My decision on December 26th of last year to dump virtually every short I had, buy GUSH, buy FAS, and short bonds, was the result of some of the most shrewd, most clear-headed thinking I’ve ever done.

In contrast, my impatience and eagerness to jump back into the world of bearishness, having had such a great quarter in Oct-Dec, was one of the worst. Indeed, in my own words from this post of December 26th:

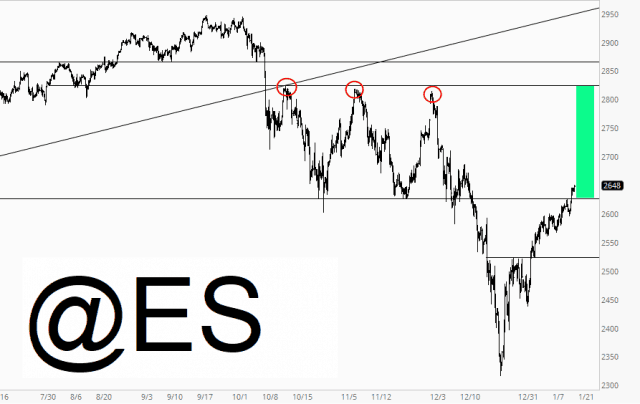

Now, had I steadfastly actually LISTENED to myself and hung up tight until 2600 was reached (that is, two days ago), that would have been brilliant. I didn’t. But that is water under the bridge, because we have a different problem on our hands now:

I think my obsession with 2600 was well-reasoned, but we have absolutely blown past it now. Indeed, the real number that counted was 2626, but even that has been surpassed. We are now in a tremendous range, spanning all the way up to the G20 Trade Truce rally, and I see no reason we couldn’t keep grinding up to that level.

After all, think of how instantly and powerfully the marketed reacted to yesterday’s Mnuchin rumor. Honestly, think about it: the rumor – – just a rumor! – – was that we were going to drop the Chinese tariffs altogether as an olive branch. And the market instantly exploded upward.

Think of what our actual goal was: the get the Chinese to open up their markets and stop stealing our technology. And yet a rumor that the U.S. was, in fact, going to totally surrender in what would be an utter sign of negotiating weakness, was embraced as absolutely fantastic news.

Can you imagine the rally if a REAL trade deal with excellent terms was produced? After all, a rumor about a horrible deal since the market ripping to new highs for the year.

There are other “overhangs”, too, which, if removed, would cause bulls to celebrate. There’s the federal government shutdown. There’s the Mueller probe. The market would probably celebrate a government resumption. The market would surely celebrate if the Mueller report was basically a big nothing-burger.

So I can only pat myself on the back for my 12/26 insight. But I damn myself for my impatience. Now that resistance is breached, we are in much more on a no-man’s land, and in spite of what I said yesterday, I’m glad to start the day so lightly positioned.

I will mention in closing that there ARE still plenty of amazing short setups, but a few points on any of them can turn them from “amazing” into “don’t bother.” My gold and diamond members can see these in my “BEAR PEN” watchlist at any time (there are 53 of them right now, I believe).