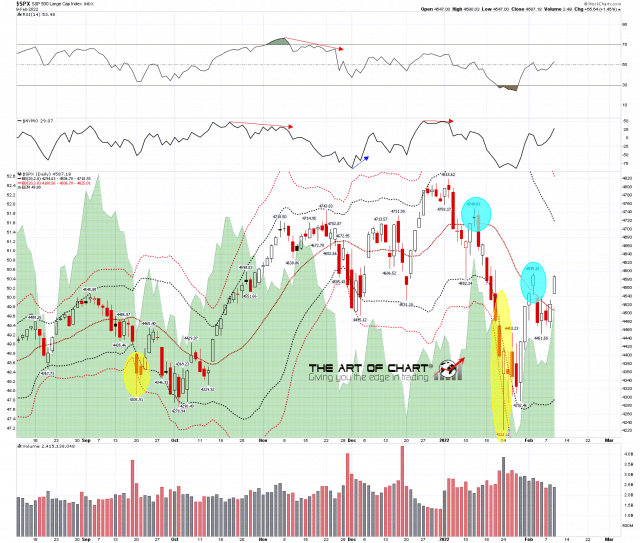

I was saying in my last post before the open on Tuesday that if SPX kept testing the daily middle band as resistance every day then another attempt to break back above it was likely and we saw a modest close back over the daily middle band at the close on Tuesday. That followed through to the upside yesterday and yesterday’s close was a confirming close back over the daily middle band, now in the 4506 area, and a test of main resistance at the weekly middle band, now in the 4583 area.

SPX daily BBs chart:

This is an important inflection point, as a sustained break back over the weekly middle band would open a possible retest of the all time high on SPX. There is a chance to close the week above the weekly middle band at the close tomorrow of course, and a confirming close above it next week would set up a possible all time high retest.

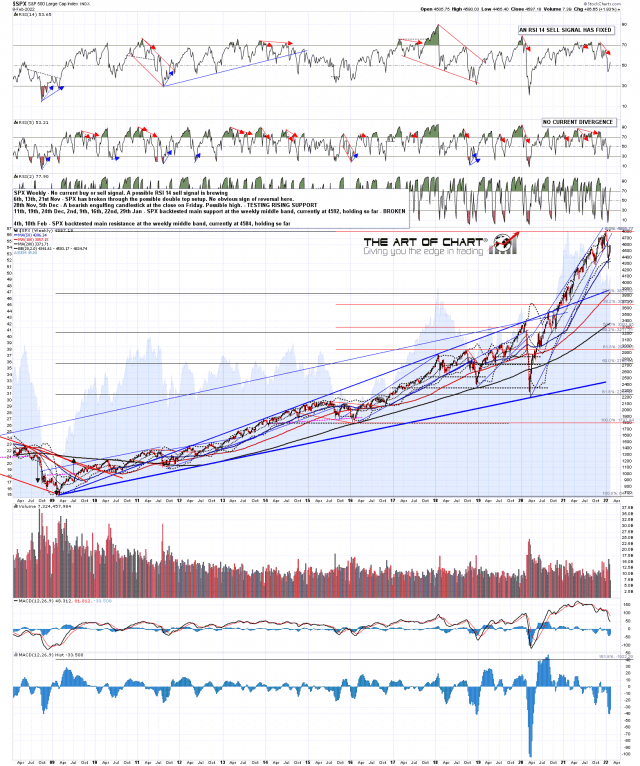

SPX weekly chart:

There is one other resistance level worth mentioning here, and it is a double resistance level currently at 4611-17. That comprises the 50dma, now at 4611, and the 45dma, now at 4617. That is the last strong resistance level below a retest of the all time high on SPX.

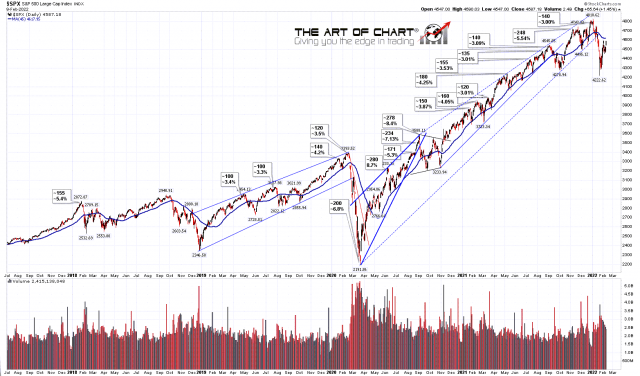

SPX daily vs 45dma chart:

