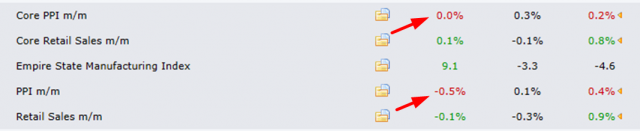

Fresh on the heels of yesterday’s gift-from-heaven-for-the-bulls CPI numbers, there was an even bigger tidal wave of data, and it was even BETTER news for our dear bullish friends. PPI came in at stone-cold 0%, way below expectations, and past data was revised LOSER. The month over month PPI was NEGATIVE and, likewise, past data was dropped. You would expect the /ES to be up about 400 points right now.

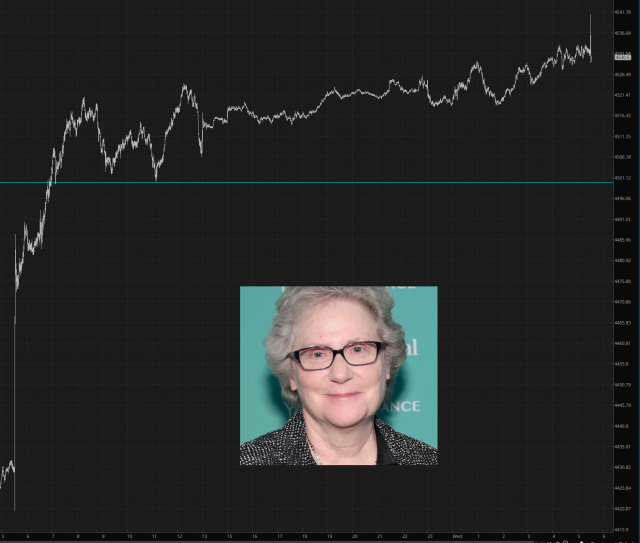

Equity futures did indeed spike for about three seconds before reversing. As I’m typing this, everything is still green, but let’s just say it doesn’t feel like 24 hours ago.

Interestingly, the /RTY futures peeked JUST above its major Fibonacci for just a moment before reversing hard.

I am also pleased to note that bonds, /ZB, which were already in the red, have pushed lower. As my premium readers know, I have puts on just two ETFs, XHB and TLT, with TLT being the big one.

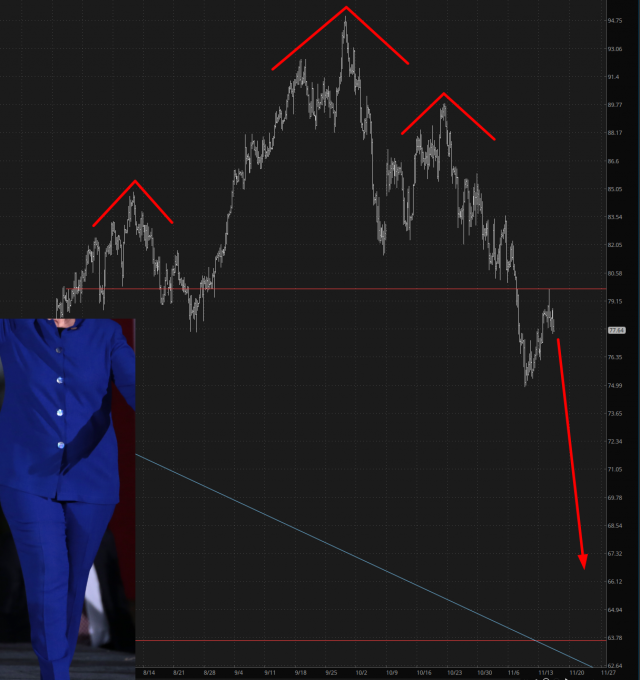

The one futures chart I think is most exciting is crude oil, which seems to have a massive top. I’ve hung on to my big SLB and COP positions, and I think these puts should continue to increase in value. The chart below, incidentally, is on a much bigger time scale than the ones above.

On a personal note, I’d like to offer the life pro tip to NOT eat Eggs Benedict every day if you visit an overseas resort. By the grace of God, I didn’t get salmonella until the very tail end (appropriately enough) of my trip, which would have otherwise ruined it. What I’ve been doing for the past six days is, sadly, something I can only wish I’d been doing just above the head of Tom Lee, but we can’t get everything we want now, can we?