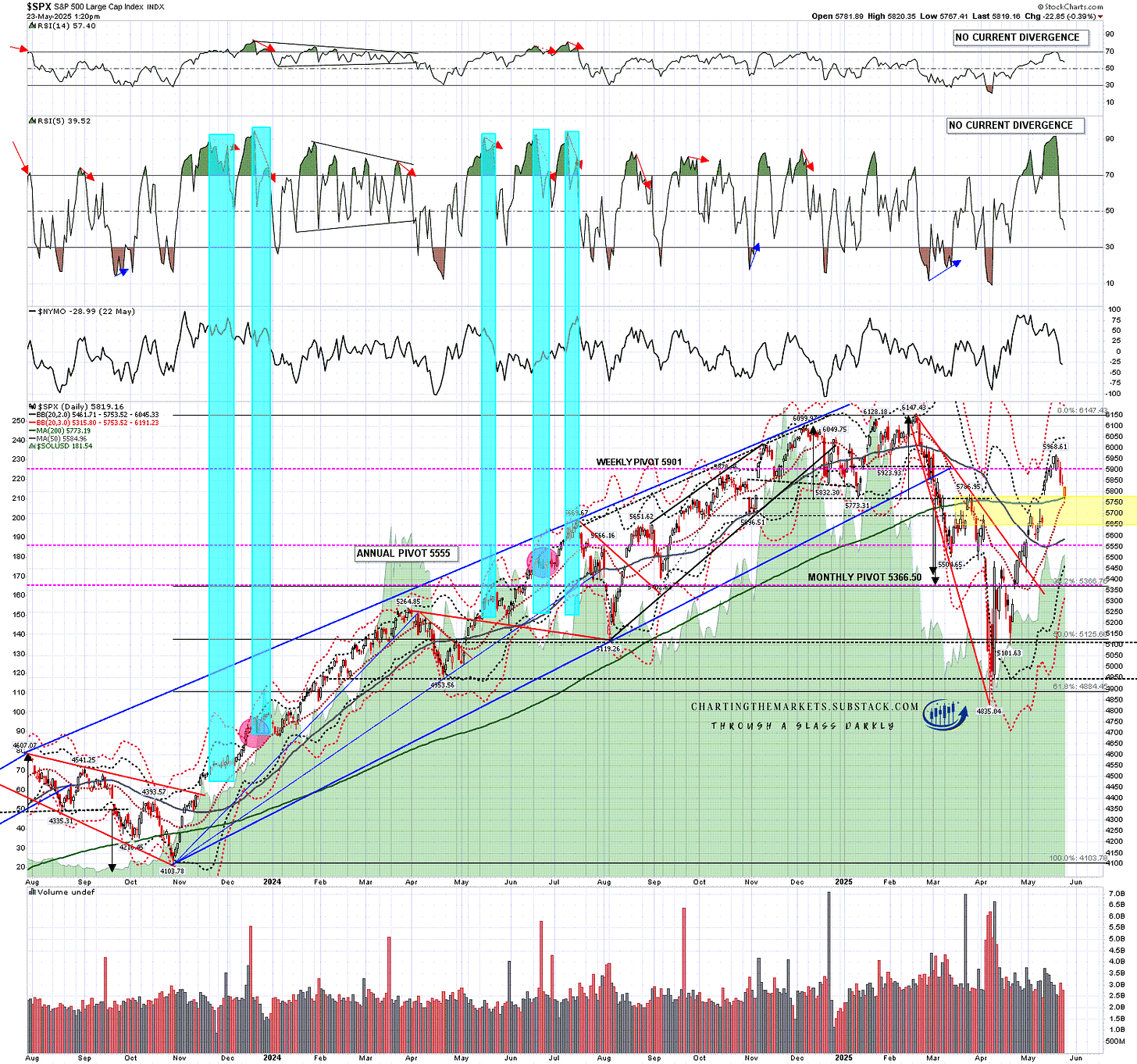

In my post a week ago on Friday 16th May I was looking at the break over 90 on the SPX daily RSI 5 and noted that history suggested that would likely be followed with a consolidation or retracement lasting for two weeks. I also suggested that an ideal retracement target would be a backtest of the 200dma that was broken hard at the start of last week.

With the decline since then culminating this morning (so far) in the backtest of the SPX 200dma at 5773, with the low today at 5667, that’s looking pretty good and this is also the obvious area to find support so this is a candidate low for this retracement.

What next? Well the obvious next step would be retests of the all time highs on SPX and QQQ, and ideally DIA as well, though that looks like more of a stretch. Historically this would be a very good time to see this happen as three days in each of the next three weeks lean conspicuously bullish. Even setting aside the fact that there are only four trading days next week that is a strong bullish lean, and looks like the ideal time to see these high retests.

