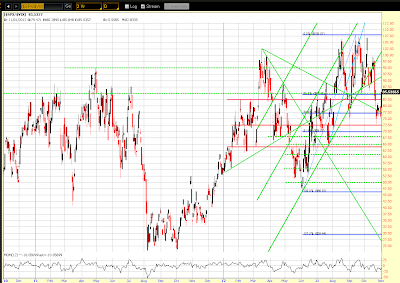

The YM, ES, NQ & TF are in the process of backtesting the

underside of their rising channel, as shown on the Daily charts

below.

The TF has already penetrated the channel and leads in strength

on this bounce over the past three days. The NQ closed just inside the channel

today (Thursday)…one to watch over the next few days to see if it can remain

in the channel. A failure to remain in the channel and follow through now on a

sustained and convincing bounce will cause me to assume that selling is not yet

finished in the short term.

The Daily

ratio charts below of the SPX:VIX,

RUT:RVX, and NDX:VXN (which compare the

Indices to their Volatility Indices) show a bounce to and close just above

near-term resistance today. Their Momentum Indicator remains well below zero

and, therefore, the Indices remain subject to further bearish influences,

particularly if they fall below these resistance-now-turned-support levels.

As

with the NQ above, follow through on the buying side from today is now key to

any kind of sustained strength in these indices…otherwise, this seems to be

the point at which serious selling will likely resume.

The above RUT:RVX

chart is confirming the TF's leadership on the recent bounce and is the one to

watch for either continued strength or a resumption of weakness. This may be

tracked more clearly on the Daily comparison chart below of the

Dow 30, S&P 500, Nasdaq 100, and Russell 2000 Indices. At

the moment, the Nasdaq is lagging and the Russell is leading. You can find a

link to this chart here.

I'll also be keeping a

close watch on AAPL, as I discussed in my post of October 23rd. AAPL is still showing relative

weakness compared with the Nasdaq 100 Index (NDX), as shown below on the

Daily ratio chart of AAPL:NDX. The Momentum

Indicator remains well below zero and continues to decline, which suggests that

further weakness is in store for AAPL.