I have been flopped on my hotel room bed, looking at hundreds of charts (what else would one do on a hotel bed?) I’m pretty excited about the week ahead. Let’s face it, Jerome Powell’s message on Wednesday is probably going to be the Last Big Event of 2018.

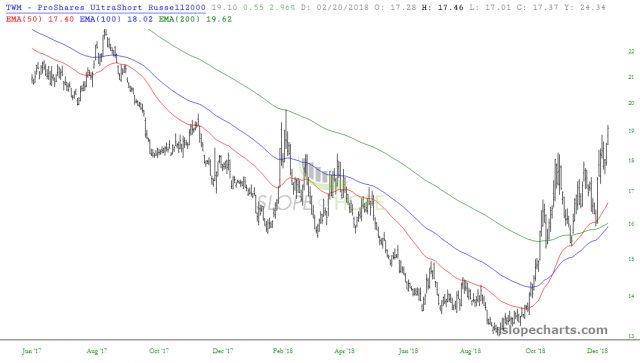

I’ve got a lot of great positions, but the biggest fish are the ones that got away. Here are some charts whose bearishness I trumpeted many times, but, frankly, I didn’t engage with. Maybe I lacked the patience, the testicular fortitude, or something else. They’re still fascinating to me: