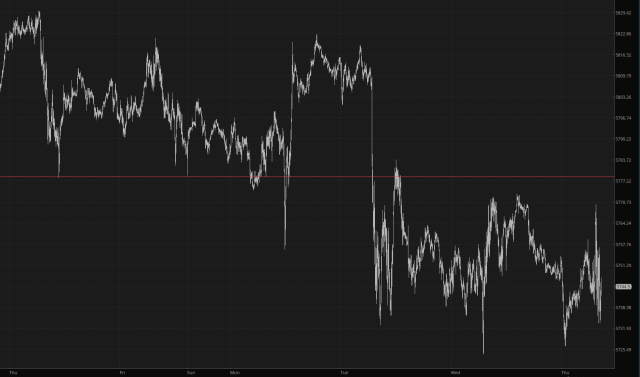

Over the course of the past week, the /ES has wiggled and wobbled without any clear direction, sometimes violently ripping up or down with little apparent cause. Simply stated, it’s a mess, at least on a minute bar basis.

Yet if we look at a daily bar, particularly in candlestick mode, something very important jumps out at me: the market had a clean and powerful triangle pattern which the bulls succeeded in escaping, and which typically should lead to a continuation of the upward movement, particularly after such a long time.

This time, however, it hesitated for a few days and then slipped right back beneath the breakout level. For both yesterday and today, we have been cleanly trading below this important S/R (support & resistance horizontal), affirming its value as a price barrier.

I have long believed that a pattern failure is more instructive than a pattern success, since everything that “should” happen fails to do so. What we have above was a perfect opportunity for the bulls to power the market higher, and they dropped the ball.

I suspect that when the jobs report comes out Friday morning, we might get an affirmation of this subtle signal’s importance.