Before I get started I want to encourage all of you interested in trading options to sign-up for my free weekly newsletter. Free Weekly Newsletter on All Things Options.

You will find educational topics on all things options, options research, options trade ideas, weekly indicators and more each week. I’ve been on Slope for a long, long time and would love your all of your support. Thanks so much. Kindest, Andy.

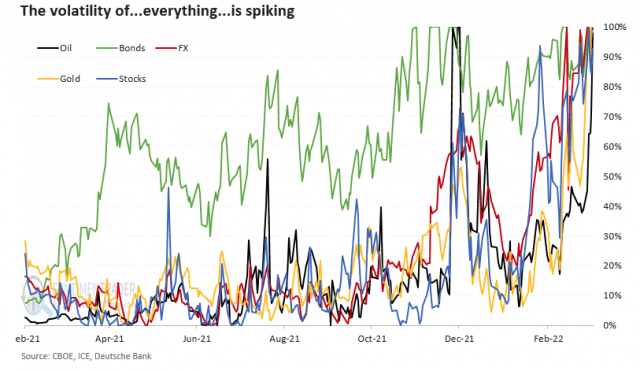

I posted a few bearish opportunities in USO last week. In that article I mentioned the current heightened levels of volatility to show that there are trading opportunities everywhere! And as some of you already know, when implied volatility (IV) is high, as seen through IV rank, IV percentile and various other measures, options selling strategies (preferably those with a high probability of success) are the preferred choice.

Typically, we must hunt for inflated levels of IV. Otherwise, we are simply selling premium when IV is at normal levels. That being said, as a long-time options trader who predominantly sells options (although I will use debit spreads and occasionally buy calls and puts) I’ve rarely seen this many opportunities to sell premium using a high-probability approach. Options selling opportunities are available across the board, regardless of your directional bias.

Jason Goepfert of Sundial Capital Research recently said, “The average volatility gauge across markets is in the top 2% of their yearly ranges.”

Courtesy of Sentimentrader.com

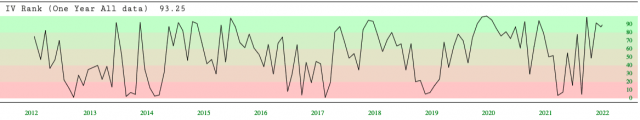

Even the volatility of volatility is nearing an extreme.

Courtesy of SlopeofHope.com

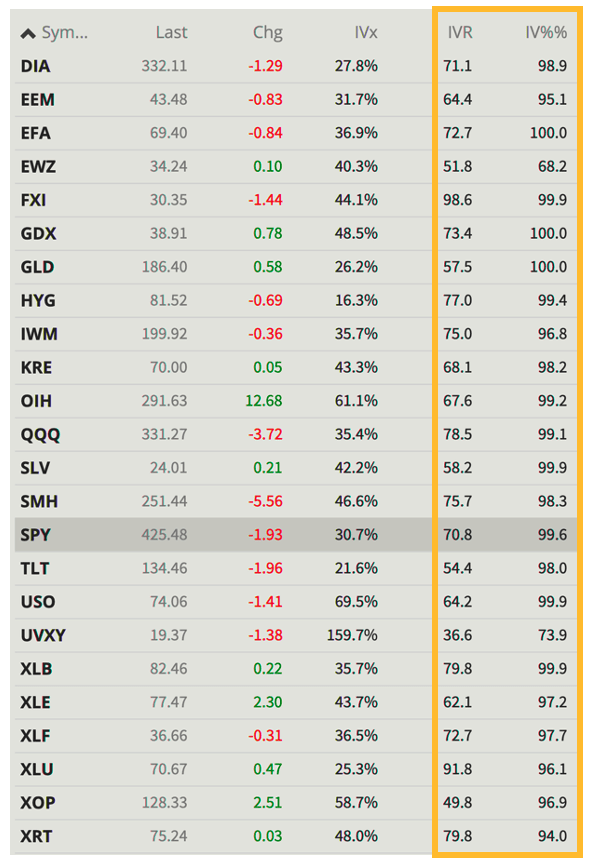

And if that wasn’t enough, take a look at the IV rank and IV percentile in the major ETFs.

*IV Rank – tells us if current implied volatility (IV) is considered high or low on an underlying security in comparison to all other IV readings over the past 12 months.

*IV Percentile – tells us the percentage of days that implied volatility (IV) has been below the current level of IV over the past 12 months.

So, as you can see, the volatility bull market has arrived. The question is: How are you going to take advantage of it?

Whether you’re a bull, bear or somewhere in between, opportunities to sell options premium are plentiful. Take advantage!

I’m going to continue to go over a wide variety of different options selling strategies using the ETFs above as my underlyings. If you wish to receive trade ideas, research and a variety of other options related information please make sure to sign up for my Free Weekly Newsletter.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below.