More good news for you options hounds out there: our third iteration of the Slope Options Analyzer for Payoffs (SOAP). This has definitely become a labor of love, and it’s eating up about 90% of our engineering efforts. In the end, I think we’ll all be delighted with the result. The interface has totally changed.

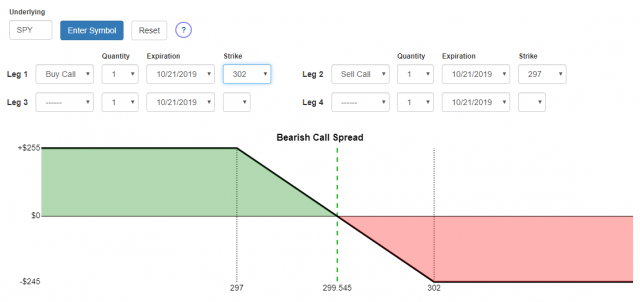

As you can see, we now support four different options legs, and we’ve also added some new strategies. The way this works is that, so long as you construct a strategy that it recognizes, SOAP will state its name and draw its profit and loss payoff chart.

Here’s another example of a strategy we finished.

In fact, here’s a list of the strategies we supposedly (more on this in a bit) support in SOAP right now!

- Iron Butterfly (Long)

- Iron Butterfly (Short)

- Iron Condor (Long)

- Iron Condor (Short)

- Long Call Spread

- Long Put Spread

- Long Straddle

- Long Strangle

- Short Call Spread

- Short Put Spread

- Short Straddle

- Short Strangle

Now, let me address that word “supposedly” right now. There are going to be errors. I don’t mean to scare you, but this is a totally new product, and there are an ungodly number of calculations going on. So I plan to beat the devil out of it (if I may borrow a phrase from our dear, departed Bob Ross), and I’m counting on you to do the same. Let’s smoke out problems!

Lord knows a handful of you have been invaluable in reviewing the oh-my-God-this-is-a-lot-of-work Options Strategy Guide, and SOAP is obviously far more complex, since words and typos are incredibly easy for me to fix.

I’d also like your opinion on two questions:

- Should I provide a dropdown of strategies so that if a user choose a certain strategy, it will auto-populate the appropriate legs with an example so that they may refine it from there?

- I am considering eliminating all the expiration dropdowns and having just one expiration dropdown. That will simplify the interface, but it also negates the possibility of doing calendar spreads. From what I’ve read about calendar spreads, they are impossible to truly calculate, because they require a rollover of options in the future, and it’s impossible to know the value of those forthcoming options. So I’m inclined to skip the whole thing and just have one expiration. Thoughts?

This is a journey together, folks. We’re getting there, one version at a time! Now go bang on the damned thing and let me know what you want to see improved.