Trump didn’t really help the market’s mood this morning when he announced that he is planning to imposed 50% tariffs across the board on the EU on 1st June, but it seems that the markets have decided so far to worry about that if it actually ever happens. We’ll see.

Looking at the SPX daily chart the retrace was a bit faster and sharper than I was really expecting, so the daily RSI 5 fell well below 50, but that was a lovely backtest of the 200dma this morning. The hourly RSI 14 sell signal on QQQ that had fixed when I wrote my last post, and the two on SPX and IWM that fixed after I wrote that post have also now all reached target.

I really like this area for a retracement low, news permitting, particularly as the daily middle band is currently just 20 handles below the 200dma so this area is double support. This area is also breakaway gap support that I would expect to hold without a gap fill until this move up has ended, which doesn’t currently seem likely to have happened already.

SPX daily chart:

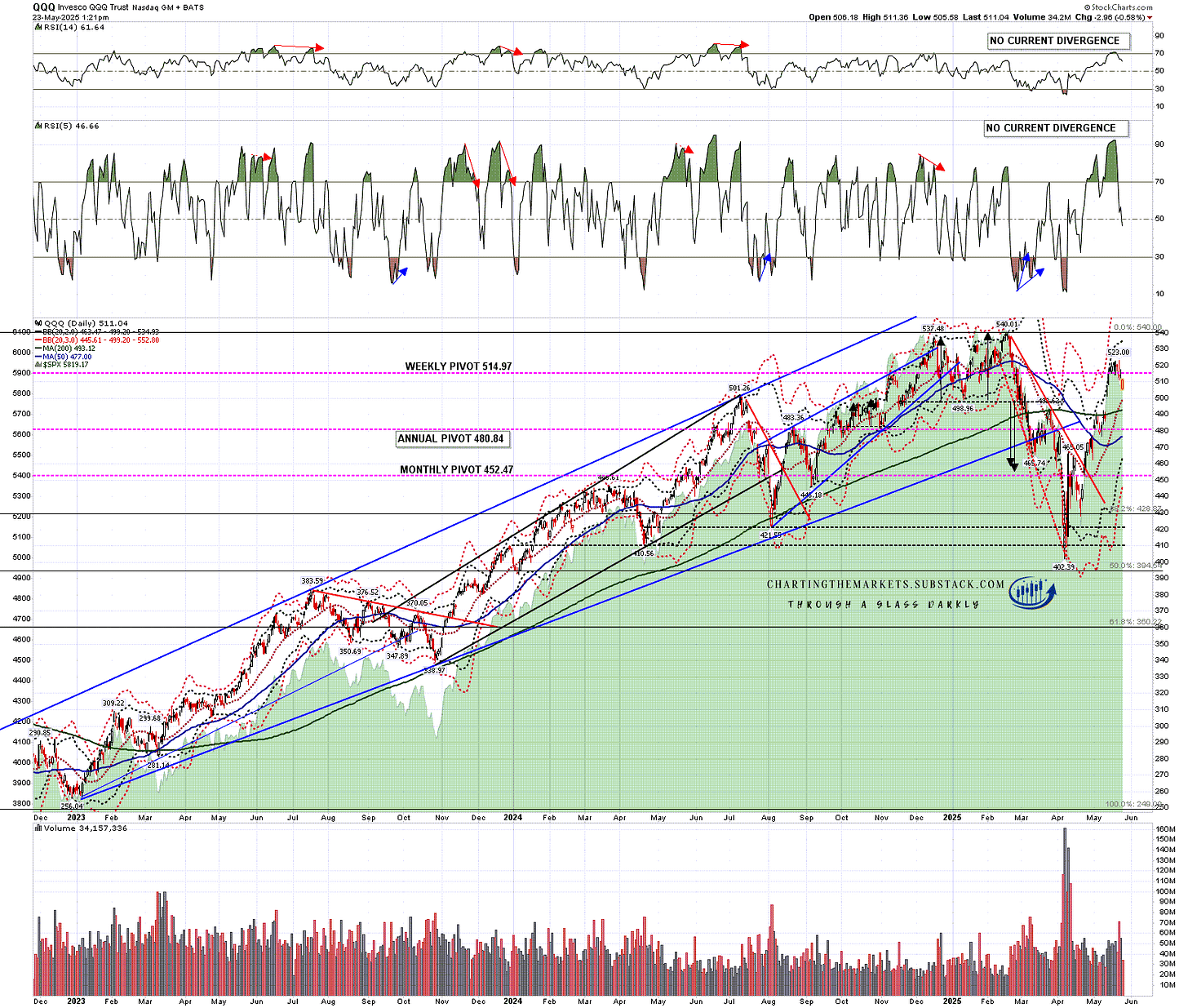

QQQ has held up the best in the last week but also delivered a decent little retracement, without the current low having hit anything significant.

