A couple of weeks back, when I went ga-ga over silver, it was my intent to get long in a medium way, get out, wait for a meaningful pullback, and then REALLY get back in, bigger than ever.

Well, parts one and two went all right. I did indeed get long in a medium way, and I got out with nice profits (arrow). I felt pretty clever for a few hours, but as you can see, silver brushed itself off and climbed yet again, so I was calling myself all kinds of creative names yesterday. As of this moment, with /SI down 1.4%, I don’t feel quite so bad.

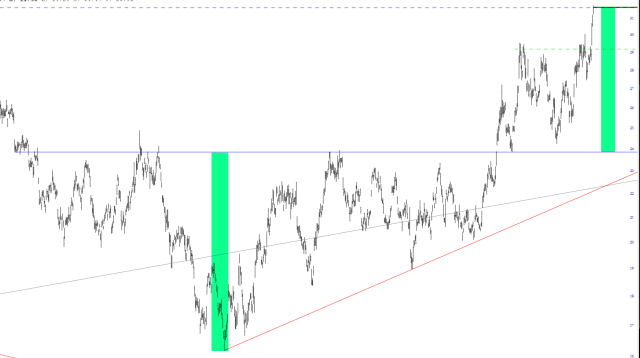

The main thing that calmed my nerves yesterday was the chart below, which is SLV. This chart has a well-formed inverted head and shoulders pattern. I have represented the measurement in green. On the right side, I have placed precisely the same amount of price spread on top of the neckline, producing the target price.

As you can see, yesterday’s move in SLV absolutely NAILED this target. Thus, I swatted my hand away from trying to chase this move. The retracement is still a distinct (and very desired) possibility.

Looking longer-term, at the /SI futures, I’m hoping for a move similar to what we saw months ago: a basing pattern, a burst higher (terminating at the circle), a retracement, terminating at the arrow, and then party time. The key right now is to sit on my hands until the retracement is complete.

Of course, we are heading into the MONSTER of all trading storms. In the next ten trading days, we have:

- The vast majority of U.S. companies reporting their earnings;

- The most consequential Presidential election of our lifetimes;

- The FOMC meeting/Jerome Powell variety hour

So, yeah, if the words “unchecked pandemonium” strike fear in your heart, you might want to binge-watch Netflix for the next few weeks. Me? I’m here for the duration.