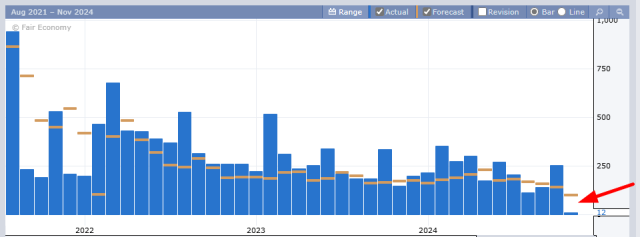

The monthly jobs report just came out. It’s the last report before the election and the last before the FOMC does their cute little theatre piece next Thursday. The jobs created number was feeble, to put it mildly. It’s the tiniest growth in years and a sliver of the already-modest expectations.

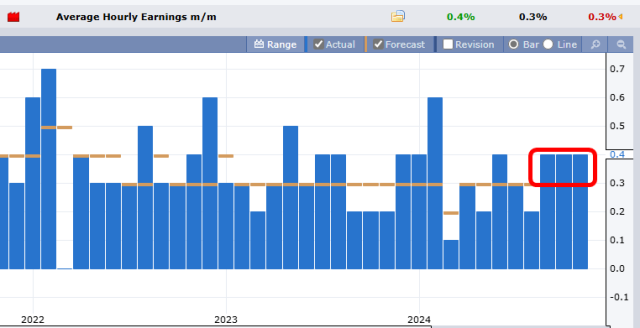

In spite of this, hourly earnings went………..up. So, yeah, we’ve got the perfect formula for a thriving economy: shrinking job opportunities yet continued inflation for persistently higher bills. USA! USA!

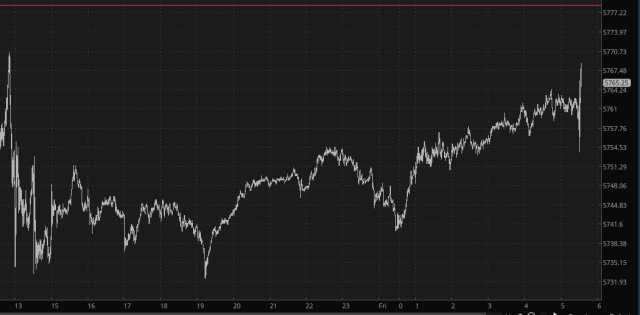

In spite of this double-dose of bad news, the powers that be in D.C. aren’t about to let the market sink for more than a day, so we’re green across the board. The /ES has been creeping higher all night long.

Keep in mind the bigger picture, though. The 4-hour chart on the /ES, as opposed to the inconsequential chart minute bar chart above, clearly shows what has taken place: a complete failure of a crucial trendline and a pathetic retracement toward obvious resistance. Enjoy the green while it lasts.

The /NQ isn’t any different. All the big techs are done with their announcements, and all they’ve got to show for it is the first failure ever of the August 5th uptrend.

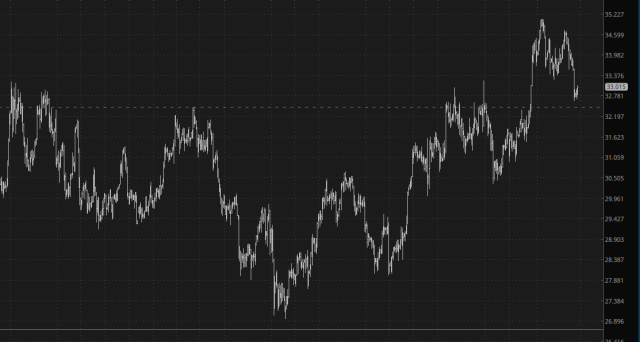

As I’ve mentioned ad nauseum, as appealing as the silver chart is, I’m staying away. This looks like a beautiful inverted head & shoulders pattern, but whether or not that neckline holds is key.

I’m fully loaded with 15 bearish positions. Just three trading days left until (hopefully) we’ll know the results of this election.