Stan was suggesting in his post market video last night that today might be pretty quiet, and so it was. Lovely two way day for intraday trades and I had a very enjoyable trading day myself calling the move up and then the fail in the final hours, but nothing much happened from a swing trader perspective apart from compression for the next move, in a direction still to be determined.

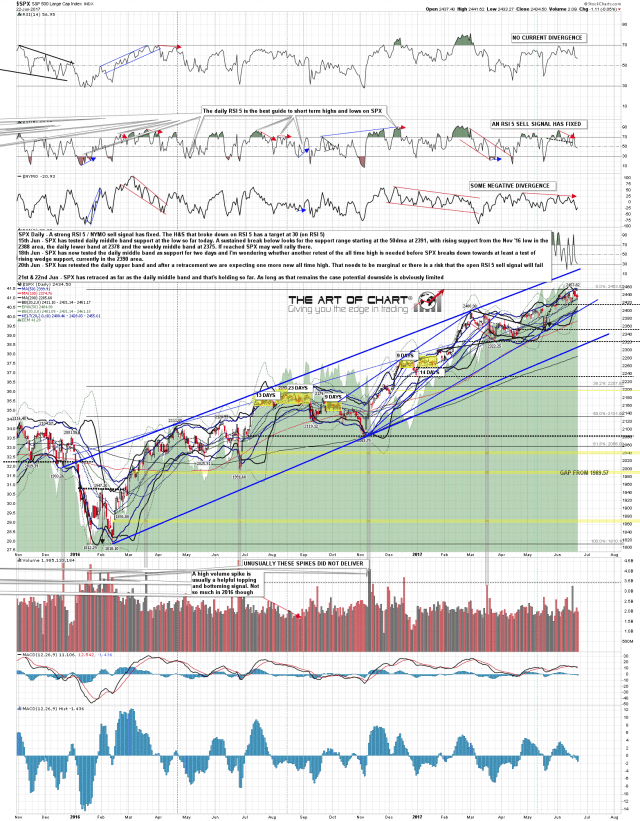

Nothing of any significance happened on the SPX daily chart. SPX daily chart:

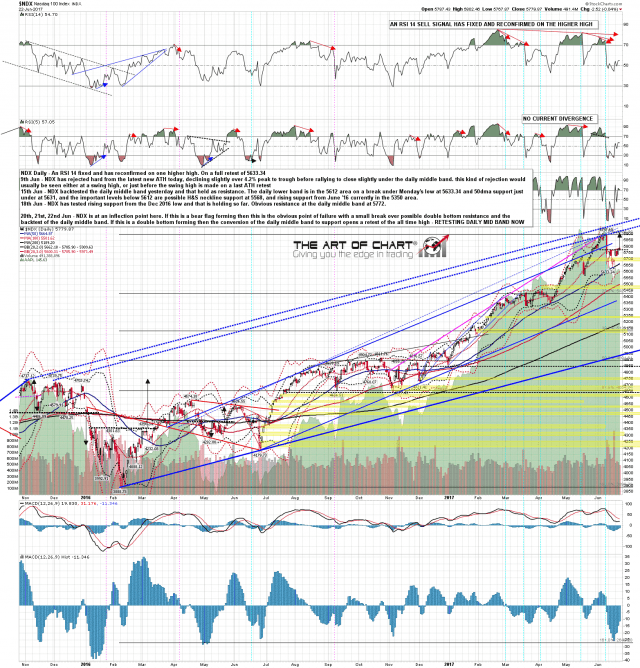

There was a small gap over the daily middle band on NDX that had me interested as a potential breakaway gap until it filled within minutes of the RTH open. NDX spent some of the day over the middle band but closed significantly below it. Not much change there overall. NDX daily chart:

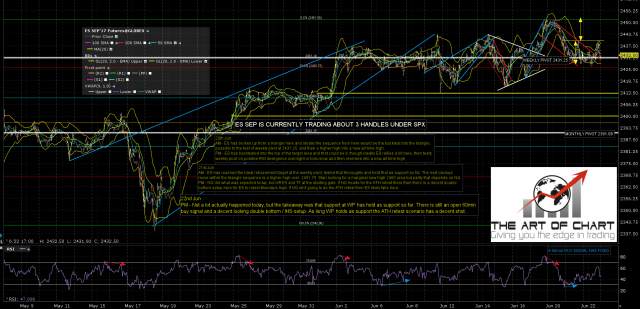

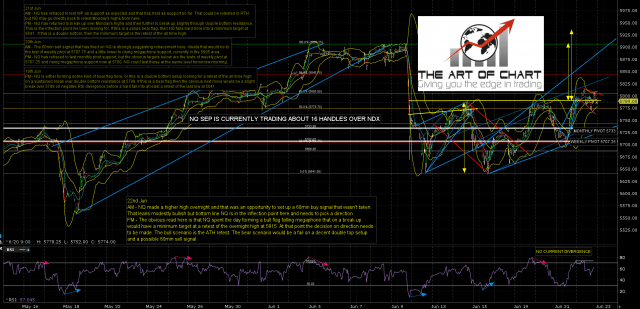

The ES and NQ futures charts below were done after the RTH close for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

ES held the weekly pivot as support for another day. I’d note that the 60min buy signal there is still open, and the possible double bottom setup there looking for a retest of the all time high still very much in play. ES Sep 60min chart:

NQ spent the day forming a likely bull flag falling megaphone. On a break up the flag would look for a retest of last night’s globex high at 5815 and that would set up another try to break up to the all time high retest, and also a double top setup if that attempted is rejected. NQ Sep 60min chart:

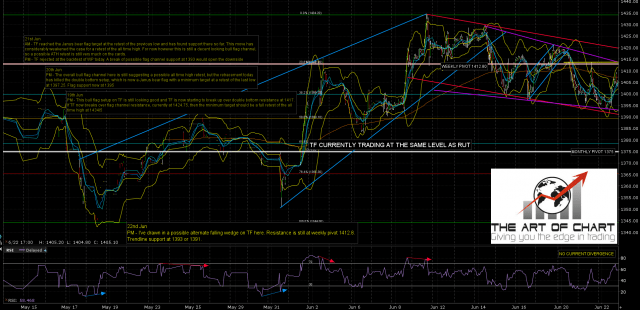

TF respected short term support and resistance. No clues there really. TF Sep 60min chart:

Overall this setup has me looking for another try at breaking up on SPX/ES and NDX/NQ, possibly overnight but likely tomorrow morning. At that point we see the break out of the inflection point in a direction to be determined then. That’s still a coin toss IMO, though with a slight bearish lean. Personally I think the all time high retests option would be neater from a TA perspective but, last I checked, the market still doesn’t do requests. Tomorrow is the other cycle trend day this week so I’m expecting direction from this inflection point to be decided tomorrow. A cycle trend day doesn’t mean a full trend day, though most of these do happen on cycle trend days. They mean that there is a 70% chance of a directional day that is dominated either by buyers or sellers, often after an opening move in the other direction of course.

The gap through support or resistance option that I was looking at last night is a bit less likely now but still very much an option. If we do see those all time high retests we’ll be looking for short entries there.