Apologies for the lack of updates this week. I’ve been reorganising my office which has been time-consuming though very satisfying. The video below is the full premarket video that I do every morning at for subscribers and there are quite a few charts at very interesting stages, most definitely including SPX/ES here.

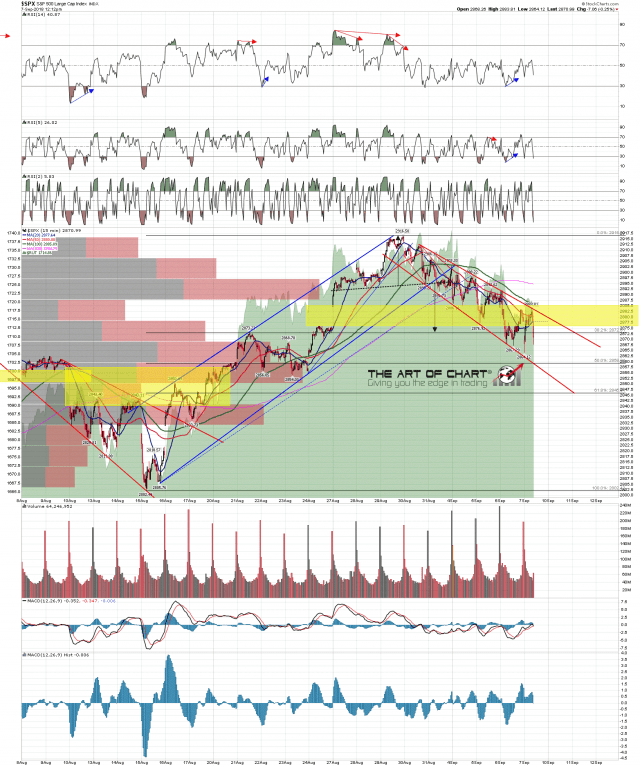

When I was showing the SPX 15min chart in the video I was saying that ideally there would be an early rally today into the mid-2880s to test bull flag megaphone resistance, before a reversal back down towards bull flag megaphone support, now in the 2858 area. That trendline is declining at about 7.5 handles per day so will likely be in the 2854 area by the end of the session.

Full Premarket Video from theartofchart.net – Update on ES, NQ, CL, NG, GC, SI, HG, ZB, KC, SB, CC, ZW, ZC, ZS, DX, EURUSD, USDJPY, USDCAD, AUDUSD:

From the chart below you can see that is playing out as expected so far. SPX 15min chart:

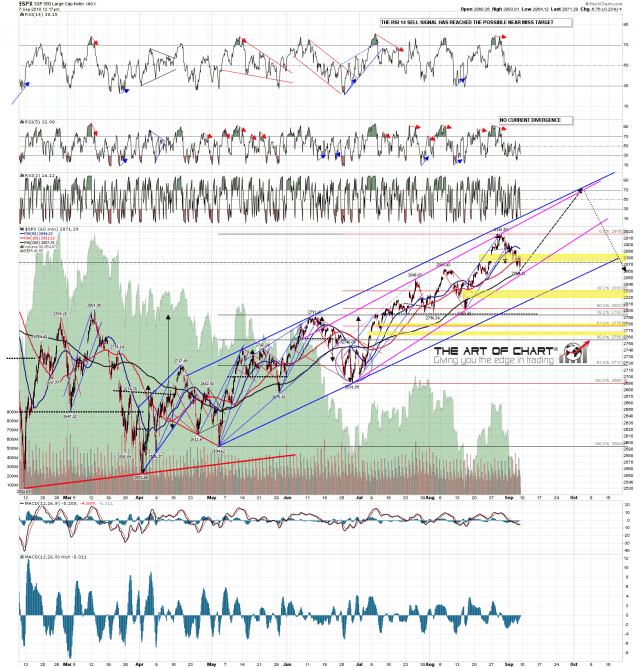

On the bigger picture hourly chart that I posted last week with my ideal path for SPX over the next few weeks, you can see that my ideal retracement low target at a touch of rising support from the late June low is now in the mid to high 2850s and a strong match with the shorter term bull flag megaphone support shown on the 15min chart above. Ideally that would be tested today and the next leg up for the next three to five weeks would start there. We’ll see how that goes. SPX 60min chart:

Two announcements today. We are doing our monthly free public Chart Chat this Sunday 9th September running through the usual 35 to 40 instruments over a very wide range of markets and, if you’d like to attend, you can register for that on our September Free Webinars page. Be there or be unaware! 🙂

We are also running another Trading Academy Boot Camp starting on Monday September 10th. The first two were very well received, and you can see testimonials from that as you scroll down on our testimonials page. It is also cheaper (and at least in our view better) than anything comparable on the market, and likely to be the last one we run this year. At the moment there are still places available and, if you’re interested in attending, you can find out more and register for that on this page here, though this is obviously the last chance to do so, as registrations for that will be closed before the first session on Monday.

Everyone have a great weekend. 🙂