changed over the short-term – – it’s no surprise that we’re deep down into the ice-cold zone.

Here is the one-year extreme perspective, which is slower-moving. Again, volatility is at death’s door (relative to past behavior).

I have not participated in these meme stocks one bit. It’s definitely not my thing. But I think we can all agree it’s been interesting to watch, even from a safe distance.