Before I get started I want to encourage all of you interested in trading options to sign-up for my free weekly newsletter. No, I’m not going to send you more than the one email a week and no, I’m not running a service. I’m a trader. This is completely free from all marketing. You will find educational topics, research, trade ideas, weekly indicators and more each week. I’ve been on Slope for a long, long time and would love your all of your support. Thanks.

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

A History of Weekly Band Tests

The lower weekly Bollinger bands are a common extreme target in most major corrections. In fact, I note only nine such tests since the 2009 bear market low. I looked and looked for some kind of reliable method to determine ahead of time how a correction would likely unfold (such as in being range bound for a while or breaking out and resuming the uptrend), but I could not find any consistent outcomes by looking at how high the VIX got, whether there was a weekly band low blowthrough or not, or how deep the correction was. There were no commonalities I could find on how high a first bounce would likely go or whether or not it would retest the low.

(more…)The January Barometer

I’ve been promising a post talking about the January Barometer, which is a statistic from the Stock Trader’s Almanac, something that I have been buying every year for many years as it has a lot of very useful information for traders and investors.

This statistic looks at all Januarys that have closed down since 1950 and what happened over the rest of the year from there, and on those years overall. The stats for the rest of the year are that 59.7% of them close down for the overall year, and 48.7% close the year lower than that close at the end of January, which was at 4515.55 this year of course.

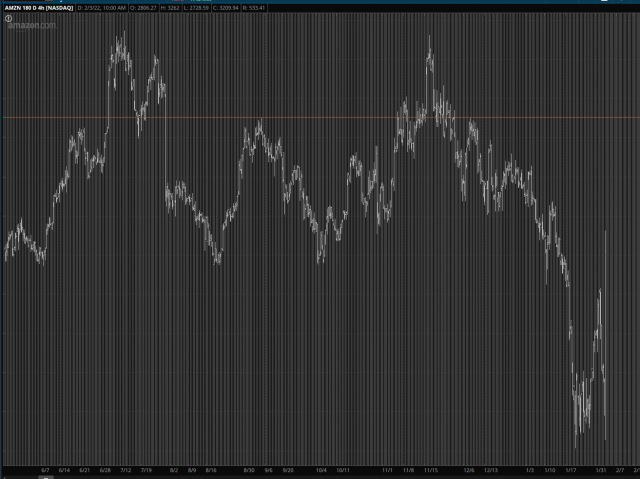

(more…)Amazon Hot Take

The hottest earnings report of the quarter just came out, and AMZN is absolutely flying higher. Keeping things in context, it has sailed to the Sierra Nevada Mountain Range of overhead supply, so I think it ain’t goin’ no higher.

AMZN Sanchez Ay Yi Yi

Well, as cool as it was to see Facebook get blown to pieces, the REAL test is going to be Amazon. If AMZN does well, then FB will be considered an anomaly. If AMZN gets the Dirty Sanchez treatment, then it’s party time. Personally, I think a lot of the froth was already blown off AMZN thanks to the FB drop, so it’ll take a real doozie to send AMZN down. I have no position, except inasmuch as I’m heavily short the market and would definitely appreciate a real homewrecker of a dive.