It seems that Powell is enjoying a “heads, I win, tails, you lose” market.

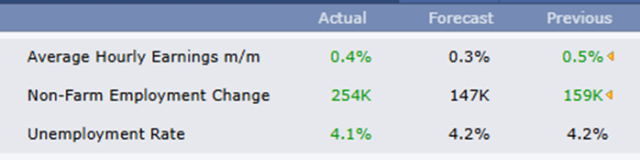

One would think that a very strong jobs report, with upward revisions to past data, would splash all kinds of cold water on Powell’s plans.

And, judging from how bonds are reacting, it certainly seems that a steady slashing of interest rates at an aggressive pace might not be panning out just yet.

Yet equities are surging. It was a tease at first, because stock futures blasted higher, only to give up the entire move, but then they re-ascended and, as of this composition, are higher than ever. We’re back to where we were on Tuesday morning.

Gold, like bonds, is getting zapped, suggesting that my XME puts might be a badly-needed bit of good news on what looks like a pretty grim day.

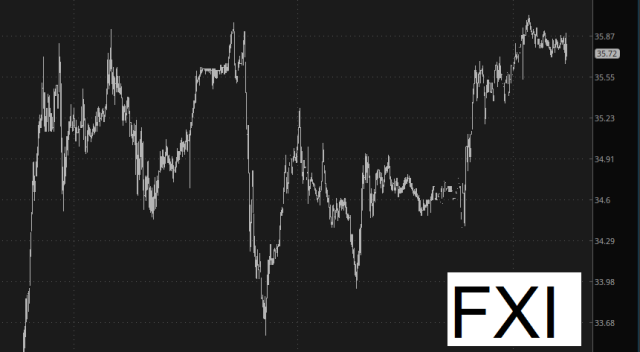

China didn’t help either. It spent the entire session climbing out of the hole it made for itself yesterday, so we are once again lingering near the top of this week’s resistance.

Broadly speaking, I probably am going to be in Partial Retreat mode, although I’m going to try very hard to obey Rule #1 from the Trading Rules page, which is to sit tight for thirty minutes after the opening bell.