QQQ daily chart:

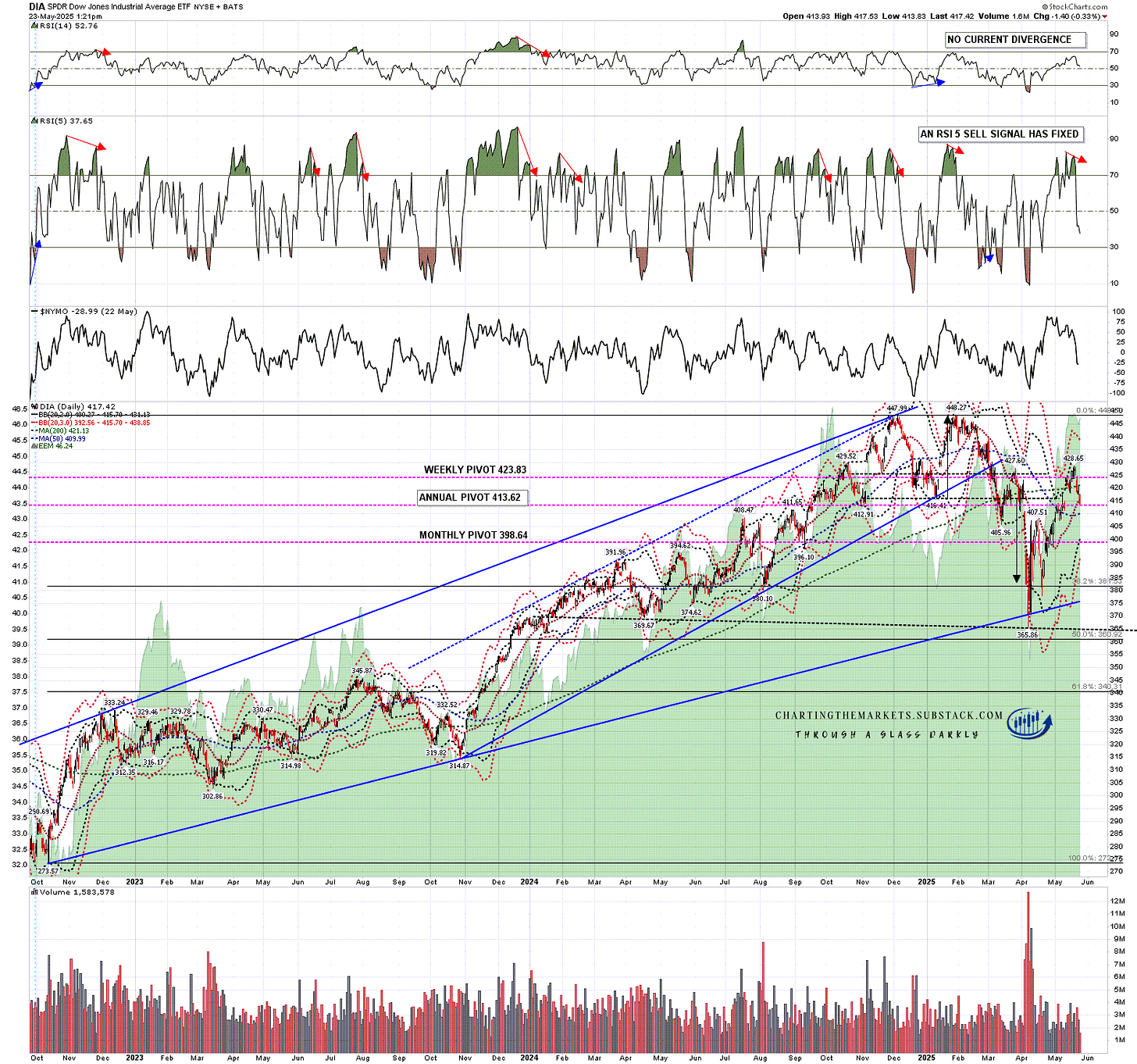

DIA has backtested the daily middle band and if it heads a little lower the 50dma is currently in the 410 area. There is some reason to think it might need to go a little lower, as there is a fixed daily RSI 5 sell signal from this last high and it hasn’t reached target yet.

