Greetings from the tarmac of the John Glenn International (!) Airport, as I await departure from Columbus back to my beloved Palo Alto. Today will be a shortened trading day, which is a little ironic, since my own availability is about to return to normal (although I have already dedicated my copious time to various home and Slope projects that await me).

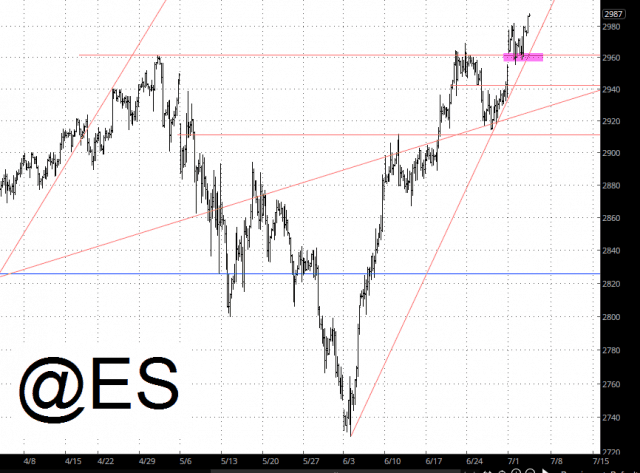

As I am typing this, it is more than two hours until the opening bell, but it’s green across the screen. The ES continues to march higher above the breakout I’ve tinted below. The psychologically-satisfying level of 3,000 is just within reach on the S&P 500, although judging from the chart, we’re definitely starting to lose momentum. The explosive surge from a month ago has given way to more moderate, incremental lifts.

The NASDAQ, having been battered more severely by the so-called trade war with China, has had a harder climb of it. Unlike the S&P, it hasn’t yet broken above its former high, although it’s extremely close (by the time you read this, it may well have already exceeded it).

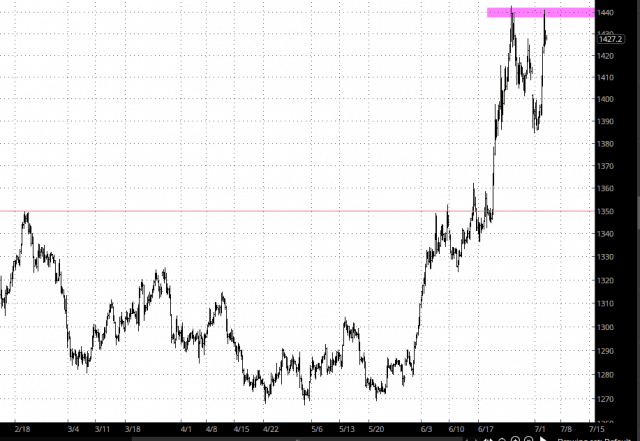

One particular dramatic mover has been gold. My understanding is that enthusiasm around a Fed nominee, and her affection for gold, is behind the move. That seems a pretty thin reed to me, since I don’t think the good people in the Eccles building are going to start proposing we go back to the gold standard any time soon. In any case, I think we’ve double-topped at 1440 for now. Firm support exists about ninety dollars below.

Even though we’re heading into a sorta-kind 5-day weekend, we at Slope are going to be taking advantage of the lull by deploying some important new improvements. I’ll announce those as they transpire.