Ya know, as hard as the past three weeks have been for bears, I was hanging in there just fine……….until THIS bolt out of the blue:

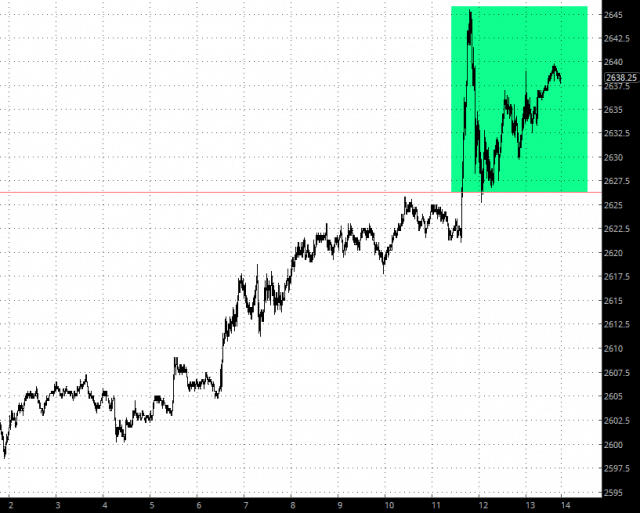

As you surely know by now, Mnuchin – – who ANNOUNCED he was activating the Plunge Protection Team back on December 26th, was associated with a rumor that we were going to drop the Chinese tariffs. The market went berserk, and the resistance figure I cited repeatedly – 2626 on the ES – – has now become support. The key number here seems to be “26”.

Given this surge, which puts us into the 4th week of this ascent, there is definitely some damage being done to resistance lines that I consider important, such as this………..

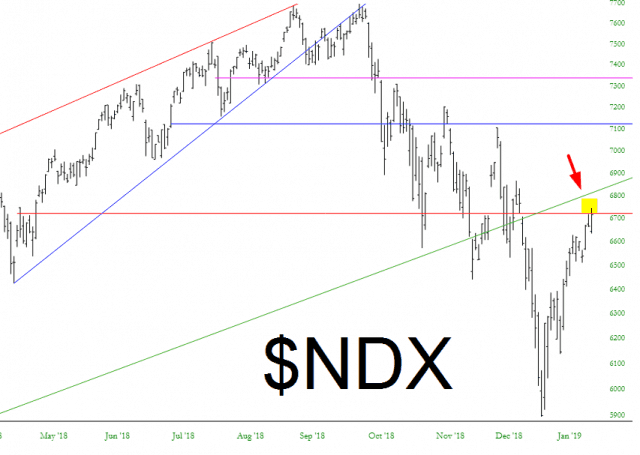

………and this………(although take note of the arrow, marking the broken long-term trendline which we’re still beneath):

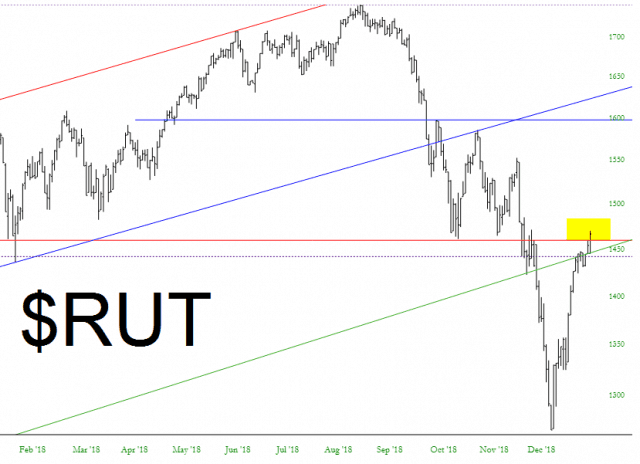

…….as well as this:

So, yeah, it’s Disappointing with a capital “D”. It sickens me to hear that this olive branch to China was to “calm the markets.” Ex-CUSE me? Volatility is down by almost 60%. The Dow is up thousands of points. What markets, precisely, are they trying to “calm”?

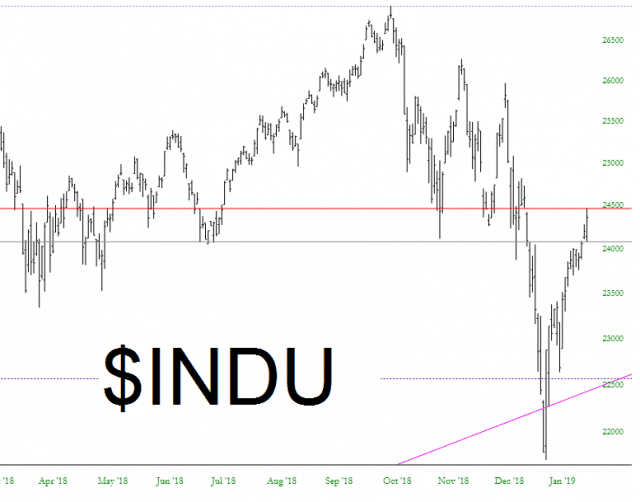

As heartsick as I am – – and, believe me, I am – – there are still flickers of hope in the form of charts which have perfectly closed their price gaps, such as the Dow itself:

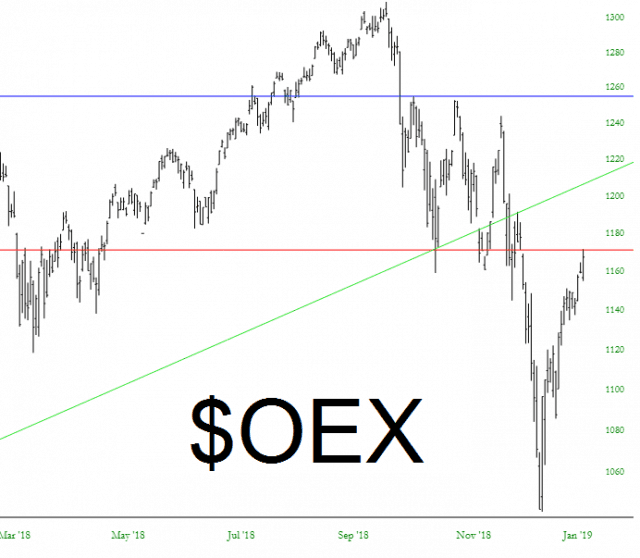

The S&P 100:

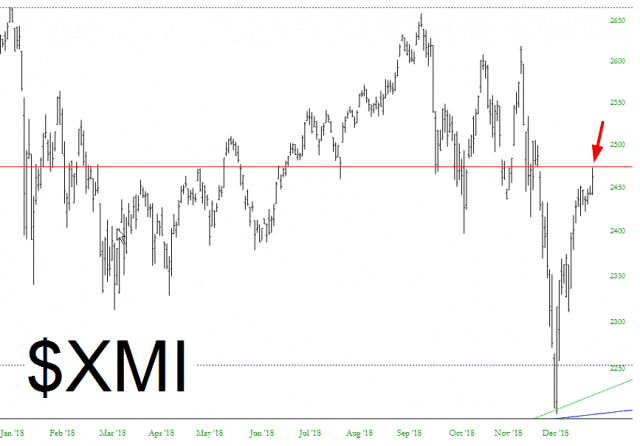

As well as the Major Market Index:

I’ll close this on a very hopeful note for the one or two bears out there: I absolutely panicked with we went ripping through 2626, and I covered things left and right. I am MUCH lighter now, with a mere 30 positions and a 74% commitment. So I can’t think of any better reason for the market to completely crash unexpectedly tomorrow. Count on it.