As can be seen from the following long-term view of 10 and 30 year bonds (monthly charts), each is facing an imminent decision…whether to break fairly substantial major support at their current levels and, potentially, fall to levels not seen since the 2008/09 financial crisis, or resume their flight-to-safety bounce to retest prior highs.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Phenomenal

Failing At Resistance So Far

This week is a holiday week and these often lean bullish but the historical stats for this week are neutral. I’d note though that the historical stats for next week are bullish.

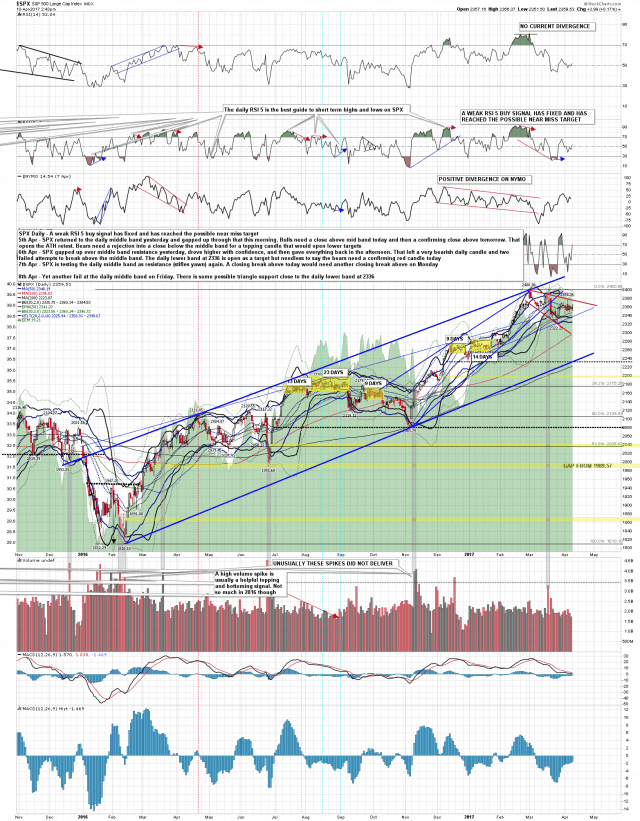

There’s been some impressively tedious tape on Friday and today so far and on the hourly charts all three of SPX, NDX and RUT have been testing their 50 hour moving averages as resistance and failing to sustain any breaks over them.

On the daily chart the picture is more mixed, with SPX and RUT both testing their daily middle bands as resistance, and NDX testing the daily middle band there as support. SPX daily chart: