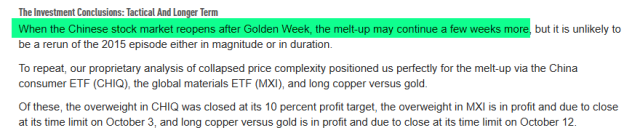

I have a vivid illustration of the difference between me and many other market observers. Just yesterday on the Goldman-loving permabull site ZH, one chap deigned that, yes, the Chinese stock market mega-rally might peter out “a few weeks” after Golden Week is over. In other words, in about a month.

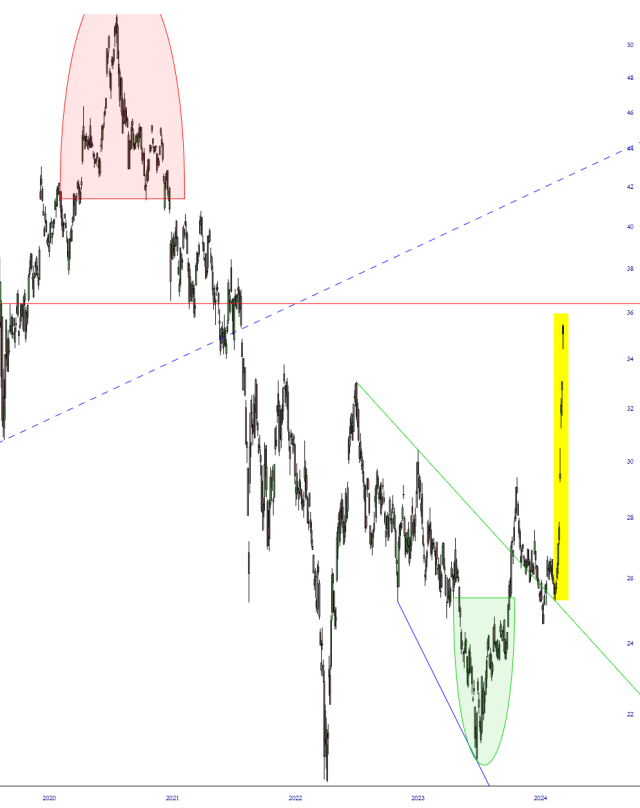

In contrast, yesterday, in the face of the 13th day in a row of Chinese stocks melting up, I declared both in print and on my tastylive show that not only was I holding my Chinese shorts, I was adding to them, because my sense was that the rally would flame out just like the one in May had.

Well, so far, so good, because every stock related to China has sputtered and is looking for a nasty gap-down opening here in the land of the free.

A specific example is symbol JD (which is the clever ticker for the company JD.com). Yesterday, as marked with the arrow, this sucker spiked higher. I was tempted to dump my puts, of course, but I did just the opposite. I bought more of them. By the end of Wednesday, things were looking not-so-terrible, and I’ve got a hunch that in the days to come, these should really pay off.

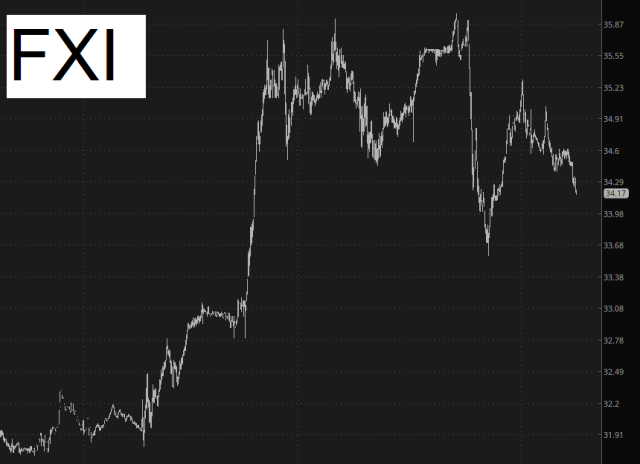

I mean, for heaven’s sake, look at the daily chart of FXI. Does this look sustainable to you? The correct answer is nope.

Here’s a nugget from a couple days back.

Good luck out there today – – looks like a good one!