SPX had a very strong day yesterday and closed slightly over the 200 DMA. There has been a remarkable change in sentiment and the intractable problems of last week all seem to be relatively small bumps in the road ahead this week. Have we really seen a major low that will trigger a big new bull run? Possibly, but I'll need to see some more evidence first.

I'll lead with the ES chart today, as that expresses best the main two technical paths for today. On the bear view, with this being a strong oversold bounce in a downtrend, the obvious upside target is rough declining channel resistance in the 1405-10 area. The overnight action looks like a bull flag so we could see a move directly to that channel resistance, with the big caveat that there is very strong resistance in the 1386-8 area.

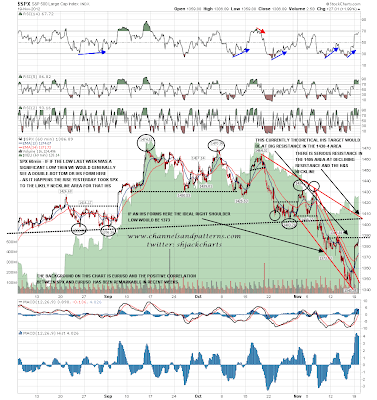

On the bull view, if we have seen a major low, I would normally expect to see either a large double-bottom or an IHS form, and as I mentioned yesterday, the obvious place to see that IHS neckline is at that very strong resistance in the 1386-8 area. The next obvious move would be to retrace for the next day or two, with an ideal right shoulder low target in the 1365 area. On a break up over 1386-8 ES after that the declining channel should break on the way to that IHS target at strong resistance in the 1432 area. I've marked up these two options on the chart below:

The setup looks similar on the SPX 60min chart, with the caveat there that there is obvious trendline resistance at 1405 at both declining resistance from the 1464 high and the neckline for the H&S that has failed (so far) to reach the 1325 SPX area target. One thing to add here is that I've noticed in the past that when an H&S pattern in either direction fails, there is usually an H&S pattern that has subsequently formed in the opposite direction. If we see that right shoulder form today that would look potentially very bullish:

On the SPX daily chart the obvious target at the middle bollinger band is now within striking distance at 1398, and in the same area is broken rising (wedge) support from the October 2011 bear market low. Between these two SPX charts that gives a string of four strong resistance levels in the 1395-1405 range, and five with the 100 DMA now at 1405. I'd have more confidence of this resistance range being broken with a strong bull pattern which we don't have here yet, but may well have soon if SPX retraces today:

On other markets TLT is retracing as expected, though not as strongly as I expected so far. The obvious target is rising support just over 124:

Oil broke declining (possibly falling wedge) resistance yesterday and has hit the possible double-bottom trigger level. The overall setup looks cautiously bullish and on a break over 90 I'd be looking for a move to the double-bottom target and strong resistance level at 94.3. If this is a falling wedge though, given that the upper trendline only had two touches, I'd normally expect a retest of broken wedge resistance to confirm the trendline, so unless we see a break over 90 I'm leaning short on CL short term:

The last chart today is my updated longer term view of DX. As I've said before, I'm leaning bearish overall on DX until demonstrated otherwise, and have been seeing the bounce in recent weeks as the counter-trend formation of the right shoulder on an H&S. It's possible that right shoulder has now topped out, but I'd prefer to see a high closer to 82, and taking another month to top out. We shall see. Short term it's worth noting that the double-top target in the 81.8 area has not been made, though the high at 81.6 was close:

I'm leaning short on equities today unless we see a break over 1386-8 resistance on ES. If we do see that there are a string of strong resistance levels up to 1410 ES, and those may well be tough to get through. I was saying to a friend yesterday that the 20 points into 1385 were easy money, but that the next 20 points up looked like a technical mountain range. That's still true. Until those resistance levels are broken I'm still regarding this as being an oversold bounce, with a likely reversal back down from the 1395-1405 SPX area. I'm considering the bullish alternative seriously though, and if we see a break up through the strong resistance levels above in the next few days I'll then be taking it very seriously.