There are times when the market is so amenable to bearish plays that I might accrue as many as thirty different positions. It can be a lot of work to manage that many positions at once, but when the opportunity arises, it is enjoyable to participate in a variety of sectors and setups.

However, in recent weeks, it has become hazardous almost to the point of foolhardiness to take a bearish position on anything. In my own case, I scaled back my positions dramatically to a mere seven, keeping most of my portfolio in cash instead. These “seven survivors” are described briefly below, along with the stop-loss level I am using to exit my long-put position should the given price be violated.

First there is Caterpillar (symbol CAT, stop loss 258.66). This stock briefly violated its ascending trendline, which suggests it will challenge it again, and the price is just beneath a well-formed top.

General Motors (symbol GM, stop loss 33.48) had a very big move higher last week, but the ascent in price put it just beneath a substantial and very long-term range, which represents the selling pressure of overhead supply. The price will have much more difficulty moving any higher than it did in recent weeks.

The real estate sector fund (symbol IYR, stop loss 87.95) has traversed nearly two full Fibonacci levels. It is getting exceptionally close to the next Fib level, which represents a major zone of resistance.

Schlumberger (symbol SLB, stop loss 53.60) has already broken beneath a long-term supporting trendline, and it is also cleanly beneath an exceptionally well-formed topping pattern, highlighted here with a pink semi-circle.

United Airlines (symbol UAL stop loss 41.38) has also broken its long-term ascending trendline, which suggests sustainable weakness beneath it.

United Parcel Services (symbol UPS stop loss 156.66) has an enormous and very well-formed topping pattern. Prices have violated this pattern to some degree, but we can allow some leniency since the selling pressure of the overhead supply is higher at these levels.

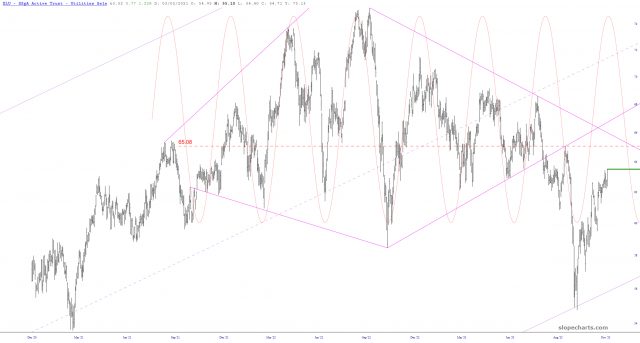

Lastly, the Dow Utility sector (symbol XLU, stop loss 65.08) has a trio of advantage for bearish investors:

- The price is beneath an exceptionally well-formed diamond reversal pattern;

- The stock has been engaging in a steady series of “lower highs” for many months, and that pattern thus far remains unbroken;

- The sinewave, lightly drawn here, conforms very well to regularly-spaced bouts of strength and weakness, and it seems that this point in time is very near the apex of the sinewave’s current cycle.