SPX made the first of my remaining three downside targets near the open yesterday when it broke below the H&S target at 2072. The remaining targets are the falling wedge target at 2060 and the weekly lower band, now at 2057.

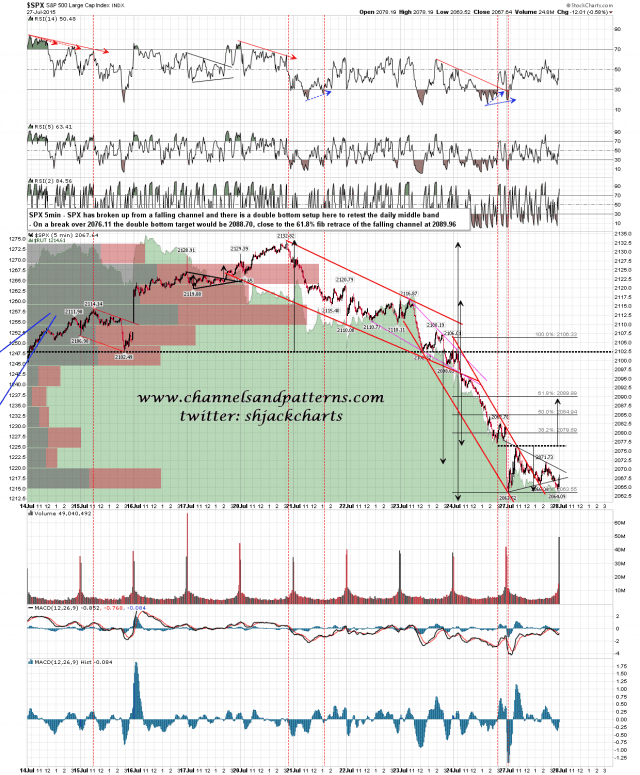

I was talking about a likely bounce coming soon yesterday morning and a double bottom formed yesterday that should be for that bounce. The target is a 61.8% retracement of the falling channel from the H&S right shoulder. I posted the chart below on twitter last night and hopefully many of you saw that (my twitter handle is shjackcharts). Looking at the overnight action that seems likely to make target today. SPX 5min chart:

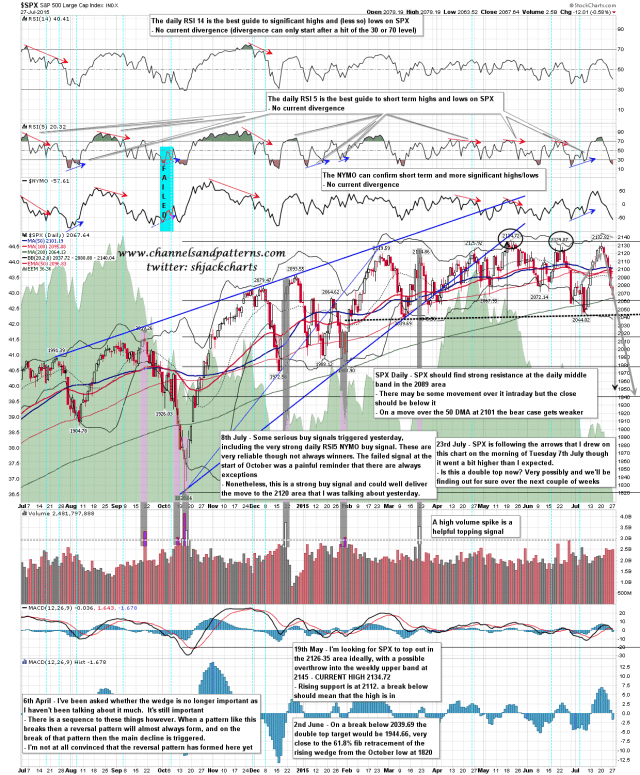

I’m expecting strong resistance at that 2088/9 target, which is also the level to retest the daily middle band. We might see a little higher intraday but it shouldn’t be much. SPX daily chart:

I have to be out for the first couple of hours today so I’m hoping that test won’t be while I’m out, though it may well be. After the test I’m expecting that SPX will reverse back down to make lower lows, and the primary scenario Stan and I are running here is that we will see a swing low form at or above range support 2039-44 in the next couple of days before a rally back to range highs. The bears could surprise us however and break range support instead, which would deliver a double top target at 1954. We’ll be watching closely as this develops.

Stan and I did a webinar on Sunday looking at SPX, oil, gas, precious metals, bonds, sugar and some other instruments. If you want to see what we’re thinking on these you can watch the video at our joint site theartofchart.net here. We’ll be doing these for the next few Sundays free to all.