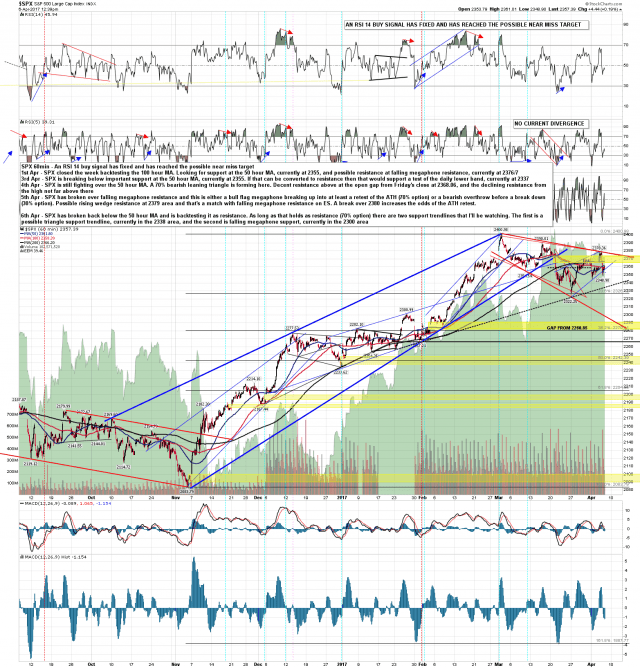

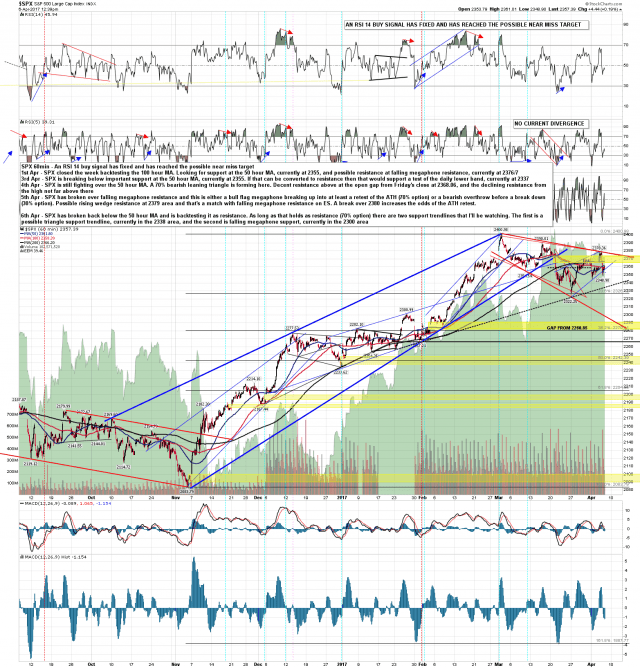

Yesterday was a very interesting day and in the end delivered a second failed attempt to break over the daily middle band on SPX and a very bearish daily candle that may have opened up the downside. Needless to say that candle requires confirmation, and we are still waiting to see whether bears can deliver that.

I won’t show it here but the rally from the lows on SPX has delivered a perfect rising wedge back to the 50% retracement and that rising wedge has broken down. That is a clear bear flag setup that should deliver at least a retest of the low at 2348.90, and likely lower. If the bear scenario is playing out then the high today at 2364.16 should hold, barring a possible retest to make the second high of a double top. On a break with confidence above the odds of the bears dropping the ball badly here will increase dramatically.

On a continuation down below 2348 there are two possible support trendlines that I’ll be watching. The first is a possible triangle support trendline in the 2340 area, and the second is falling megaphone support, currently in the 2300 area. SPX 60min chart:

(more…)