The SPY & QQQ both put in Bearish Engulfing Candlesticks

at the close today. Looking at the previous similar patterns circled on the QQQ daily chart above, both were

followed up by a substantial gap down the following day (one on a

Friday, the other on a Monday). Therefore, although I can't give

specific investment advice, I can tell you that I certainly won't be

trying to buy the gap down if we happen to get one on Monday. On the contrary, I

will most likely deploy what little dry powder I have left after adding

to my short positions yesterday and today.

-RP

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Drinking with Bar

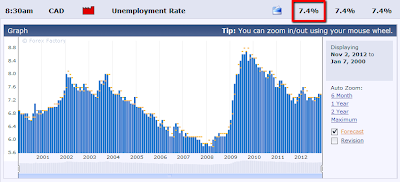

Unemployment Rate Ticks Up & Commodities Weaken (by SB)

The NASDAQ and the Weeks Ahead

There are a lot of dumb trading rules out there (and a few good ones), but one I hate particularly is: "If it's obvious, it's obviously wrong."

No, it isn't. Some of the greatest trades ever were "obvious". I present to you another one – the NASDAQ. I shorted it early this morning, during the retard-jobs-ramp, and I think it's headed to 2538.25

How's that for an unambiguous projection?

Resistance Levels (by Springheel Jack)

SPX broke up with confidence from the daily lower bollinger band yesterday and the obvious targets and resistance levels above are the 50 DMA in the 1434.5 area and the middle bollinger band in the 1436.5 area. Looking at the NDX chart as well I'm expecting the mid-1430s to be tested today: