Microstrategy was one of the biggest bombs of the Internet bubble, losing almost its entire market cap. It has reinvented itself, however, quite successfully, as a de facto Bitcoin hedge fund. The stock has done exceptionally well over the past couple of years.

Bitcoin is virtually the entire value and purpose of the company, as they have issued many tens of billions of dollars in debt in order to buy $BTC. It appears that their present holdings of the crypto coin are $16 billion, with an average price of $39,000, showing a handsome profit at present price levels.

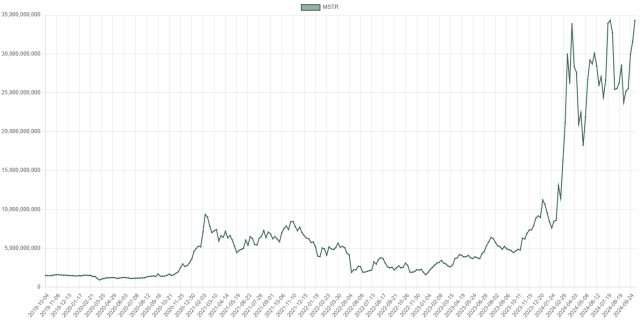

There’s something weird going on, however, because MSTR used to track $BTC quite closely, but in recent months, MSTR has pushed higher, in spite of $BTC stalling, producing a premium price for the company for reasons I honestly cannot explain.

Looking at Slope’s market capitalization chart, you can see that Microstrategy is worth about $35 billion. Yet their $BTC holdings are only about $16 billion. Why the huge premium?

It has seriously been suggested that the tweet below explains the price premium. All right, people of Earth. You do you.