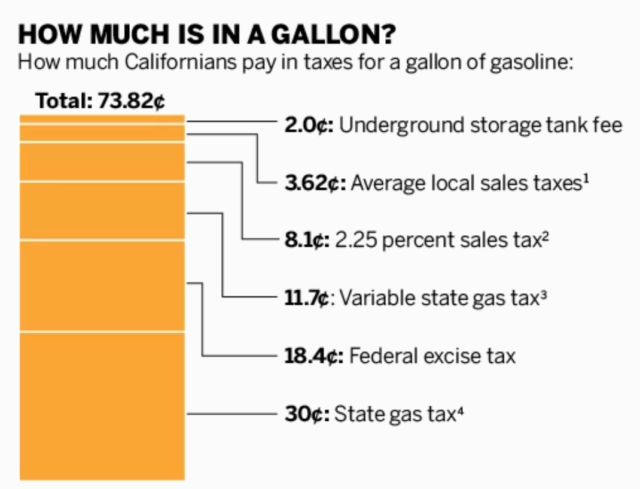

The idiotic and baseless ramp-up from last Friday is now totally gone. The old saw about markets climbing the stairs up and taking the elevator down seems to have been turned on its head. Why even put me through that exercise? It’s infuriating. The only good thing about it is that bulls were tricked into losing money.

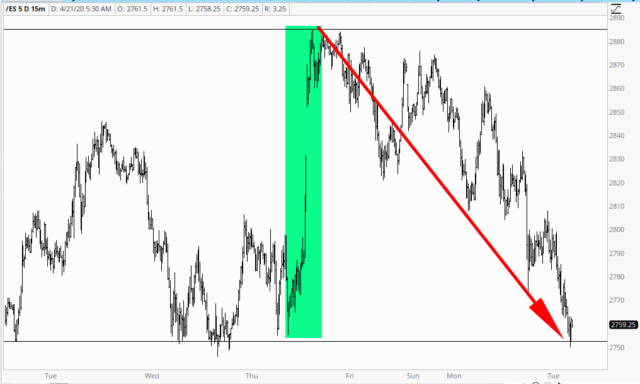

So, here we are again at 2750 support. Even the cocaine-addled Kudlow recognizes that if this breaks, it’s party time for the bears again, so God knows how much the Feds are throwing at the ES in a desperate bid to keep things up. If this was an organic market, equities would be like crude oil right now – – blasted into oblivion and negative valuations. As it is now, it’s reality (Slope) versus fantasy (the morons in D.C.)

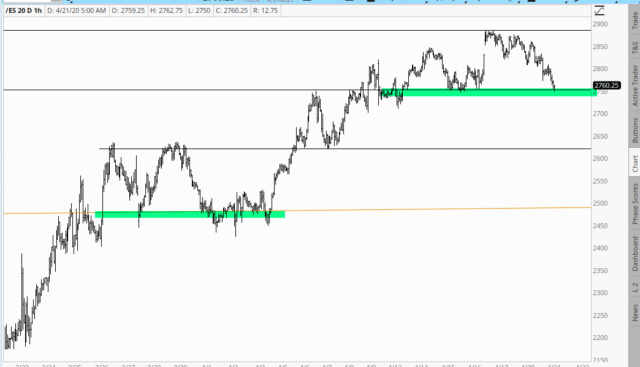

The even-more-insanely-overvalued NASDAQ (you really think the mail order retailer Amazon is worth $1.25 trillion dollars?!?!) is also holding on for dear life.

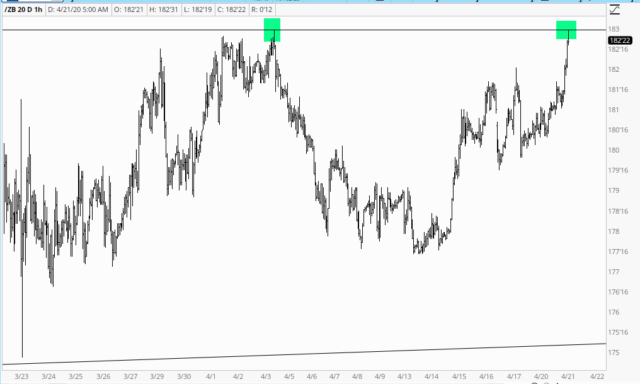

With all this going on, bonds have recovered and are at the cusp of another breakout. This would make sense, since interest rates, like crude oil prices, truly should be negative considering the apocalyptic future we all have.

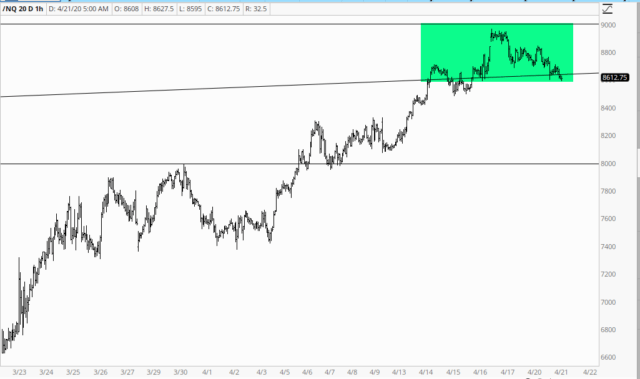

Incidentally, some people may wonder why gas costs anything at the pump anymore. Well, it’s all about taxes, which are at fixed prices and not based on a percentage of the commodity’s value. Putting it another way, at this point people are simply paying the government for the privilege to drive from place to place.