Sigh.

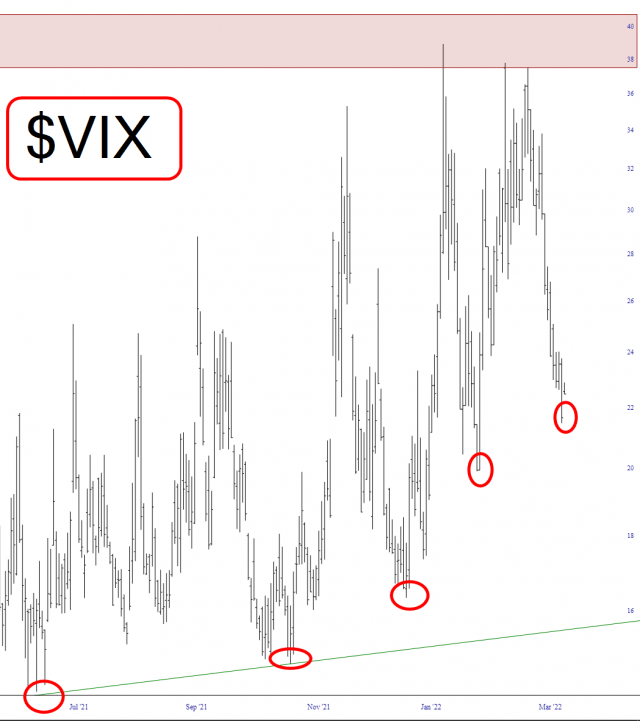

A month ago, this market was so riveting that I could barely take my eyes off of it. As it is right now, if I may be so candid, it is as dull as dog shit. Honestly. And I say that, even if it harms me, because an unspoken component of my role is to get people excited about trading the markets. But one look at the VIX, and I think you’ll understand how disingenuous this would be. All the oxygen has left the room.

Although I think one easy insight we can agreed upon is that whenever the VIX approaches 40, it’s time to ring the register and hit the hammock for a while. There’s a reason my cash level is at 35%.

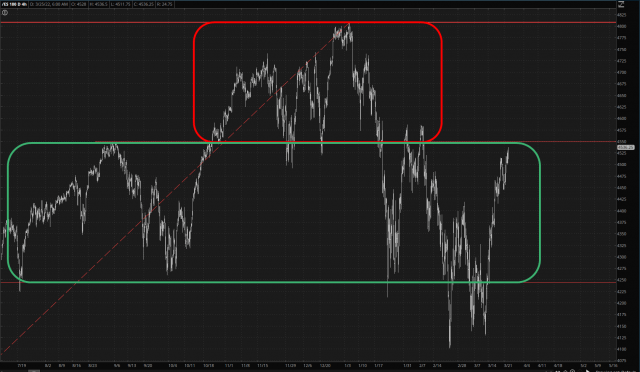

The one bright hope I can offer to any surviving bears out there is that the entire past month of the virtually uninterrupted /ES upside has been dedicated to just one task, which is to push the market back to the top of its range. The portion you see envelope is red is our defense. My view is that the bulls could be setting themselves up for another hard fall, given this almost too-obvious pattern formation. In the meanwhile, though, good God, what a drag!

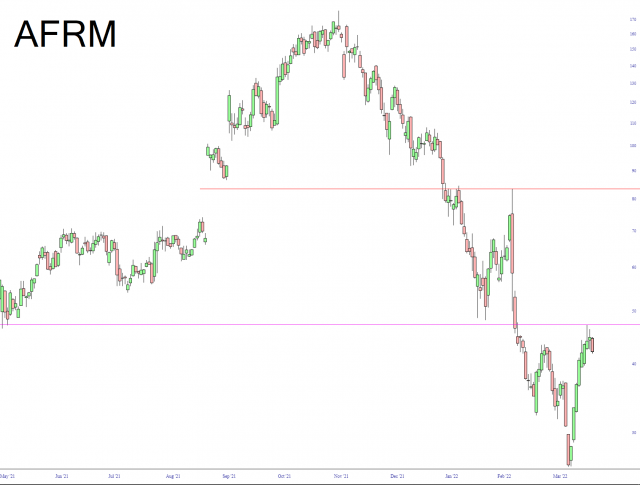

Weeks ago, a Sloper wrote to me to bring a company called Affirm to my attention. I wasn’t aware of them, but after I learned their name, I started noticing them all over the web. From what I can gather, they provide credit to people with not-so-great credit when purchasing items.

For example, if you’re buying a $500 airline ticket, you could just pay them $500 like a normal person, or if that’s a stretch for you, you could set up a monthly payment plan with Affirm. It’s kind of like having a credit card for people who might not have a credit card. In other words, sub-prime for everyday purchases.

That, to me, sounds like a recipe for disaster. I would close by offering this chart of the company, pointing out it has done a beautiful job sealing up its price gap and positioning its price underneath a megaton of overhead supply.