There is a very clear target for an AM low this morning if we are to see an AM low and then continuation upwards today. At the time of writing that area is at 1912-4 ES, and that target is at the rising wedge support trendline from last Thursday’s low. A break below there would open up a possible decent retracement but in this very bullish tape since last Thursday I won’t be holding my breath waiting for that to happen. – TARGET TRENDLINE HIT WHILE WRITING POST. ES Mar 60min chart:

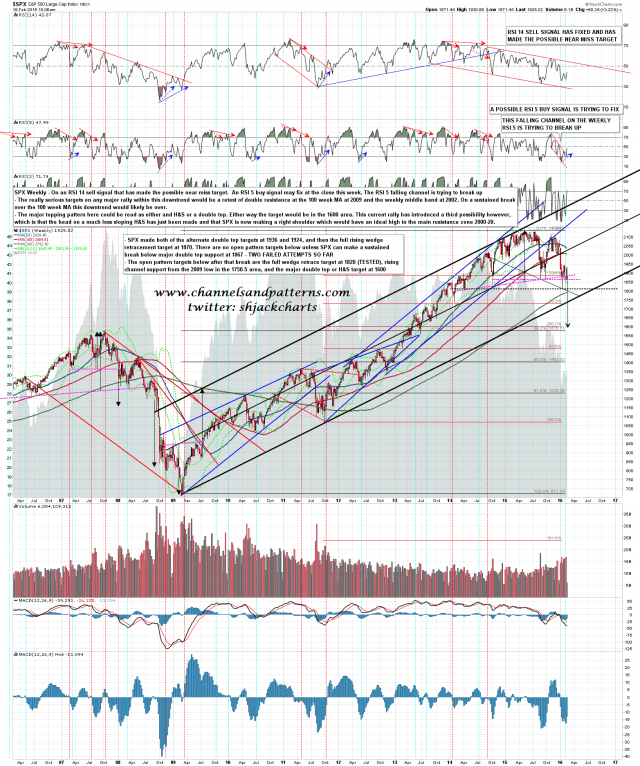

On the weekly chart I think that this move is returning to test the strong resistance in the 2000-20 area that was the obvious target for the last rally but was never reached. There is also an interesting H&S right shoulder possibility that I outline in the text on the chart below. SPX weekly chart:

A decent retracement is overdue here and if we see SPX break below the 1912 level then we could see that today. Failing that the next obvious target remains a retest of the last rally high at 1947.20.