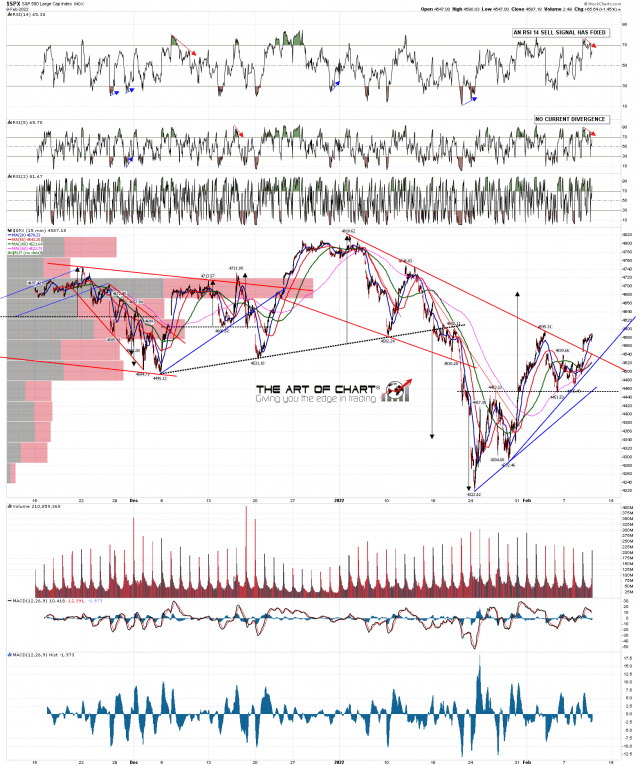

There is already some short term negative divergence here, with a 15min RSI 14 sell signal fixed on SPX and an hourly RSI 5 sell signal fixed on ES. If we are to see failure here I’d be leaning towards seeing a full retest in regular trading hours of the current rally high at 4595.31.

That would set up a clear double top here that on a subsequent sustained break below 4451.53 would look for the 4305 area and a probable retest of the current retracement low at 4222.62.

SPX 15min chart:

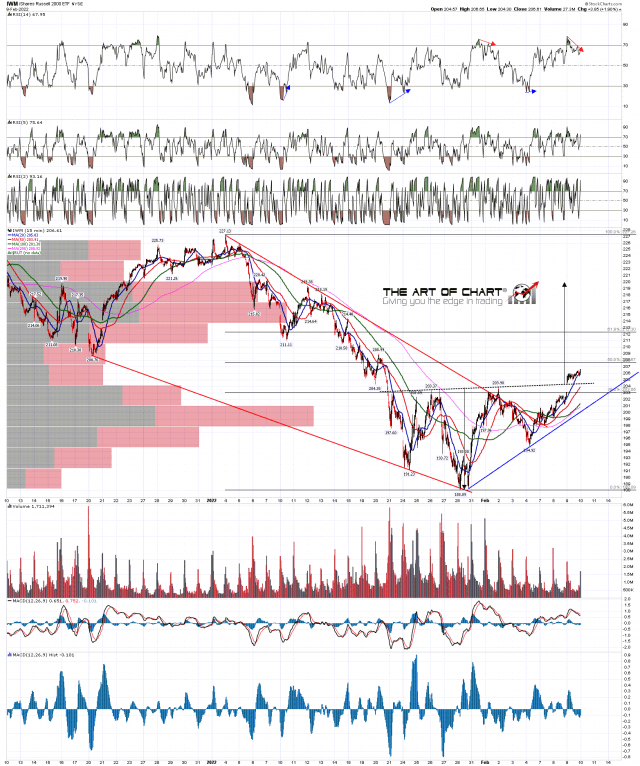

The possible IHS I was watching on IWM has completed forming and broken up with a target in the 220 area. At this point there are two main options here, either that the IHS makes that target, or that IWM fails into a retest of the lows. We are very likely to see one of those two options deliver directly from here, and a break below the right shoulder low at 194.92 fails that IHS and sets up the low retest as the target.

IWM 15min chart:

This inflection point still likely resolves downwards but if that doesn’t happen today we may well see SPX close over the weekly middle band tomorrow. I’d note tomorrow leans historically 66.7% bullish.

We are doing a free public webinar at theartofchart.net an hour after the RTH close tonight on ‘Trading Commodities – Setups and Approaches’. We will be looking at at commodities markets and will be designing two options trades that could be used to take advantage of potential moves in two of those markets. If you’d like to attend you can register for that here or on our February Free Webinars page.

Our high end options service Paragon Options started the year strong with a $47,000 profit trading ES in January. We are looking at taking on up to ten new subscribers this month and if you’d like to sign up for a free trial you can do that here.