There are plenty of things I like about a market like the one we are in right now, which is one of unchecked pandemonium.

There’s the profits, of course. It’s really gratifying to see my assets grow so swiftly.

The vindication of being right feels good, naturally. Having virtually every single prediction unfold as reality so swiftly is like a tall drink of water in the desert compared to the past nine years. I have 73 different short positions, and every last one of them is in the green (some of them massively so).

And since my trading life is tied directly to my little business, I get “icing on the cake” by having subscriptions to Slope PLUS go roaring higher.

There is icing on top of the icing, however, because I get to point and laugh at world-famous prognosticators at their absolutely horrible predictions. Jeremy Grantham, for instance, called for a “melt up” to 3700 on the S&P only weeks ago………..

And of course Ray Dalio nailed the exact top almost to the millisecond with this beauty:

At the moment, though, these “gurus’ have mysteriously vanished, and the only thing left in their wake are hundreds of articles with headlines like this:

I can offer you sincere assurances that these “advisers” don’t know what they are doing either, and their advice should be ignored. (I’ll save you the time: they all say “Don’t panic and don’t do anything”, because their livelihood depends on people staying participating in this massive Ponzi scheme).

It’s not all good, however: with a move this massive and this quick, the opportunities lost are going to really sting. I’d like to explain this with a personal example that has quite a bit of detail.

I trade a couple of different portfolios. One of them is my “normal’ portfolio of equities, and all things considered, I’d pretty proud of how I’ve handled myself with that one. I’ve been “legging in” and “legging out” of positions with a decent amount of grace and precision, and I’ll give myself a reasonable good pat on the back for how I’ve managed 2018 so far on that one.

I have another smaller portfolio, however, which is strictly for options. You know me well enough to know that these are always going to be put options, and you know the market well enough to know that put positions, until January 26th, were pretty much guaranteed losers.

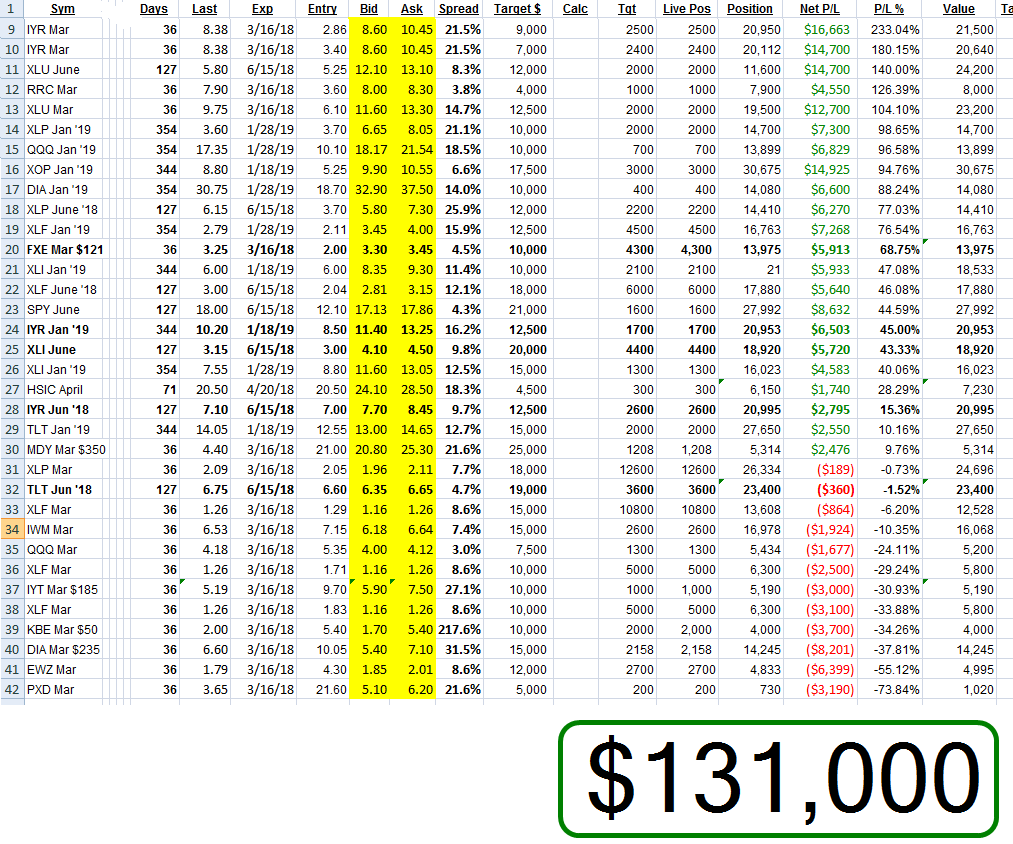

When I exit an options position, I “preserve” the data on my spreadsheet so I can see, over time, what would happen with that trade had I held on to it. (As options expire, I simply delete them from the spreadsheet). Here, as of the close on Thursday, are all of them (click on the graphic to see a larger, easier-to-read image).

The “bottom line” of $131,000 is the grand total of all the profits if I had blithely held on to every single position. This of course implies infinite capital and infinite testicular fortitude, of which I have neither.

The interesting thing is that just a couple of weeks ago this figure was something like ($120,000). In other words, I avoided losses in that amount by getting out. Seeing a big negative number was a relief, naturally, since the positions moved against me, but as you can see, there’s been about a quarter million dollar reversal thanks to the market completely blowing to pieces.

For those curious about the spreadsheet, here’s a description of the fields:

- Sym – Symbol and expiration

- Days – How many days left until it expires

- Last – Most recent price

- Exp – The expiration date

- Entry – My entry price (which for these purposes is what I sold it for)

- Bid – The current bid

- Ask – The current ask

- Spread – The percentage spread between bid and ask, which these days is gargantuan

- Target – How big I wanted the position to be in dollars

- Tgt – How many contracts that would be

- Live Pos – The size of my position

- Net P/L – The net profit or loss (which is since the time of sale)

- P/L – The profit or loss in percentage terms

- Value – Current value of the position

As traders, there’s no perfect outcome. We either wish we never entered a trade, or we wish we had tens time as much. If nothing else, it’s been fascinating this week to see the “bottom line” of all these expired trade fly up and down, because it has hopped between profits and loss many times.

I wish all of us continued good luck in what has been an exceedingly challenging market to navigate. Click this link to watch my live show on Thursday on tastytrade in which, once again, I completely went off the rails.