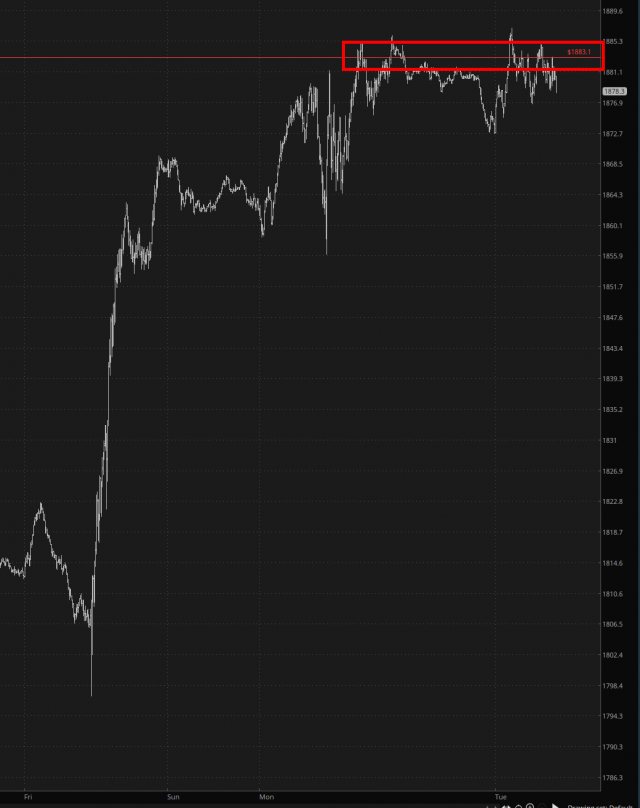

Good morning, folks. Well, there’s just 18 trading days left this year! Let’s focus on the Russell 2000 futures, symbol /RTY, because there’s clearly some power in this red resistance line:

That is, of course, the Fib level, which is at 1883.10. We have absolutely blasted to this height in the span of the past five weeks or so, and although it would be tidier if the head and shoulders reversal shared this line as its neckline, it doesn’t quite do so. The neckline is somewhat lower. Still, it’s an interesting feature on the landscape.

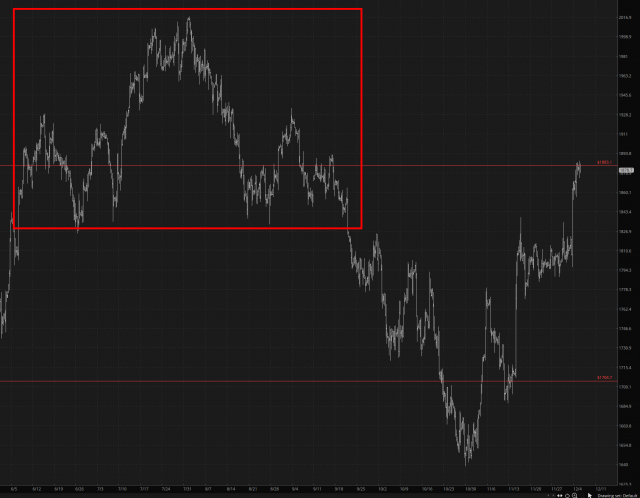

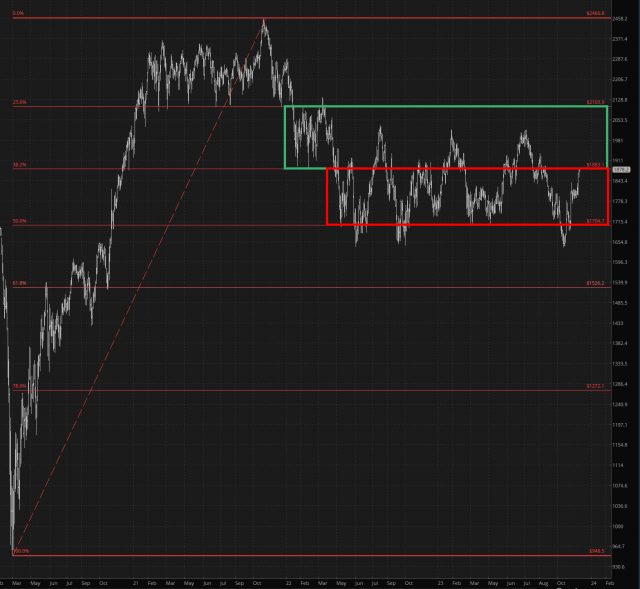

Just to sex things up even more, check out the longer-term view of the Fibs. Most of the action the past two years has been in that red zone, and we are at its tippity-top. Another portion, maybe 30% or so, manages to reach escape velocity and get into that green rectangle.

My fondest wish, as you can surely imagine, is for present price levels to be the exhaustion point. If that is the case, it means:

- The market hasn’t the strength to muster its way into the forbidden green zone, as it has multiple times in the past, which is an instance that would imply an important change in the character of the market;

- It introduces the easy-to-trade prospect of another traverse to the lower portion of that red range