Yogi Berra was quoted as saying that “it’s tough making predictions, especially about the future.”

However, there are times when one is able to at least obtain a probabilistic reading about the future, based upon an understanding of mass human sentiment and human psychology.

In fact, back in the 1940’s, an accountant named Ralph Nelson Elliott identified behavioral patterns within the stock market which represented the larger collective behavioral patterns of society en masse. And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics.

Elliott understood that financial markets provide us with a representation of the overall mood or psychology of the masses. And, he also understood that markets are fractal in nature. That means they are variably self-similar at different degrees of trend.

Most specifically, Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of “news.”

This mass form of progression and regression seems to be hard wired deep within the psyche of all living creatures, and that is what we have come to know today as the “herding principle,” which gives this theory its ultimate power.

And, over the last 30 years, many social experiments have been conducted throughout the world which have provided scientific support to Elliott’s theories presented almost a century ago.

But, even before these more recent studies have begun to support Elliott’s understanding of the market set forth 80 years ago, Elliott provided us with an extraordinarily bold stock market prediction. Allow me to present you with the following prediction made by Ralph Nelson Elliott in August of 1941:

[1941] should mark the final correction of the 13 year pattern of defeatism. This termination will also mark the beginning of a new Supercylce wave (V), comparable in many respects with the long [advance] from 1857 to 1929. Supercycle (V) is not expected to culminate until about 2012.

For those of you that do not understand this quote, Elliott was predicting the start of a 70-year bull market in the face of World War II raging around him. Quite an amazing prediction, no?

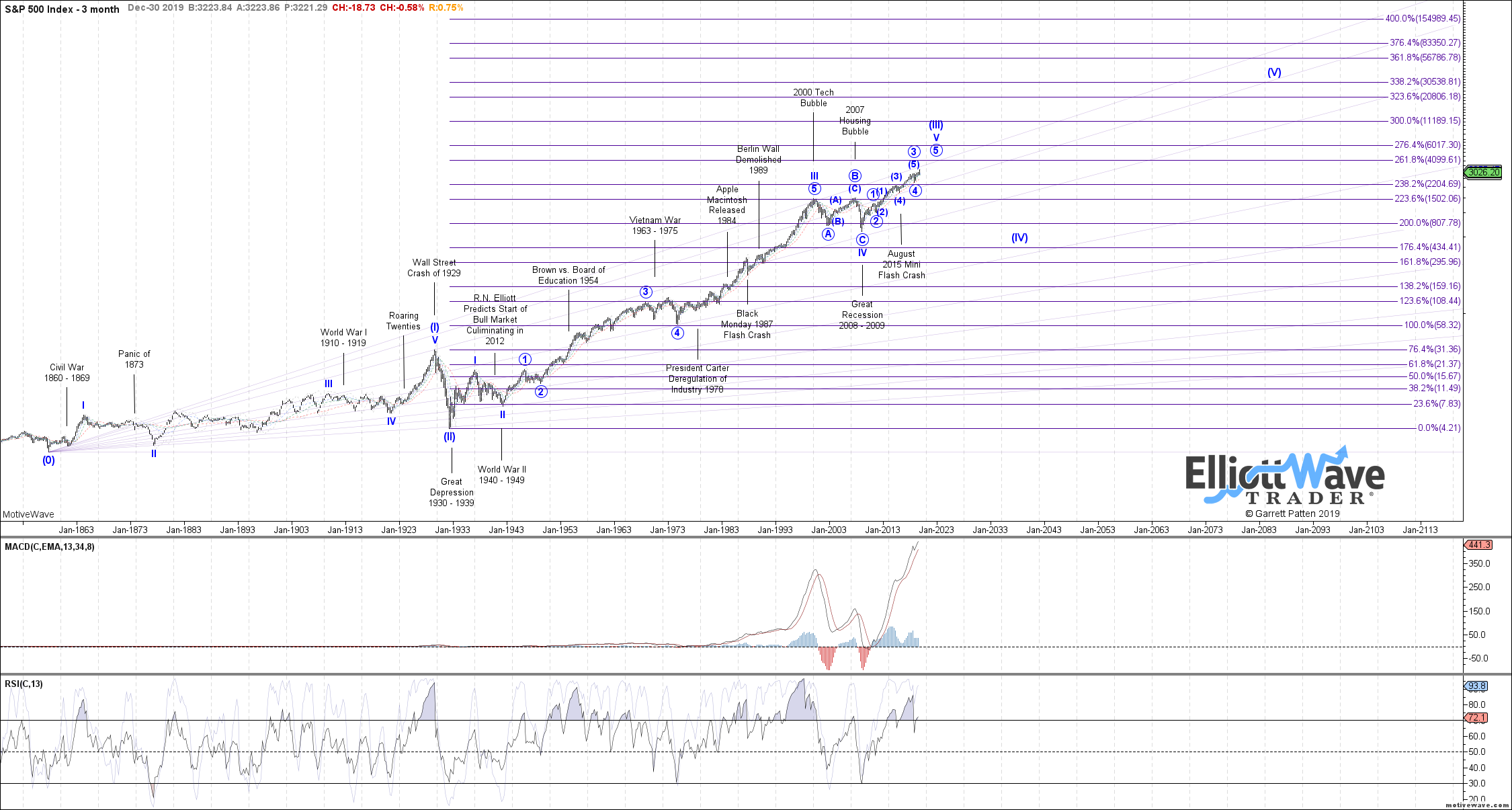

Now, the rally that Elliott was predicting seems to have gone well beyond his expectations from a timing standpoint. In fact, if we follow through with Elliott’s original assessments, and we take into account the actual structure we have seen over the last 70 years, I believe the rally he was forecasting will last considerably longer than his expectations, especially when we now can fill in the wave structure of the rally he expected. You can see what I am speaking of on the attached chart compiled by Garrett Patten of Elliottwavetrader.

Specifically, what it tells us is that the market could very well be in the final stage of a multi-year rally, which in my work has an ideal target in the 4000 region. But, as you can see from this much longer-term perspective chart, it even has potential to rise as high as the 6000 region in a blow off top. (I will have a much better idea of that topping target within the next year or so).

Yet, the main take away for those investing over the coming decade is that we are likely approaching a point in time where the market can enter into a multi-decade “correction” in wave [IV], as outlined on the chart above. While that would likely be the next generational buying opportunity, it seems to suggest that the last half of the upcoming decade will result in a lot of pain for investors.

At a minimum, I would expect the next bear market would have us revisit the 1800SPX region in the second half of the new decade. So, enjoy the profits of this “last hurrah” over the coming several years, as we are likely setting up for a once in a century event, which can rival the Great Depression, as it is of the same long-term wave degree. Remember, while history does not exactly repeat, it certainly does rhyme. And, those that are unwilling to learn from history are certainly bound to repeat it.