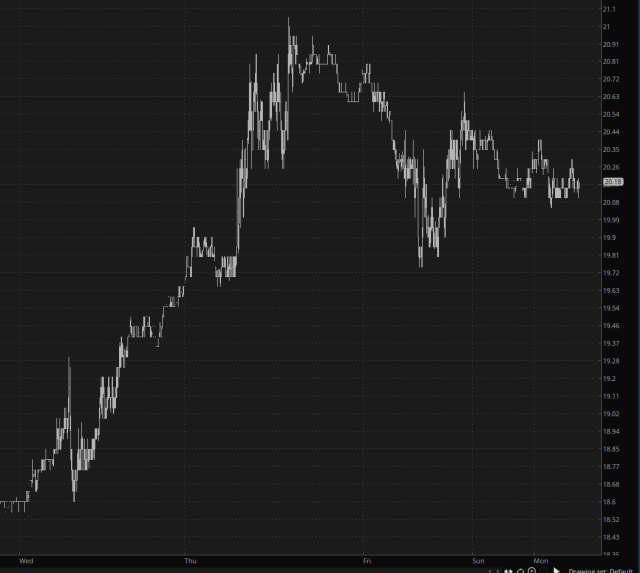

Tensions are running high, with the grueling 2024 election cycle finally drawing to a close. Tomorrow is the big day, although you’d never know it looking at the VIX, which is ambling around 20 with complete indifference to any future risk.

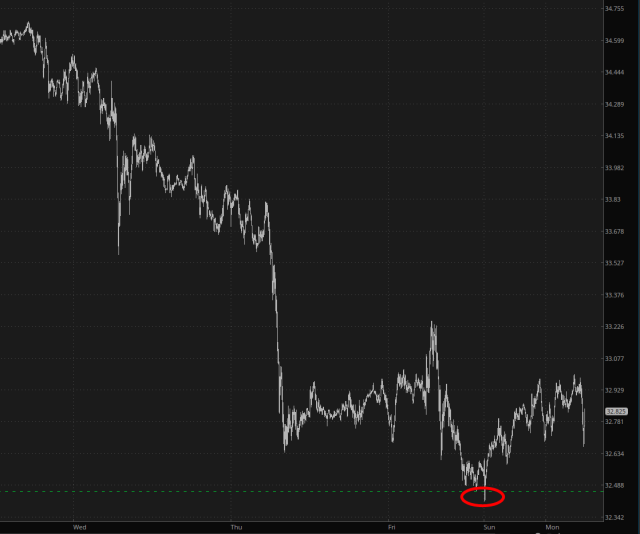

Silver approached crucial support last week, and it decided to give it a one-second “test” the moment futures opened on Sunday. It has passed the test for now, but should we breach that green level, we’re in for another leg lower.

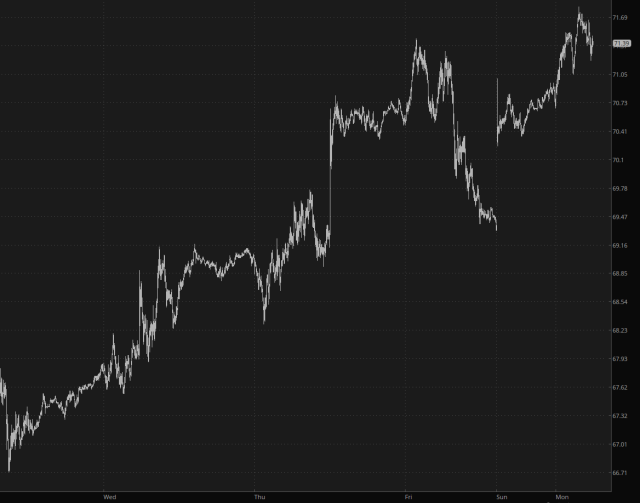

The big news over the weekend was OPEC+ deciding to yet again forego any boost in production, which has popped /CL prices higher by nearly 3%. This is just another measure by the cartel to try to prop up prices in the face of a slowly dying global economy. Sooner or later, crude is going to follow its natural path, which is much lower. This big OPEC+ news might not last more than a few days, if that.

The key shift last week was the change of the /ES horizontal from support to resistance. There’s no doubt that the next 48 hours are going to be unchecked mayhem, although we may be in a serious holding pattern for the first half of those 48.

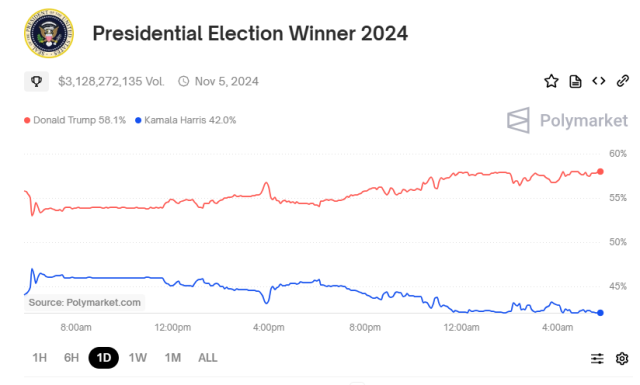

The betting markets, which are pretty much a new thing this time around, all predict the exact same thing: a total Trump sweep. If that doesn’t happen, you can expect betting markets, and Polymarket in particular, to suffer an irreversible blow to their reputation, Nate Silver style.