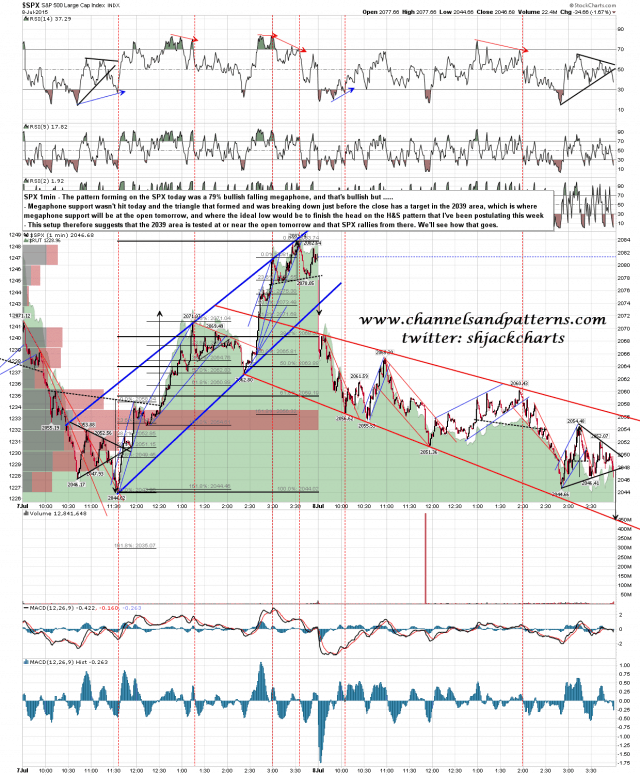

I posted a chart on twitter last night showing the falling megaphone that formed during the day and the triangle that formed and broke down near the close. What happens to a short term pattern like this overnight? Well that rather depends on where the open is the next day. If there is no gap then the pattern will often play out as though it had never been interrupted. If the market gaps away hard then the pattern becomes irrelevant.

Back in the old days you’d have to wait until the open to find out whether the pattern was a fine carriage or just a pumpkin, but nowadays the futures can tell us which is more likely and this triangle, sad to say, is going to be a pumpkin.

That leaves us with the 79% bullish falling megaphone, with a likely gap up over megaphone resistance and with ES at 2061.5 at the time of writing, possibly having made the full pattern target in the 2068 SPX area as well. SPX 1min chart:

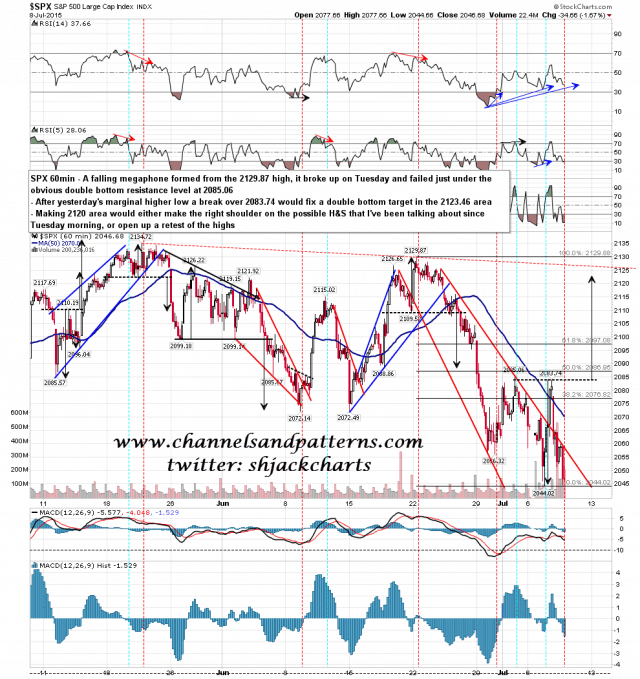

So where does that leave SPX this morning? Well I was saying near the lows yesterday that I was expecting the move to make the second low of a double bottom that would target the 2123 area on a break back over 2084. That scenario’s obviously still looking pretty good this morning and the next step would be for bulls to test double bottom (and range) resistance in the 2083-5 area and see if they can break it. We may in any case see a bounce off that level at the first test today unless this is a gap and go trend up day. SPX 60min chart:

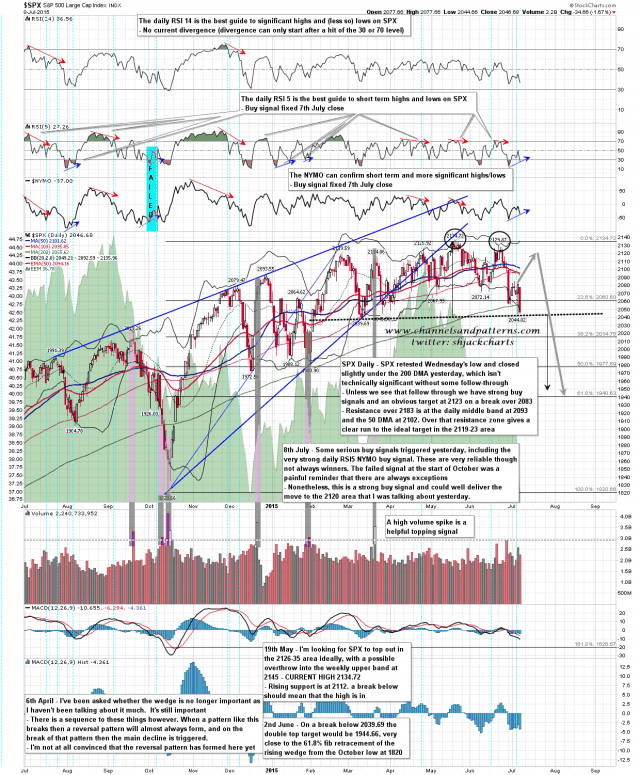

Given the strong daily and 60min buy signals here I’m expecting the 2083-5 area to be broken, though not necessarily today, and after that break the target is the 2119-23 area, either to form the right shoulder on the still theoretical H&S that I’ve been looking at since Tuesday morning, or possibly to retest the all time high. SPX daily chart:

I’m looking for a reversal back down at the first test of the 2083-5 area today, but if we are going to gap up into a trend up day today then it might break at the first test. On a reversal from there the 2059 level would be the level at which I’d be getting concerned about a full reversal into yesterday’s low, same level as yesterday. We are still in a headline minefield so trade safe.