Part 1 of this series can be found here.

The wealthiest people in the world have something in common. They are owners, investors, creators, and builders. They have a mindset of building organizations and structures that will last, produce profit regularly, and re-investing that profit into building more of the same.

- Bill Gates – Microsoft founder

- Jeff Bezos – Amazon founder

- Bernard Arnault – Overseas more than sixty brands, including Louis Vuitton

- Warren Buffett – Investor

- Mark Zuckerberg – Facebook founder

- Amancio Ortega – Founder of Inditex, largest fashion group in the world

- Larry Ellison – Cofounder of Oracle

- Carlos Slim – Owner of America Movil, as well as numerous other businesses

- Larry Page – Cofounder of Google

- Mukesh Ambani – Family founded Reliance Industries, largest company in India

10 out of 10 were either owners, investors, or creators. They share the idea of creating something that will last and produce wealth. What can we learn from this to start our journey into the psychology of trading?

I went through an exercise earlier this year to think through consciously what I wanted the core tenets to be that I govern my life by. It was interesting to me how some of these intersected with what I wanted my trading and investing life to look like. I will focus on one tenet here. Build.

I want to build with my trading account, build with my investments, and build with my overall assets. For a long time I felt compelled to get to a certain number in my trading account as quickly as possible. This was a problem. I had to adjust my mindset to get in line with the idea of building. This involved accepting where I am at presently, and becoming content with the mindset of building steadily something that would last and get me where I want to go.

From the perspective of building, I employ three rules with my trading account that help to keep my focus on building steadily. They are:

- Be profitable each month.

- Set profit goals based on past performance and the opportunities you are seeing.

- Don’t forget rule 1.

The idea here is starting with a mindset that is not a get-rich quick scheme, not a lottery mindset, but a repetitive focus on generating profits that will compound month after month. I want to be a builder. Not just from the perspective of long-term investments, but I want to build trading profits month after month. This is the mindset of treating your trading account as a business. Let’s take a look at a couple practical strategies to help us toward that goal. First, I believe it is crucial to track your progress. I keep a simple excel spreadsheet to track my monthly balance in each asset class. You can see mine below.

At the end of each month I’ll enter the total for my trading account, direct registered accounts, long term investment account, my checking account, as well as physical cash and silver holdings. This practice has numerous values.

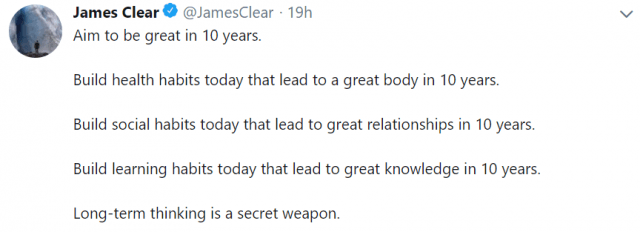

First, it gives me data to analyze. Am I reaching my goals? Am I making/losing money? What changes do I need to make? We need to consistently track and analyze this data in order to answer these questions. Treating your trading account as a business means understanding and managing its performance.

Second, it makes me feel good to see that I’m making money each month. We’ll learn more about the neurotransmitter dopamine in future articles, but being able to put down in writing your balance each month and see that you made money will give you a release of dopamine and make you feel good.

Third, tracking your progress helps to accurately understand and accept my performance from an emotional standpoint. When you are trading the markets day in and day out it is very easy to feel enormously excited, or deeply depressed if you don’t have an anchor. Tracking your progress is one anchor. If I see a loss, I can accept it for what it is, mourn it, accurately put it into perspective, and examine some possible needed changes. I can also look back over previous months and years of gains, and encourage myself that I know what I’m doing, and am more than capable of being consistently profitable. This is one form of managing your emotions on a daily basis.

Fourth, seeing a do-able plan to achieve a desired goal yields hope. It’s the difference between saying one day I’d like to have a million dollars, versus if I do x, y, and z month after month I can see how I can realistically get there by this date. Hope is powerful fuel to propel your emotions. When you see a path to achieving your goals through steady building, you will steadily lose interest in lottery strategies that deter you from building.

Finally, committing to a focus on consistent profitability and steady building will mean taking a look at your chosen trading strategies and trading instruments. For me this meant almost entirely eliminating the use of options. With three exceptions in 2019, I used only long/short stock and ETF positions. I used varying amounts of leverage with those positions. The focus on steady consistent building added up to a trading profit of over 350% in 2019. Here’s how it looked. Always be building!