Editor’s Note: TnRevolution has been a loyal and generous Sloper for many years. He has put together a series of essays for the site that I am very pleased to share. Thank you, TNR!

Decisions & Emotion

Merry Christmas and Happy New Year to my Slope family! I am excited to announce I will be publishing a new series on the Psychology of Trading, beginning with our first chapter on “Decisions & Emotion”. The series will include scientific and theoretical research, trading techniques, psychological study, practical applications, as well as some of my own personal experiences. I hope you enjoy it, and get some golden nuggets from the work.

Today I want to establish and leave you with one idea. It is impossible to make a decision without engaging your emotions.

To illustrate the relationship between emotions and decision making, we’ll be looking at the book Descartes’ Error by Antonio Dimasio. Dimasio is one of the world’s leading neuroscientists. He is currently the chair of neuroscience at USC, as well as a professor of psychology, philosophy, and neurology. Below is a brief presentation where Dimasio discusses the work of the book.

Dimasio first observed the connection between emotion and decisions in a patient he calls Elliot. Before Elliot’s problems arose, he had been an extremely successful individual. He was highly intelligent, successful in his profession, happily married, and had good social skills. His life however began to deteriorate, and it was discovered he had a brain tumor. The brain tumor was successfully removed, but Elliott had changed.

He began having trouble at work, unable to complete tasks as he had before. He lost his job. He began having relationship issues, unable to manage his relationship with his wife as he had before. He was divorced. He was unable to at times make decisions. At other times he began making bad decisions, associating with people he wouldn’t have before the tumor, and starting ill-advised businesses. He lost his savings, and was applying for disability benefits.

Here is where Elliott’s path crosses with Dimasio. He was being denied for disability benefits because no one could find anything wrong with him. The brain damage that he had suffered did not cause any damage to his movement ability, speech ability, memory, or anything else that was noticeable to the doctors who examined him. He was referred to Dimasio.

Dimasio first details that the damage to Elliott’s brain is limited to the ventromedial sector of the prefrontal cortex. This is the area of your brain closest to your forehead, just above and behind your eyes. Dimasio terms this area of the brain one of the places where “emotion and decision making intersect”, as well as “reasoning to culminate in decision-making”.

Dimasio places Elliot through a number of experiments, but is unable to draw any conclusions at first. After taking a brief pause in his work with Elliot, he interviews him again. He has Elliot describe for him all that he has been through, and is struck by the fact that he seems to be devoid of emotion. He’s had a brain tumor, major surgery, lost his job, lost his wife, and lost his money. He has no emotional response to these events whatsoever. He seems completely emotionally numb. Dimasio first theorizes here that there is a connection between emotion and decision making.

“He told me without equivocation that his own feelings had changed from before his illness. He could sense how topics that once had evoked a strong emotion no longer caused any reaction, positive or negative… Try to imagine not feeling pleasure when you contemplate a painting you love or hear a favorite piece of music. Try to imagine yourself forever robbed of that possibility and yet aware of the intellectual contents of the visual or musical stimulus, and also aware that once it did give you pleasure.”

Antonio Dimasio (Descartes’ Error)

Dimasio then places Elliot through a series of experiments that involve understanding numerous options, and making a choice. Elliot is able to verbalize all the available options, and understand them clearly. Elliot says, “And after all this, I still wouldn’t know what to do.” He is unable to make a choice, unable to make a decision.

After working with Elliot, Dimasio goes on to detail his work with twelve other patients, as well as researching the work of other neuroscientists with similar patients. He details a total of three parts of the brain that are involved in emotion, that inhibit decision-making when damaged. They are the ventromedial sector of the prefrontal cortex, the amygdala, and the complex of somatosensory cortices in the right hemisphere.

He concludes in the first part of the book:

“The human evidence discussed in this section suggests a close bond between a collection of brain regions and the processes of reasoning and decision making. First, these systems are certainly involved in the processes of reason in the broad sense of the term. Specifically, they are involved in planning and deciding. Second, a subset of these systems is associated with planning and deciding behaviors that one might subsume under the rubric “personal and social”. Third, the systems we have identified play an important role in the processing of emotions.”

Antonio Dimasio (Descartes’ Error)

In the second part of Descartes’ Error, Dimasio goes on to detail the experiments he performed with patients to prove what he termed “The Somatic Marker Hypothesis”. This hypothesis proposed that emotions guide or bias behavior, particularly decision-making.

“Somatic markers are feelings in the body that are associated with emotions, such as the association of rapid heartbeat with anxiety, or of nausea with disgust. According to the hypothesis, somatic markers strongly influence subsequent decision-making.”

