Well, there I go again. Great chartist. Crummy trader.

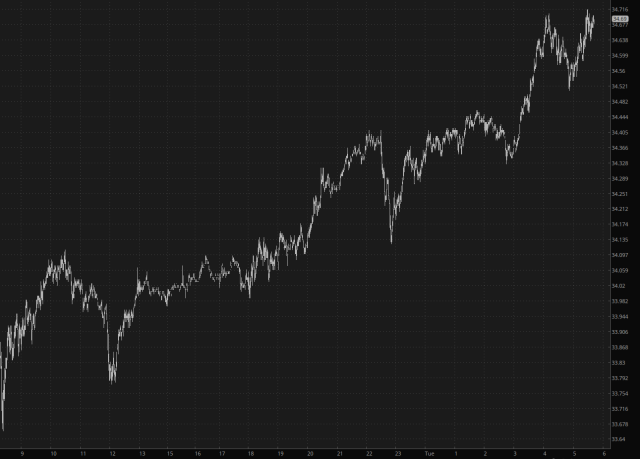

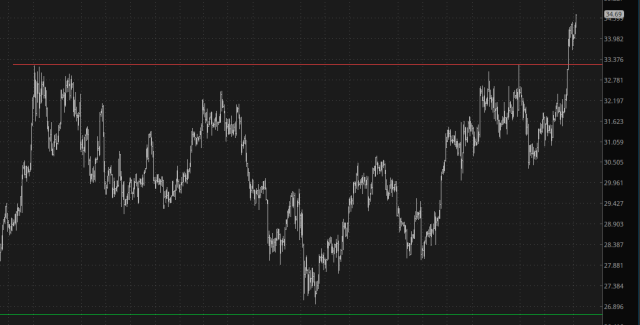

My thesis, as I mentioned every 12 minutes, is LONG precious metals (silver, specifically) and SHORT equities. That actually, based on my picks, has been working out just dandy. Yesterday morning, prompted by yet another pop in silver, I decided to take profits and retain only a partial “let’s see how things go” position. Well, the way things “went” has been to continue zipping higher, as I predicted:

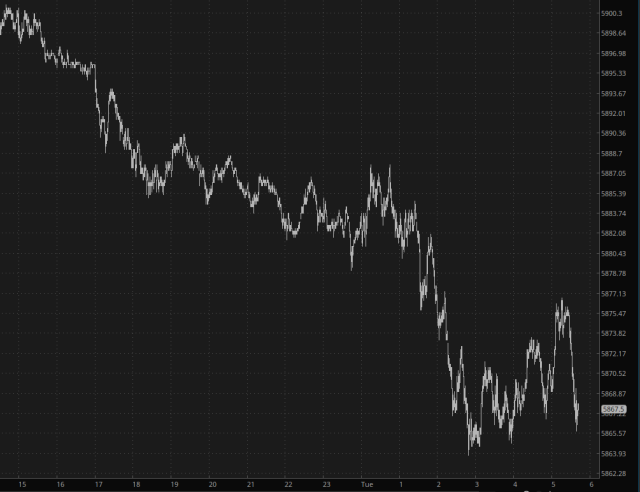

As for the other half of my thesis, stocks are down across the board this morning. Yay.

It isn’t just silver that’s up, of course. Gold has push to another record high, and it can see $2800 over the horizon.

So, yeah, I fumbled this one. The inverted H&S on silver looks fantastic, and I’m wondering if it’ll even bother easing back to the neckline, as I hoped. At this point, I’m very, very conflicted, because I don’t want to “chase” this thing, but the more it moves away from the bullish pattern, the more stupid I am going to feel. Long-term, it probably doesn’t matter jack squat, since it’ll ultimately be much higher, but I feel like a bit of a dolt at the moment.

I’m going to wait the fabled half hour to see how things shake out, particularly since I own GDX puts which I need to consider dumping. Who knows, perhaps silver will ease after all, but I’ve really got to examine regular hours market action to make my next move.

Anyway – – – the thesis is doing great, and the only thing not performing properly is my brain!