Yesterday was a momentous occasion. About three months ago, the weak, cowardly, and amoral Jerome Powell cranked interference with the markets up to an “11” with his free-money-for-big-banks Repo scheme, and of course the market did nothing but hit new highs every day. Yesterday, for the first time in nearly 80 trading days, we actually dropped more than a single percentage point. The poor dears!

Can you imagine an era where people are screeching and whining about a slightly more than 1% drop off of a Dow that nearly reached 30,000? Powell and his disgusting ilk have crafted a globe of self-entitled whiners, and it’s a cool drink of water on a hot desert day to actually see things flip slightly organic, even if just for a few moments.

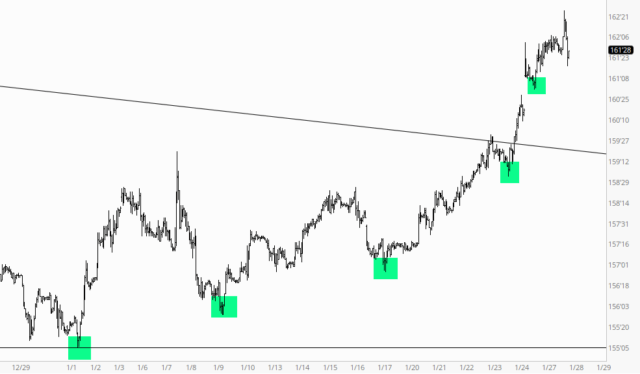

Having said that, let’s take a quick look at my holy trinity, with the evening’s action already in the bag. I guess what I’m least concerned about is my bullishness on bonds. Not only has the chart been plotting out a clean series of higher highs and higher lows, but intuitively, I think a world choking on debt that can never be repaid (in real terms) isn’t really ready for interest rates to go up. Maybe in the year 2493, but not now.

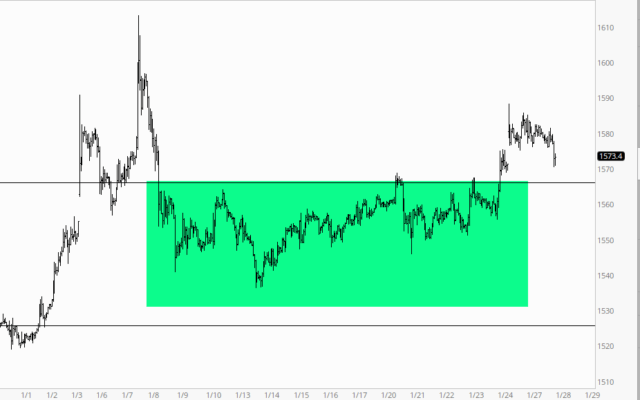

Gold had a fairly disappointing performance yesterday. It blasted out of the gate on Sunday, and then stumbled around, more or less weakening. Even though it was green for Monday, the miners were decidedly not, and gold lost more ground last night. All the same, we’ve got a pretty decent intraday base, and I’m not too worried about a little easing back before the next fear-induced bolt higher.

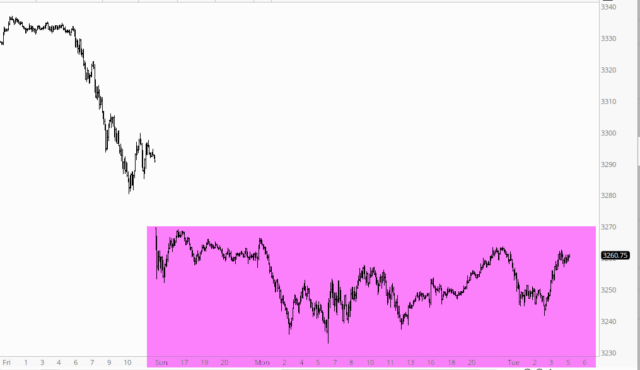

Finally, we come to what is of far greater to concern to far more people: equities. On the one hand, we are still grinding around in the post-weekend price gap. No one knows the longevity or impact this Corona thing is going to have on the global economy. On the other hand, God knows there has been no time in the past eleven years that our helpful government hasn’t plunged in to save the time with some new scheme or another. There will come a time when their interference simply doesn’t work anymore (and God help them at that point………….) but, let’s face it, the Dow is about 17,000 points higher than it would be if it were not for the constant, daily, and unlimited intervention of that most pernicious enemy of true capitalism, the Federal Reserve.

For myself, as I mentioned yesterday morning, I dialed back the risk somewhat, but I’m still quite “in there.” This week is going to be absolutely exploding with earnings news, with the biggest of the big, AAPL, after today’s close. They’d better knock it out of the proverbial ball park, because they are priced for perfection.