This is a self-indulgent post, because I just upgraded our platform to an editor that uses a much, much fancier approach to creating posts.

- It’s gluten-free

- It’s carbon-neutral

- It’s wholesome and organic

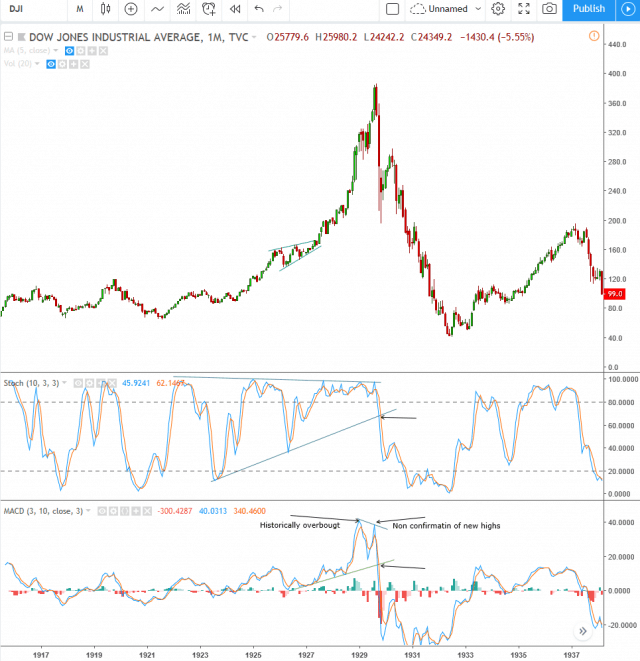

In any case, I am watching with great interest what’s going on with futures right now. The “2620” number I kept yammering on about has been broken, as of this moment, and I certainly hope to wake up to plenty of red.

In the meanwhile, I’m going to return to my Glenlivet and the draft of my new book (and, please, I don’t need any more proofreaders; bless you all for volunteering, but goodness gracious I’ve got a lot of volunteers already).