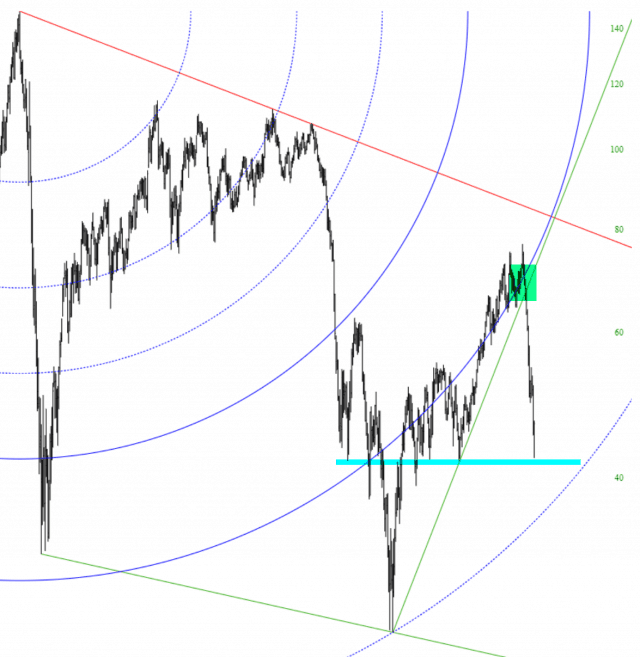

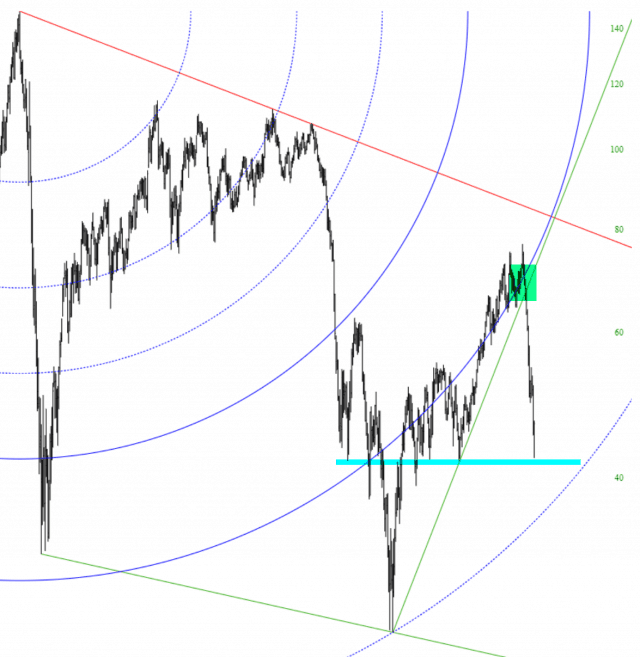

I rarely use Fibonacci Arcs, but on occasion they do some cool things; earlier this quarter, I pointed out the failure on the arc pattern (green tint); pretty interesting to see what took place since then!

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I rarely use Fibonacci Arcs, but on occasion they do some cool things; earlier this quarter, I pointed out the failure on the arc pattern (green tint); pretty interesting to see what took place since then!

I am absolutely THRILLED about how today went. Let me recount my day for you, to set the stage:

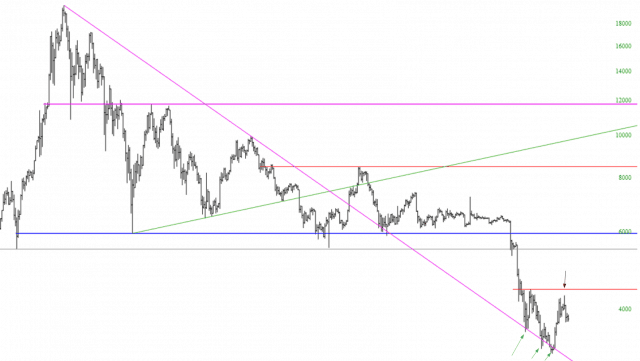

Although I don’t trade them, I persistently find the cryptocurrencies to have fascinating charts. Every line seems to have meaning and import. Notice how Ethereum scraped along its supporting trendline, vaulted higher, and then weakened at the horizontal.

I’m out. I’m done. I’m flat.

Well, almost. I decided to quit messing around with ANY remaining shorts since I keep stating how deeply oversold things remain. Why have shorts just for the sake of getting stopped out?

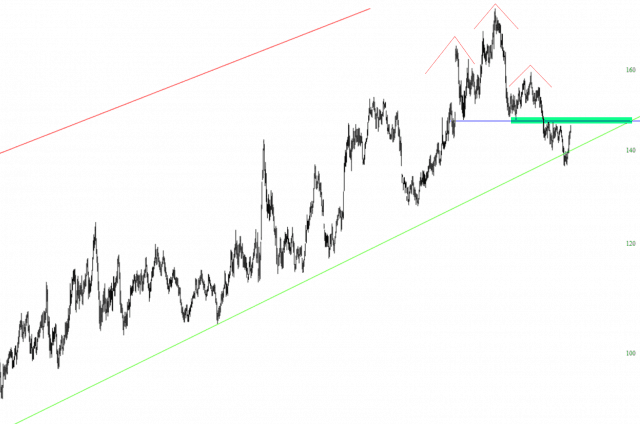

Thus, for the first time in years, I have one and only one position: a short in TLT. So if the market wants to break my heart, it would be a good time to crash right about now. Because I am only short bonds.

Even though I believe we’re in for more big “up” days similar to yesterday in the near future, I have preserved a small stable of short positions whose patterns are still good enough to keep (at least until such time as they may be stopped out). I therefore offer you my tiny gallery of twelve remaining shorts: