Preface to all three parts: I’ve written dozens of books, but the only history book I’ve ever written was Panic Prosperity and Progress. This weekend, I’m sharing one of the chapters from the book in three parts, since it offers interesting lessons about what can happen when governments decide to experiment with finance and economics. Part One of this piece can be read here.

So impressed was the French court by Law that it granted him a new title – Comptroller General of Finance – and new powers. Law set out to take down what he saw as encumbrances to the economy, such as canal tolls and overly-large land holdings; he encouraged the building of new roads throughout France; and he put in place incentives, such as below-market low-interest loans, for new industries.

As France’s de facto treasurer and finance secretary, he also focused on the revival of overseas commerce. These pro-business measures aided the country with an increase in industrial output of 60% over two years. One simple metric that illustrates the power of Law’s actions was the number of French ships engaged in export jumped from merely 16 to a full 300.

Riding high on the success of Banque Generale, Law submitted a second major proposal to the regent: the creation of a new company that would have the exclusive privilege of trading with the province of Louisiana. This territory, stretching for 3,000 miles from the Mississippi Delta up to the frozen mountains of Canada, was rich with natural abundance, and Law saw it as a vast and untapped resource for France.

As with the national bank, the proposed capitalization and business of this new company was quite simple: Law proposed that the organization be capitalized with French bonds, as well as the valuable exclusive trading rights with Louisiana. Shares in the company would be sold to the public, and that cash could be used to retire the bonds (thus saving France the burden of continued interest payments on the bonds themselves).

The royal court agreed to Law’s proposal, and in August 1717, Compagnie d’Occident (the Company of the West) was founded. The firm’s capital was divided into 200,000 shares at a value of $500 each, and it was granted exclusive trading privileges with the Louisiana territory for twenty-five years, as Law had requested.

In spite of the attractive makeup of this new organization, the value of the shares languished. As mysterious as Louisiana was, it was generally recognized that very little was actually going on there, particularly since hardly any French citizens emigrated there to work the land, trap furs, or seek out fictional mountains made of emeralds. The shares in The Company of the West sank from $500 to $300, and Law’s sterling reputation started to get tarnished.

He then hit upon a simple but effective plan to reverse the poor showing of the company’s shares. He announced that, in six months time, the company would pay $500 for a certain number of shares in the company. This was the equivalent of a board of directors in a modern-day corporation issuing a stock-buyback program, and the effect was swift and exactly as Law hoped. Individuals being told that a share that presently cost $300 could be sold for a 66% profit in a half-year’s time pushed the price back up to its original offering value. The idea worked.

More importantly, the public surmised that the company’s prospects must be far healthier than they imagined, if the company itself was willing to pay such a premium on its own shares. It seemed to the investing public that the management was in the best position to know about its firm’s prospects, so it was suspected that The Company of the West was being very discrete about just how bright the future looked.

Absorption and Ascent

The role of the Banque Generale took a dramatic turn in 1718 when it became the Royal Bank. Now the notes were not simply the paper produced by a private enterprise; they were now backed by the full faith and credit of the crown itself. The notes were guaranteed by King Louis XV. No guarantee had more strength or credibility.

Other important changes took place as well. The company acquired the right to mint new coins; it was made responsible for all of France’s money minting and finances; it had the right to collect most French taxes. Indeed, what had started out as an experiment quickly developed into France’s first central bank and all its associated powers, with Law at the helm.

The Royal Bank was then made into a conglomerate. It absorbed The Company of the West as well as similar French companies such as The China Company, The India Company, and other rival trading outfits. Law had, in the span of just two years, created the most successful conglomerate in all of Europe with vast powers to tax, coin money, enjoy worldwide trade monopolies, and retire the debt of the state. It was even granted a monopoly on the sale of tobacco.

The French national debt was about $1.5 billion, a vast sum at the time. The Royal Bank bought large amounts of this debt, which paid an interest rate of 4%, and extracted interest from France at a rate of 3%. From the crown’s point of view, it was almost like free money: the state was able to eliminate a 4% debt burden in exchange for a 3% burden by means of an enterprise of its own creation. This was beneficial to The Royal Bank as well, since it was assured a healthy flow of dividends from the state to fund its future endeavors.

The Frenzy Begins

Law and his Royal Bank had magnificent prospects. He had exclusive privileges of trading in the East Indies, China, the South Seas, and, of course, Louisiana. His optimism manifested itself in a pledge of a yearly dividend of $200 per share which, given the share price of $500, was an obscenely rich bounty for investors.

The investing public became increasingly enamored with shares of the Royal Bank, and a virtuous cycle was in place: paper notes, ostensibly backed by gold and bonds, were easy for the state to print; the public was all too eager to take these notes and give them to the Royal Bank in exchange for stock certificates in the Mississippi Company; and the trading public began trading the increasingly-limited quantity of publicly-traded shares among themselves, making its original offering price of $500 a distant memory. (If this is all starting to sound an awful like the modern-day Central Bank, various programs of quantitative easing, and “emergency” Repo measures, you are not mistaken.)

Between May 1719 and August 1719, shares rose from $500 to $1,000, doubled again, and doubled yet again. Part of the reason for the near-vertical ascent in the share price is the very limited quantity of shares made available. Every couple of months or so, fresh shares would be made available to the public, and the men and women of Paris would stampede for the opportunity to get their hands on them.

The use of margin also poured fuel onto the proverbial fire, as it became a common practice for a buyer of shares to be given an entire year to actually pay for them. Thus, a person who wanted to acquire shares could do so on a 12-month installment plan. Given the near-vertical ascent of the company’s stock, it seemed to be the closest thing to free money ever created. Law himself wrote, “The gates of wealth are now open to all the world. It is that which distinguishes the fortune of the old administration from those of the present.”