DIA daily chart:

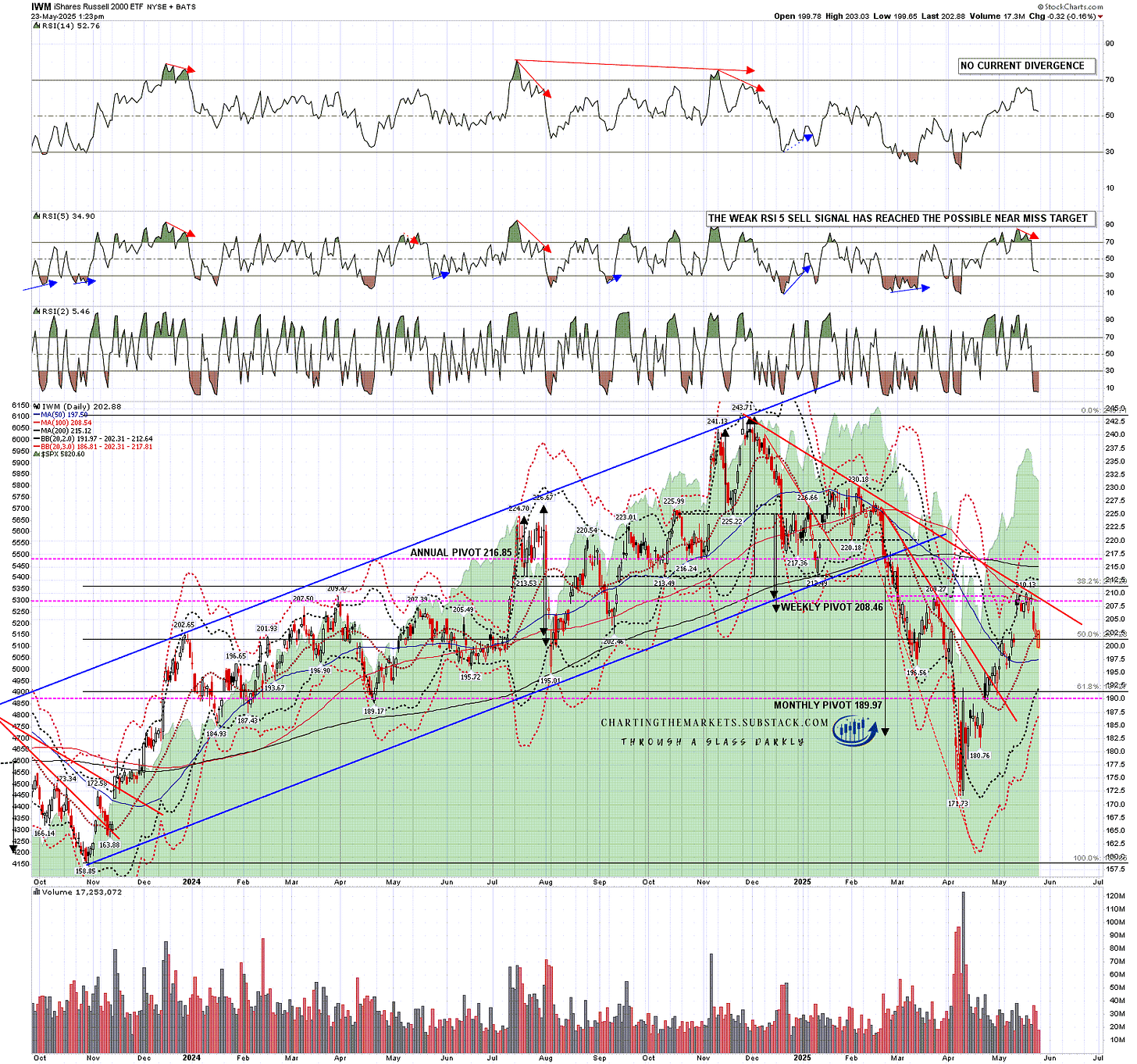

IWM also had a (weak) daily RSI 5 sell signal fix from the last high but that has already reached the possible near miss target. This has been a hard backtest of the daily middle band which has held so far on a daily closing basis. IWM has been the weakest this week, which is to be expected as there have been issues in the bond markets and IWM are the index most vulnerable to higher interest rates.

