This is a pretty thin reed, but I’ve got nothing else to say, so I might as well proceed. After all, how much ink could I possibly spill about a day in which the S&P futures went up 0.11%?

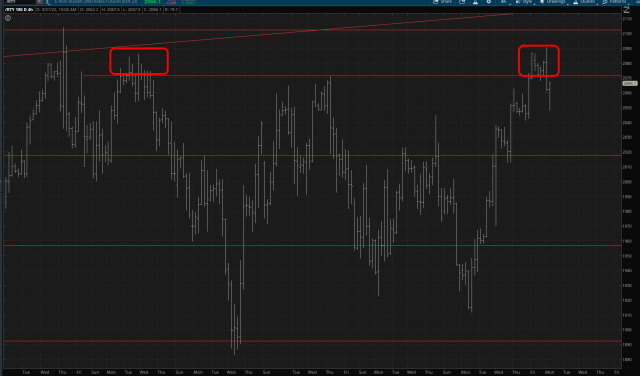

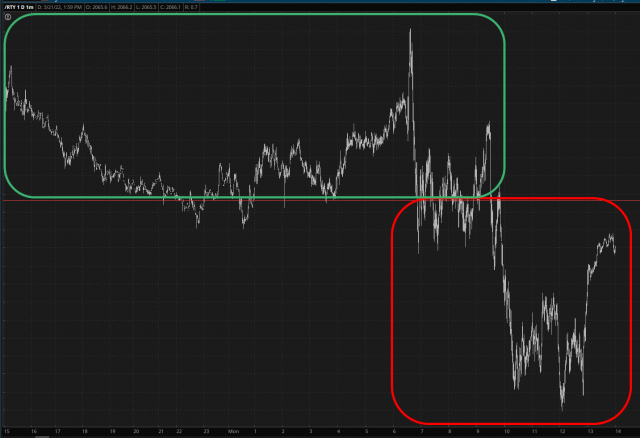

Anyway, before I went to bed on Sunday night, I noticed the small cap futures (/RTY) had found support at about 2071. It had, just as what happened back around January 19th, February 10th, and February 15th, pushed itself into the highest echelon of its multi-month range and was levitating above the apparently magical 2071 level.

After Powell did his thing on Monday, however, that was enough juice to cut through that level, and, short-term, we found ourselves banging around a lower range (red zone) as opposed to the levitation range (green zone) before.

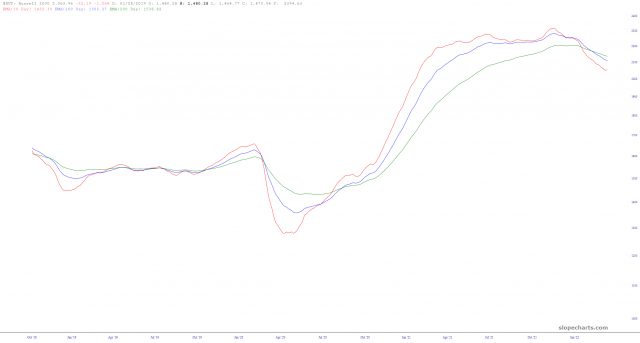

It’s subtle, but I would simply suggest this lines up nicely with the fact that we’ve got a full-on moving average breakdown in place on the Russell 2000. This is a perilous juncture in the market for bulls and bears alike. Of course, there’s only one of those parties I actually care about.