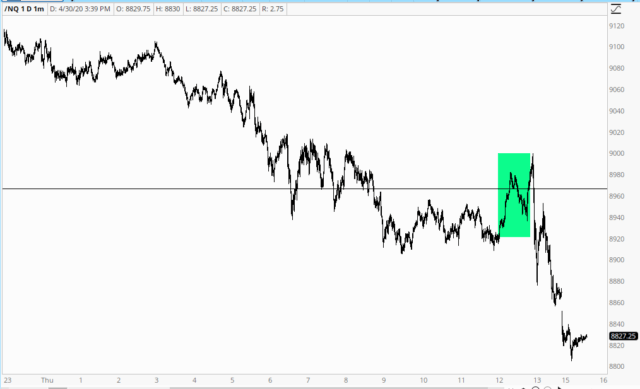

Tonight, Thursday night, was the pinnacle of the earnings season, with AMZN and AAPL reporting (along with hundreds of other smaller companies). The NQ had a brief surge near the end of Thursday, but it didn’t last.

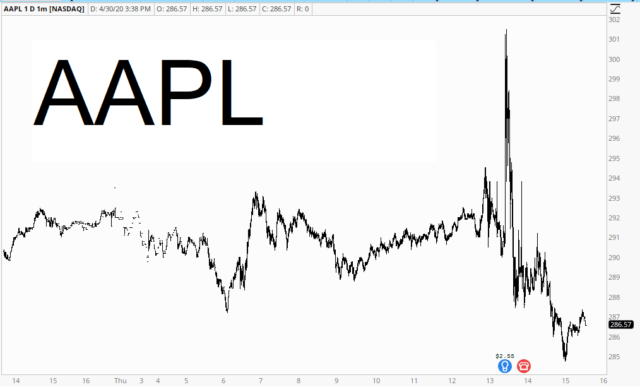

A big reason for the spike is that Apple – – incredibly, I must say, considering how much hate has been thrown toward stock buybacks – – announced they’d be spending $50 billion in cash to buy their own stock (an act which, in a just world, would be absolutely illegal, just like it was prior to the 1982). This totally whoring by Tim Cook didn’t last long, however, because Apple’s fundamentals didn’t exactly inspire confidence.

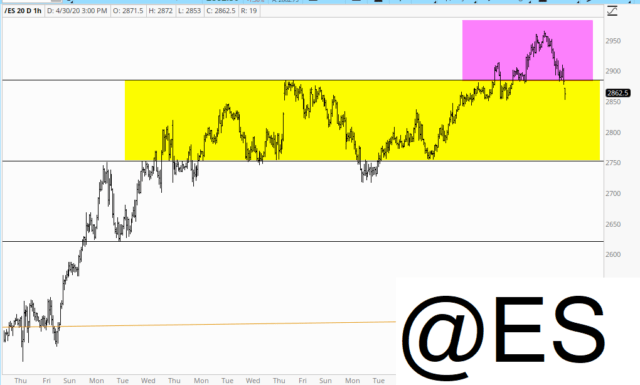

The exciting news is that the bullish breakout (magenta) has failed, and we’re back into the “yellow zone”, so to speak. I pray to any market gods that are listening that this weakness stays intact. After the last five weeks, God knows we poor beleaguered bears could use a bit of sanity in these totally fake markets we have to deal with.

Looking at the daily chart of the S&P 500 cash index, we precisely nailed a 78.6 Fib level yesterday, and the 14-day RSI is starting to turn lower. Don’t point and laugh, but allow me to invoke EW at this point – – if this is the start of Wave 3, it’s going to be something to behold.

The NASDAQ, which ripped 50% higher in just a month’s time, has also hopefully peaked. Wednesday’s price peak is a critical line in the sand. I continue to think how comic it is that a totally ginned-up Gilead “cure” was the impetus. Funny how they timed that fake announcement about 3 milliseconds after the terrible GDP, isn’t it? Makes ya think.

The Dow Jones Composite tells much the same story. I look at over a thousand charts every single day, and I still contend this is one of the most opportunity-rich environments I’ve ever seen for shorting. If only that should-really-be-executed son-of-a-bitch Jerome Powell would stop destroying capitalism with his goddamned interference.

I am no longer light as a feather in my portfolio. Once the Fed kabuki theater was through on Wednesday afternoon, I ramped up positions. I am now back up to 75 equity shorts and a 173% commitment level. Let’s see if we can string together two whole days together of weakness, OK?