Wikipedia – Somatic Marker Hypothesis

In one noted experiment, Dimasio tests normal subjects as well as patients with the type of brain damage he is studying. In the experiment, each individual is given $2,000. They are told to lose as little as possible, and make as much as possible.

Each subject will then be instructed to draw cards one at a time from four different decks of their choice. They are told that some cards will result in being given more money, and some cards will result in having to pay a sum of money back to the experimenter.

What the subjects are not told is that Decks “A & B” are the bad decks. The cards in decks A & B pay out $100, while the cards in decks C & D pay only $50. A small number of cards in decks A & B will cause substantial losses, up to $1,250. If you continue drawing from this deck you will lose all of your money. Decks “C & D” are the good decks, incurring small occasional losses averaging less than $100. If you continue drawing from these decks, you will slowly build more money over time. The experiment lasts for 100 turns.

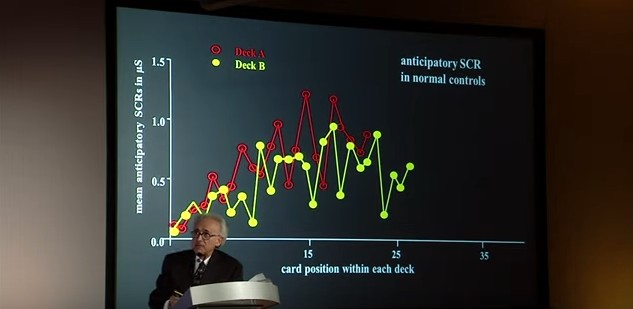

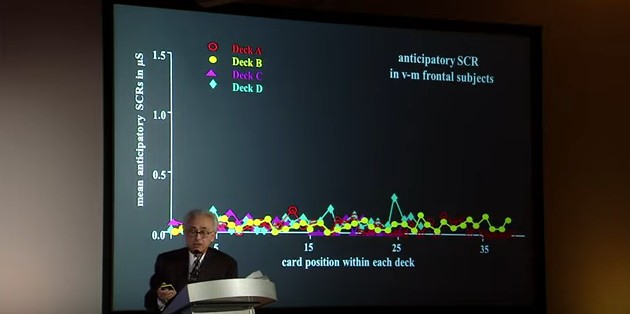

The results can be seen in the charts below. The vertical axis of the chart shows the subject’s anticipatory emotional response just before drawing each card, or skin conductive response. This is their subconscious emotional response working to learn and inform decisions. The horizontal axis shows how many cards the subject drew before ceasing to draw from the bad decks.

The above chart shows the normal subjects. These subjects typically begin by sampling cards from all of the decks, looking for patterns or clues. They show an early preference to decks A & B, given the higher rewards. However, on average before turn 30 they stop drawing from the bad decks, and stick to the strategy of drawing from decks C & D until the end. In the chart you can also see their varying anticipatory emotional reactions. As they are initially drawing from the bad decks there is no anticipatory emotional response. However, over time they begin to have stronger emotional reactions just before drawing from the bad decks. This is their brain subconsciously working out the effects of the bad decks and warning the individual.

The below chart shows the subjects with brain damage to their emotional processing. The first thing you can notice is that these individuals are feeling almost nothing emotionally. No matter how many cards they draw there is no subconscious emotional reaction.

After initially sampling all the cards, the brain damaged patients systemically began choosing more and more cards from the bad decks, and fewer and fewer cards from the good decks. Halfway through the game, each was bankrupt and needed more money from the experimenter to continue.

Elliot also plays the game. He describes himself as a conservative, low-risk person. By the end of the game Elliot mentally knew which decks were bad and which were not. However, even when the experiment was repeated, Elliot continued to choose from the bad decks, going bankrupt.

Dimasio goes on to detail how the experiment was attempted with other brain damaged individuals who had no damage to the areas of their brain affecting emotions. These patients were able to play and succeed in the game as normal individuals.

Dimasio’s research gives us strong evidence that emotions play a part in decision making. I can see the process more clearly from his work, and will move forward with the idea that it is impossible to make a decision without engaging your emotions. He begins the final chapter of Descartes’ Error with this quote:

“The poet’s voice need not merely be the record of man, it can be one of the props, the pillars to help him endure and prevail”

William Faulkner

I will leave you with this. What was someone like Steve Jobs thinking before he “re-launched” Apple the second go around? Before the iPod. Before the iPhone. He was thinking about connecting Apple to its consumers via emotion.

As you watch the below video, realize that Apple and Steve Jobs were attempting to tap into people’s emotions to drive their connection to Apple, and thereby their purchases. This presentation was from 1999. The iPod was launched in 2001.

From the stand point of your trading mindset, it is important to ask yourself the question what emotion am I feeling when I trade and why. Your decisions must pass through the gateway of emotion.