Newfound wealth in sums formerly reserved for the highest ranks of the nobility found itself in the hands of the unwashed masses. Tales of vast fortunes being made by the lowest of society only exacerbated demand for the shares. There were tales of the chimney sweep who made $30 million profits and the shopkeeper who amassed $127 million. (The modern equivalent may be found over at WallStreetBets).

Even Law’s own coachman appeared in front of his master one day to present two other coachmen as replacements. “But I only require one coachman!” said Law. His then-servant replied, “Yes, I know. The other one I shall engage myself.”

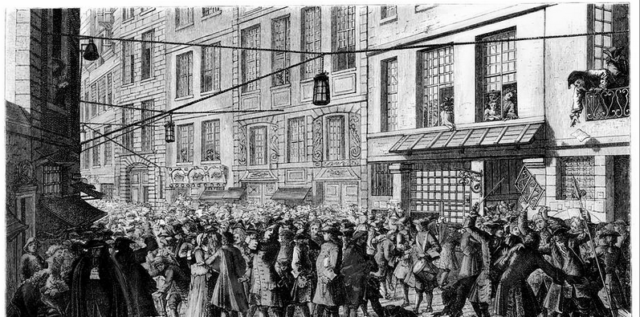

There was no particular building in Paris dedicated to the exchange of common shares, but a narrow street known as the Rue de Quincampoix took on the role. This little lane became a daily frenzy of activity, with two gates set up on each end: one for the well-to-do, and the other for the common people. At a pre-determined morning hour, both gates were opened, and people from both sides of the street rushed forward to begin the day’s frenetic trading.

Of course, those lucky enough to own property on the heretofore unremarkable street enjoyed the dividends of this mania. Homes which in saner times had rented for $1,000 per year now yielded sixteen times that amount. A cobbler rented out his tiny stall for $200 per day so that a trader could have a reliable and comfortable location from which to trade. It is said that even a hunchbacked man seized upon the entrepreneurial idea of lending out his misshapen back as a writing desk to eager speculators.

In the autumn of 1719, as the share price vaulted to $7,000, $8,000, and $9,000, the financial orgy was in full swing, and Rue de Quincampoix was the epicenter.

A New Venue and a Plateau

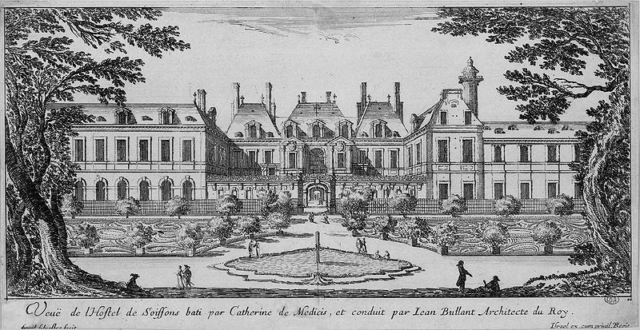

Law recognized the need for a more civil place for traders of his wildly-successful enterprise to convene each day – – accidents among the swarming crowds were becoming commonplace – – so he made an agreement with a French prince to rent out the Hotel de Soissons. It boasted a multi-acre garden, which would provide ample space for the swarms of traders, and the elegant statues and fountains in the garden certainly had greater appeal than the filthy road in which speculators were presently crowding.

As soon as Law had secured the property, an edict was passed stating that the only lawful place for the trading of securities was within the gardens of Hotel de Soissons. Amidst the trees of the gardens, no fewer than 500 small tents were set up so that traders could conduct their business with some shade as well as a sense of place. The prince, already wealthy, enjoyed an avalanche of cash, as each of the tiny tents rented out for $500 each month, yielding a quarter-million dollars in pure profit merely for the use of his enormous back yard.

As the share price lurched toward $10,000 – – a twenty-fold increase in less than a year’s time – – the volatility of the share price became extreme. Prices could fluctuate 10% or 20% in the course of a few hours, and it was said that a man could rise poor in the morning and go to bed in affluence that very night.

Nobleman began to view the nouveau riche with scorn if not amusement, as the uneducated from the lower classes might have acquired some of the wealth of their betters but none of the refined mannerisms.

It should be remembered that all of this newfound wealth was not realized in the form of wheelbarrows of gold and silver being pushed throughout the streets of Paris. The nation’s precious metal supply was safely tucked away in the vaults of the Royal Bank, and the people of France had wholly accepted the lightweight, convenient, foldable money stuffed into their pockets as being “good as gold.” After all, any of the notes could be submitted to the bank at any time in exchange for the promised amount of “real” money.

Unknown to the common citizenry, however, was the fact that the value of the tidal wave of paper money flooding the citizens of Paris had long surpassed the value of the gold actually on hand. The royal court had become intoxicated with the sudden positive turn its financial situation had taken.

Sovereign debt was being retired, the economy was humming with the steady flow of this new paper currency, and the crown could dispatch with the fiscal woes that had plagued it only a few years earlier. Since wealth seemed as simple as cranking out fresh banknotes, the temptation was too great to resist.

Notes were not hoarded simply for the pleasure of having a large bank balance. New houses sprung up in every direction of the countryside, and a feeling of prosperity accompanied the “wealth effect” of rapidly-escalating share prices. Luxury goods, formerly enjoyed only by the noble few, suddenly became commonplace.

Statues, paintings, linens, tapestries – – all manner of high-quality manufactured goods – – began to grace the rooms of the middle class. It seemed that wealth was within the grasp of anyone willing to participate in the frenzy, and the pleasures of what can be acquired with wealth were likewise at hand for even the lowly-born.

Part Three will appear tomorrow. If you are enjoying this piece, consider purchasing Panic, Prosperity, and Progress, my book about 500 years of financial history.