Before I get started I want to encourage all of you interested in trading options to sign-up for my free weekly newsletter. Free Weekly Newsletter on All Things Options.

You will find educational topics on all things options, options research, options trade ideas, weekly indicators and more each week. I’ve been on Slope for a long, long time and would love your all of your support. Thanks so much. Kindest, Andy.

I don’t really care for market opinions.

Oftentimes, they aren’t objective, just simply self-serving.

I’ve traded professionally for over 20 years and it amazes me the lack of forethought that goes into actual investment strategy. I mean, come on: Don’t boast about returns over the past three years when we’ve seen the market skyrocket to epic heights. It’s downright lazy!

2021 saw 70 new all-time highs with a peak-to-trough drawdown of only 5.2%. Incredible! To put that in perspective, we are coming off a year when one-third of the trading days saw all-time highs and losses were maxed out at 5.2% … and the world’s largest index, the S&P 500, was up almost 30%.

So, great job to those professionals touting exceptional returns in 2021. Guess what? An overwhelming amount of investors, professional or otherwise, were right there with you.

If you are offended by this opinion, so be it; my job is not to appease egos, it’s simply to do the best by my clients, subscribers and myself as an investor. This has been, and will always be, my goal. Otherwise, I shouldn’t be doing this as a profession.

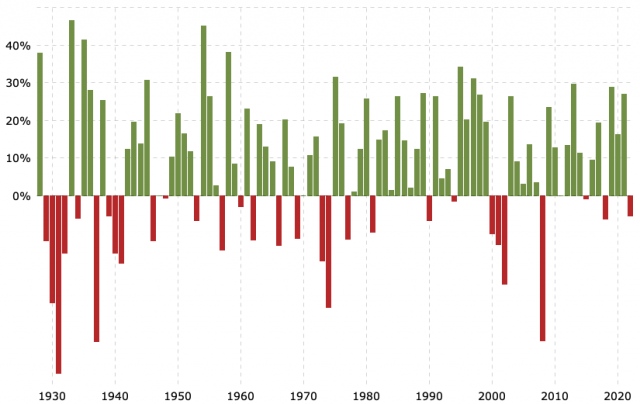

S&P 500 Historical Annual Returns

Just look at the histogram above. The last three years the S&P 500 has seen returns of 26.9%, 16.3% and 28.9%.

That should be the baseline for returns, right?

So, if you are using a high-beta strategy or a low-probability options strategy trying for 100%, 200% or more, well, chances are you are taking on significant risk in doing so. But people just want to talk about returns; they rarely talk about associated risk or that the stock or strategy they’re using has associated risk that is 3 to 5 times greater than simply buying the S&P 500 ETF (SPY). By choosing this route, those people should expect to have a highly volatile portfolio. And if they don’t have the wherewithal to discuss the risks, they certainly aren’t beta-weighting their portfolio to show the associated risk. Again, lazy!

Most just sit back, pick a stock based on what they think will happen in the future and hope the market cooperates. And when it doesn’t, much like what we’ve seen in 2022 so far, they sit puzzled or just downright comatose. I’ve seen it over and over and over in my career.

I don’t want to hear how great an investor is when the market is making historic returns. I want to know how an investor does during times of duress. Are they actually outperforming the market during bull markets given the associated risk they are taking, or better yet during volatile periods, bear markets, corrections? Transparency please! Is that too much to ask?

The next few years should be interesting. Because I have sense there will be a great humbling among those that have touted returns during one of the greatest bull markets we’ve seen in market history.

Over the past 13 years the S&P 500 is averaging 19% gains, yes 19%, per year with total returns of over 800% since the early March 2009 low. It’s been amazing! Of course, bullish ways could continue, no one knows for certain. No one!

The point is, understand your expectations and the risk associate with your expectations. Try to smooth out your equity curve by implementing high-probability options strategies.

Listen, as investors we are all going to experience losses. It’s called sequence risk, but we can minimize the volatility in our portfolios by using options as they were intended to be used—not as a way to continually seek 200% returns. Just know that taking on that type of risk to seek those types of returns will eventually bite you in the ass. Math tells us the probabilities will play out, as they always do.

I’ve had people call me in the recent past, saying they have $250K and would like to double it over the next 12 months. Really? I immediately respond by saying no one can promise you those returns without taking on exorbitant risk. And if they tell you they can, well, they are straight-up lying to you. Moreover, by taking on that type of risk, seeking those types of returns, you have a greater chance of losing everything. And unfortunately, many have come close to that in 2022.

Again, understand the associated risks you are taking with each and every investment decision you make, whether it’s the strategy or the stock of choice. I’ll be discussing this in greater detail over the coming months with some more advanced topics like beta-weighted portfolios, etc.

Stay tuned!

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below. And don’t forget to sign up for my Free Weekly Newsletter for weekly education, research and trade ideas.