Last week I was writing about the solid short setup forming on Crypto and have been looking at it every day in my premarket videos. That setup has played out now, all the daily sell signals I was looking at on BTCUSD (Bitcoin), ETHUSD (Ethereum) and SOLUSD (Solana) formed, fixed and have now made their full targets at the 30 level on the daily RSI 5.

So what now? Well we’re seeing a rally today which I was looking for on yesterday’s premarket video, and a likely backtest of key resistance is coming. On Bitcoin that resistance is at the daily middle band, currently at 62,604. A break and conversion of that to support opens the upside.

Am I looking for low retests to set up possible RSI 5 buy signals? No, for the reason that such a signal wouldn’t mean much here. The daily RSI 5 sell signals happen regularly and have a good track record of making target, but that’s not the case for RSI 5 buy signals. On Bitcoin there have been no daily RSI 5 buy signals in the last two years, on Ethereum there was one, which failed, and on Solana there were two, one of which failed. They have no history of being a guide here. A daily RSI 14 buy signal would be a different story, but there is no prospect of forming any of those unless we see a lot more downside.

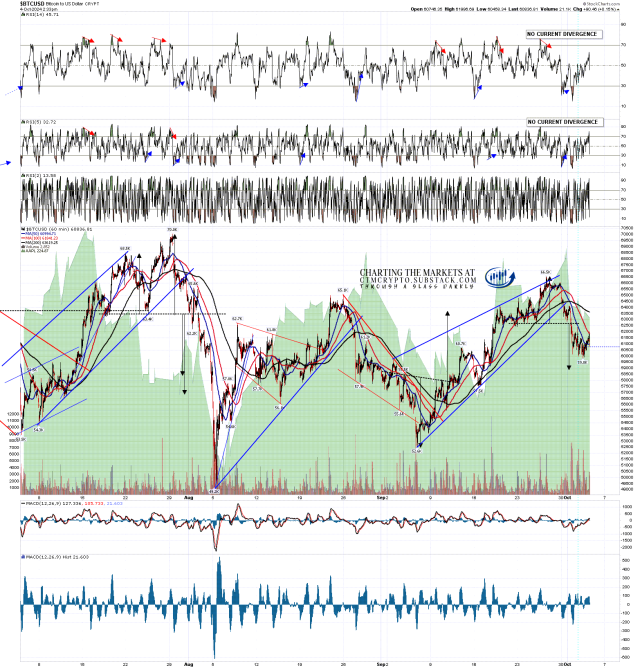

BTCUSD daily chart:

On the hourly chart there is no hourly buy signal to match the ones that fixed overnight on Ethereum and Solana, but there is a small nested double bottom setup that could deliver a rally back to the 65k area.

BTCUSD hourly chart:

On Ethereum key resistance is also at the daily middle band, currently at 2511, and supported by the 50dma slightly below at 2507. A break and conversion of that resistance would again open the upside.

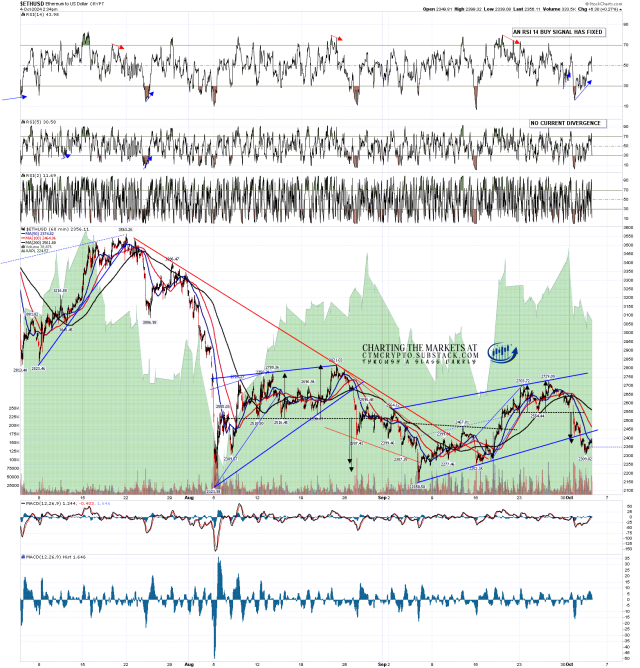

ETHUSD daily chart:

On the Ethereum hourly chart the double top target was reached, and there is a possible small IHS forming that could deliver a move back to the 2490 area and that resistance test. An hourly RSI 14 buy signal has formed and is not close to target.

ETHUSD hourly chart:

On the Solana daily chart resistance is at the 50dma, currently at 141.80, and then at the daily middle band, currently at 145. A break and conversion of these resistance levels opens the upside, with next resistance at the 200dma, currently at 151.

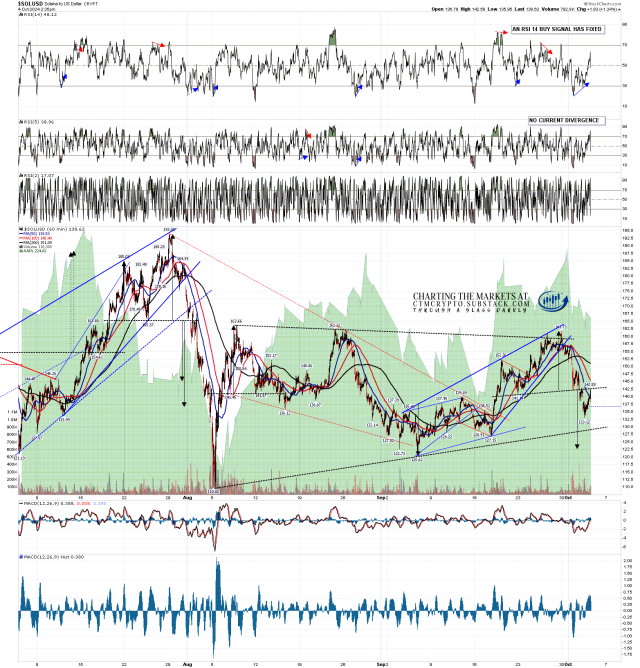

SOLUSD daily chart:

On the Solana hourly chart the initial small double top made target and there is a larger, though less well formed, H&S that has broken down with a target in the 122.5 area. That H&S would fail on a break over the right shoulder high at 148.95 and, if seen, that fail would fix a target back at the September high at 161.73. 148.95 is therefore the biggest level to watch on Solana. An hourly RSI 14 buy signal has also fixed but has already reached the possible near miss target area.

SOLUSD 60min chart:

As I’ve mentioned before, Crypto are significantly correlated with equity markets, so if equity markets break up here then likely Crypto will too. I’m publishing another post on equity markets next today on my other main substack, but the bottom line there is that equities don’t look ready to break up quite yet and there may well be a rally here, currently in progress, followed by a larger decline (on equities) than the one we have just seen, and then I’m leaning towards a bull move into the end of the year. A variant of that which rhymes rather than repeats is what I’m leaning towards seeing on Crypto. That next move wouldn’t have an obvious target on Bitcoin, but I’m wondering if we might see a retest of the August low on Ethereum at 2121.38, and the August low on Solana at 110.02. If seen they could both be nice looking second lows on large double bottoms to end the pullback from the highs this year.

Everyone have a great weekend! 🙂

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I’m also to be found at Arion Partners, though as a student rather than as a teacher. I’ve been charting Cryptos for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.