At some point, perhaps soon, the Fed is going to start reducing interest rates. The assumption is that, once that starts, it’s going to be party time for stocks (as if 2023 wasn’t a party enough). That’s true sometimes, but it turns out that it is utterly dependent on whether we enter a recession or not. As the chart below suggests, stocks do tend to go up once Fed starts cutting (upper-right portion of the chart below), but in instances in which the economy is entering a recession, the stock market not only falls, but it falls a lot more than it rises otherwise.

As for whether we’re going to have a recession, the probability indicator (symbol FR:SAHMREALTIME) seems to be on the uptick…………

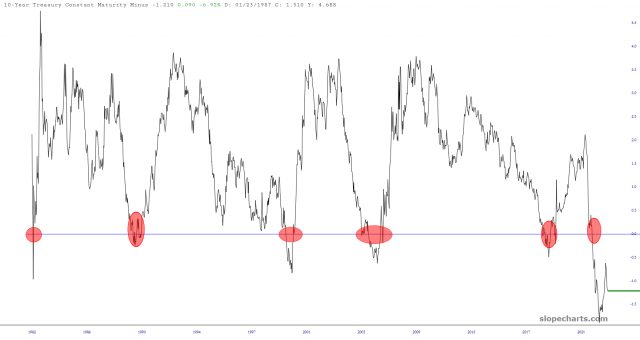

………and the hasn’t-been-wrong-once inverted yield curve seems to emphatically agree.