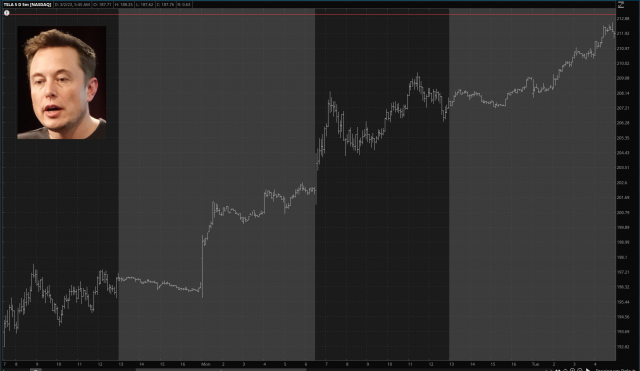

For days, every man, woman, child, and analyst was absolutely ga-ga over the prospects of Tesla Investor Day. It was widely touted as a major announcement about some incredible new products, and it was the kind of event that would make Cathie Wood slide right off her chair with anticipation. The chart clearly reflected that, as people elbowed and pushed one another to buy the stock.

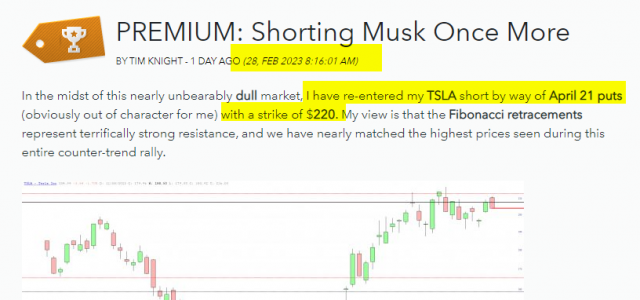

Since I’m a freak, and not prone to sliding off my chair, I did the exact opposite by way of this post to my beloved Gold and Platinum members (which, let’s face it, you should man up and finally join the ranks thereof) which stated my point of view in clear, precise language.

I think you can guess what happened following my freakish declaration.

More broadly, the market has embraced its disease once again, and I applaud it. A couple of weeks back, the /ES did a perfect to-the-penny touch of its Fibonacci retracement level (red circle) and has been slipping furtively ever since. Now, since 99.9999999999% of stinking humanity is a permabull, they have been fighting it every tick of the way, and it’s been annoying as hell to watch them grasp and claw and try to reclaim their David-Portnoy-esque glory of 2020 and 2021. Indeed, their most valiant (if we may deign to use such a word on such a vile mass) effort was mark by the red arrow, in which they tried to deny the reality that the trendline was broken and get it back on the supporting side. Nope. It’s failed.

I’m coming into the day with some cash – 9% – and will wait for the first half hour to clear to decide if I’m going to augment any positions. As it stands now, same old same old – – 21 puts with an average expiration day 144 days into the future, and my best wishes to you for a good day ahead.