IWM daily chart:

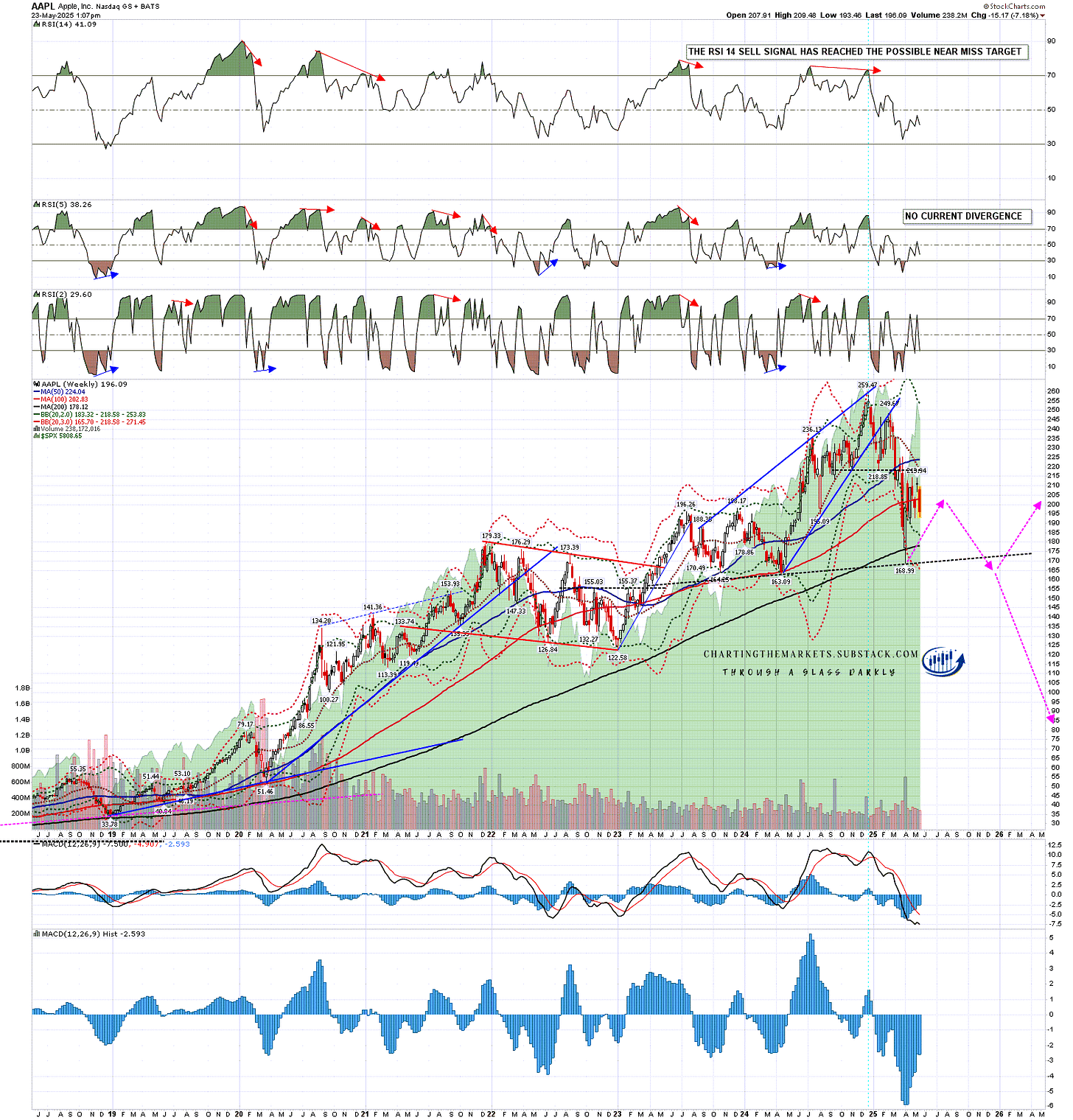

The other thing Trump mentioned this morning was a 25% tariff on iPhones not made in the USA, which I assume would be all of them. This seemed a strange one and he might just have woken up on the wrong side of his random number policy generator but it did remind me that I emailed out an AAPL weekly chart as my Chart of the Day for my substack subscribers earlier this week noting that the arrows I drew on this back in early April to show a possible very large H&S forming are still looking pretty good.

AAPL weekly chart:

I’ve been saying the following on all my posts so far this year:

As I have been since the start of 2025 I’m still leaning on the bigger picture towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities, not least because both of the last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. UPDATE 11th March 2025 – I am wondering if this may be a bear market that dominates the whole of 2025.

This is going faster than I expected and it looks like we may see both the initial weakness and the new all time highs in the first half of this year. I remain doubtful about seeing much more than retests of the all time highs and I think we may well see a lot of further market disruption in the second half of 2025. We’ll see how that goes. Everyone have a great weekend. 🙂

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.